Periods of market transition create opportunities for long-term allocators. While public markets have regained momentum, the private markets continue to be the place where tomorrow’s leaders are built and scaled. We believe venture capital is once again positioned at the intersection of innovation, improving liquidity avenues, and attractive market entry points.

The Innovation Cycle is Accelerating

The pattern is clear – with each major technology platform shift comes a redefining of the economic landscape: mainframes in the 1960s, personal computing in the 1980s, the internet in the 1990s, and cloud and mobile in the 2000s. These waves created companies that have anchored public indices. Now, a new platform shift driven by artificial intelligence and adjacent technologies is underway.

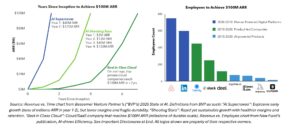

The above chart shows technological disruption that has historically produced companies that reshaped their respective industries and would go on to dominate public markets. This is what sets artificial intelligence apart from its predecessors – its unyielding pace and efficiency. The chart below highlights how AI-native businesses are scaling revenue faster than previous generations, reaching $100 million in annual recurring revenue (“ARR”) in just a few years with a fraction of the employees required.

The reduced cost of scaling paired with a shorter path to meaningful revenue has opened the door to a more capital-efficient generation of businesses. Healthcare innovation, deep technology, and sector-specific applications have been some of the first to benefit from these tailwinds. For allocators, venture capital remains the only reliable way to access these companies before they mature into public leaders.

Downturn Vintages Deliver Outsized Returns

Historically, vintages following market corrections have outperformed. Following the global financial crisis, the 2009 – 2012 venture vintages delivered nearly twice the median performance to that of previous years. We believe timing plays a crucial role here – missing just one or two of these entry points can have a noticeable impact on long-term outcomes.

As capital efficiency improves and exit markets begin to reopen, current vintages carry the characteristics that have previously been linked to stronger performance. Allocators who diversify across vintages during these periods position themselves well to capture a larger share of liquidity over the course of a fund cycle.

Liquidity Pathways Are Reopening

A common challenge for allocators in Venture has been the timing of liquidity, though the environment has begun to shift. IPO windows that were largely closed in recent years show signs of reopening, with several high-profile listings leading a recovery in the VC-backed IPO index. For companies with scale and profitability, the public markets are once again becoming a viable option – creating renewed momentum for distributions.

M&A activity tells a parallel story. Supported by stronger balance sheets and renewed growth mandates, strategic buyers are returning to the market. The above chart demonstrates a meaningful level of deal activity, proving that acquisitions remain an important outlet for venture-backed companies to deliver realized value. While M&A outcomes may not capture the same headlines as IPOs, they account for a significant portion of venture liquidity and provide flexibility across company stages.

Taken together, these developments create a healthier exit backdrop, reduce the J-curve[1] pressure, and give managers greater flexibility in navigating cycles. For allocators, it means that commitments made today are better positioned to generate realizations within a reasonable horizon.

Venture Outperforms Over Time

One of the most compelling aspects of venture capital for long-term investors has been its tendency to outperform public market equivalents across extended horizons. Over ten, fifteen, and twenty-year periods, US venture capital has delivered returns that surpassed benchmarks like the S&P 500 and the Russell 2000.

The data above suggests that when held with patience, venture programs can generate returns that complement and enhance broader allocations. For this reason, we believe that the compounding effect of gaining early access to transformative companies is a key driver of this outcome. Gaining exposure to category-defining businesses before they reach scale presents an opportunity for growth that is difficult to replicate elsewhere in a portfolio.

A Window of Opportunity

Cycles in venture are not new. This current movement is distinguishable through the convergence of a powerful innovation wave, greater capital discipline, and exit pathways that we believe are beginning to reopen. Periods like this have produced vintages that would define the next generation of market leaders. Current conditions indicate that allocators who maintain exposure in this part of the cycle position themselves well to participate in the next era of potential compounding returns.

Timing, diversification, and patience have long been central to successful venture investing. These principles remain today. [1] The J-Curve represents the tendency for private funds to post negative returns in the initial years and then post increasing returns in later years when investments mature.

[1] The J-Curve represents the tendency for private funds to post negative returns in the initial years and then post increasing returns in later years when investments mature.

Disclaimer: Top Tier Capital Partners, LLC (“TTCP”) provides this material as a general overview of the venture capital asset class for educational and informational purposes only. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or to purchase, shares, units or other interests in any security or investment and must not be construed as investment or financial advice. TTCP has not considered any reader’s financial situation, objective or needs in providing this information.

The value of a venture investment may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. TTCP has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information and TTCP undertakes no (and disclaims any) obligation to update, modify or amend this document or to otherwise notify you in the event that any matter stated in the materials, or any opinion, projection, forecast or estimate set forth in the document, changes or subsequently becomes inaccurate. This material is intended only for the direct recipients to whom it was sent. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited.

TTCP is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training. For additional information regarding TTCP, please see TTCP’s Form ADV which can be found on the SEC’s web site (www.sec.gov).

Copyright © 2025 Top Tier Capital Partners, LLC All rights reserved. #2025-069