There is a lot of news of late about women in the venture capital industry. Top Tier Capital Partners (“TTCP”) has long been a proponent of diversity – and that is apparent if you look at our team. Our culture of inclusion and diversity is by design and comes from the top. No two of us have the same perspective, whether defined by race, ethnicity, gender, college or graduate degree, type of university, work experience or hometown. We disagree at times and the broad perspectives help us challenge each other. TTCP has a culture as defined by four letters – L.T.T.R. This stands for Leadership, Transparency, Trust and Respect. The first two can be taught. The latter two must be earned. This is engrained in each and every employee. We recruit talent based on this principle. In this post, we will discuss the benefits of diversity, the current makeup of the investment teams within the funds we have invested in, and some ideas for what our industry can do to help bring more women into the business.

TTCP started our fund of funds business in 2001 with a team that was 50% women, 50% men. We now have 13 people on the investment team. 50% of the investing managing directors are women and 75% are women or minority. Among the full investment team, 31% are women and 79% are women or minority (as defined by non-Caucasian males). We have set a culture of inclusion and diversity from the start because we wholeheartedly believe different perspectives are critical to a successful business, especially in the relationship-centric venture capital business and maybe even more so as a fund of funds. No one wants to be on a team where all thoughts or positions are the same, and we don’t believe successful teams are set up that way in any industry, sport or partnership.

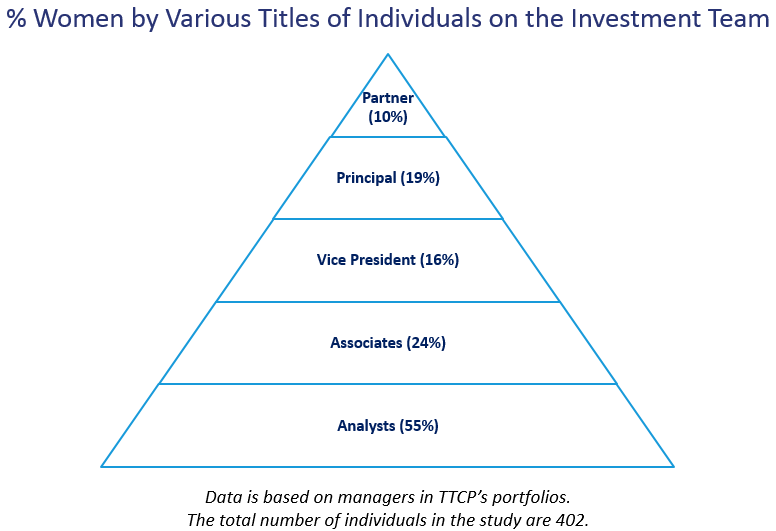

Our data science team analyzed data on the makeup of the investment teams of each venture fund where we have committed capital. We looked at their investment teams as shown on their websites as of July 7, 2017 and found that out of a total data set of 284 Partner-level VCs, 10% are women. We agree that this is an abysmal percent, but it is slightly above various stated industry numbers of 7%-9%. However, nearly 24% of the non-Partner level team members are women! This number is more encouraging as venture capital is an apprentice business, and these women essentially are the next generation of Partners.

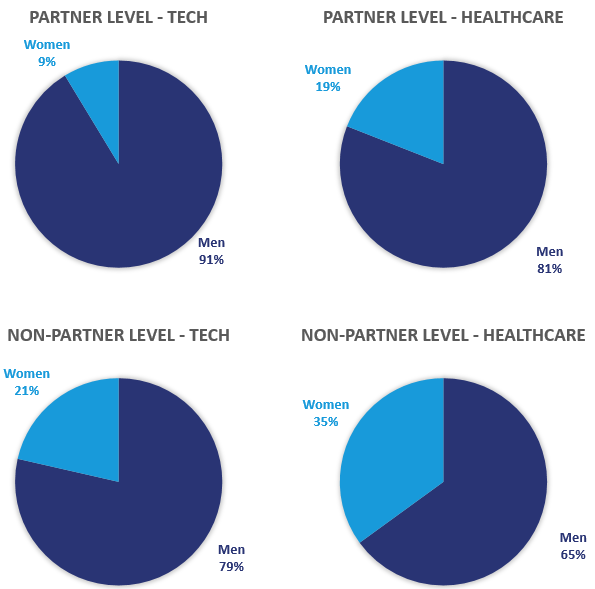

Interestingly, when we further cut the data by sector, we found a higher percentage of women in the healthcare space. The data shows that while only 9% of tech partners are women, 19% of healthcare partners are women. More than twice the amount! There may be reasons for this, but our experience reveals that there are nuanced cultural differences between the two sectors, perhaps even starting in school. Regardless of sectors, we all know we need to create attractive places to work and a funnel from which to create great opportunities for women. It will take time to get to 50% – if that indeed is the goal. Our feeling, however, is that we can’t and shouldn’t force it in an unfair or unnatural way.

Let’s now shift from the problem to potential solutions. As we often tell our colleagues, identifying a problem is helpful; identifying a problem while proposing a solution is incredibly valuable. The worst thing the industry can do is to hire a bunch of women just to hire women and check the proverbial gender box. We believe a better solution is to ask how we get more women, and diversity in general, into our industry at all levels? Why aren’t there more women Analysts? Associates? Vice Presidents? Are we looking in the wrong networks or do women not want to work in the venture capital industry?

We recently were asked by one of our GPs, “How bad is it if we don’t have women on our team?” We told this individual that it is now a “negative” if there is no gender diversity among the team. It may have been a “neutral” before, but that now has changed (hopefully permanently). We hire our Analysts, in pairs, straight from undergraduate programs. We’ve tried to hire a man and a woman in each Analyst class. That is not always possible, but the intention is to build the funnel, and we are happy to take the extra effort to look for talent in different circles. You might have to look harder, but you don’t have to lower the bar.

As an industry, we can bring more women in to the funnel, and over time we can increase the percentage of women in Partner positions. It will take time, but we need to begin. We’ve made progress over the past few years, but we need to keep it top of mind.

As investors, we have long recognized LPs have the ability to effect change, both with the actions we take and with the advice we give. We signed the #DecencyPledge, and are committed to doing our part to help bring more women and minorities into our industry, both by continuing to build a diverse work force and also by asking our managers to do the same.