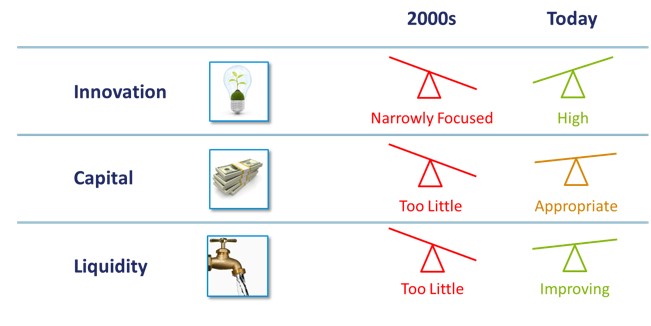

Top Tier Capital Partners (“TTCP”) has been evaluating the venture capital industry for twenty years. As we analyze the market across various regions, we look at three metrics in particular – innovation, capital and liquidity. A balance of these three metrics often leads to attractive market conditions. Too much or too little of any one of those conditions leads to uncertainty which can create opportunities. Too much or too little of two of the three tends to cause concern which often needs a change in strategy to balance.

In Europe and Israel, we believe the venture capital market is quite attractive. We see high rates of innovation, appropriate levels of capital and increasing amounts of liquidity in both sectors which has led TTCP to open an office in London in order to be closer to the activity and to invest more into Europe and Israel.

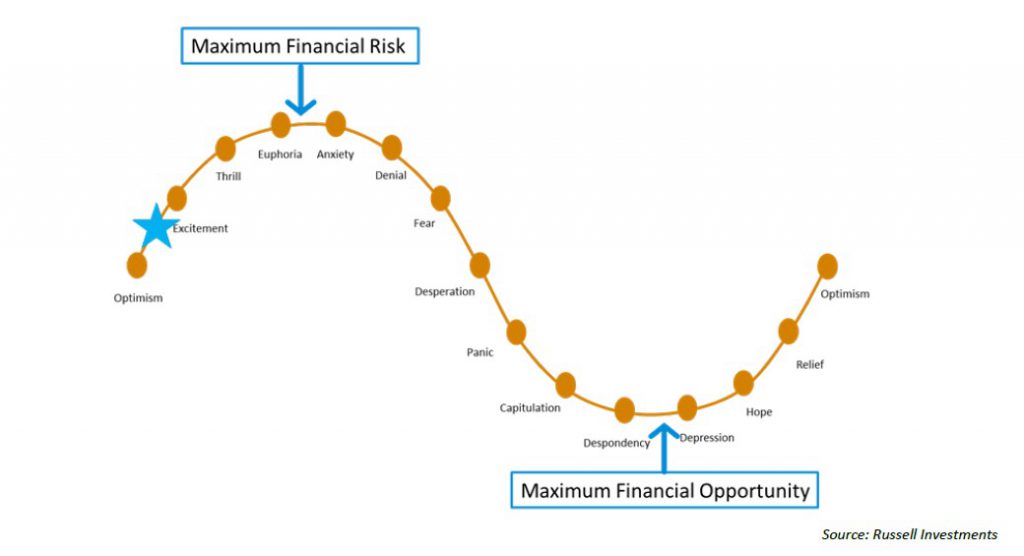

The market has not always been attractive in Europe and Israel, and many venture investors remember the largely unsuccessful investment period of the late 1990’s. That time period should not be overlooked, and investors should not look at just one short stretch of time when evaluating opportunities. The graphic below illustrates TTCP’s assessment of the European and Israeli venture ecosystems, and shows the struggles encountered during the prior decade, and the reasons for our optimism today.

We’ll break down each of the three metrics as they relate to Europe and Israel, and through that analyses, we will explain why we are bullish on investing more into those regions.

Innovation:

There are three components which we believe are attractive in Europe and Israel at this time. These components are: (1) an innovation ecosystem created through hubs of technological excellence; (2) entrepreneurial enthusiasm due to domestic market consumption high enough to

develop local revenue companies into potentially successful endeavors, and (3) long-term technology accomplishments attractive enough to create quality companies.

Europe and Israel have both had excellent universities for a long time but they haven’t built economic engines associated with them, like many U.S. schools, until recently. Some of this lag has to do with the idea of entrepreneurialism and the entrepreneurs’ desire to build global companies. Universities in Europe have excelled at machine learning which is starting to generate graduates that are relevant to the current economic cycle. Technology hubs are starting to thrive throughout the region (London, Berlin, Stockholm and Paris, for example) because the movement of people within the European Union allows entrepreneurs to aggregate around thought centers, versus being trapped in their home countries. These hubs are starting to compete with similar technology hubs in the U.S., like San Francisco, Boston and New York. Tel Aviv and Herzliya have long been technology hubs for Israel. Overall, innovation ecosystems have not been a problem in Israel.

One of the things that makes San Francisco and Silicon Valley so valuable is the large number of employees who have worked at start-ups, regardless of whether the company was a success or a failure. Today, many of Silicon Valley’s largest employers were once high flying start-ups funded by venture capitalists. Europe and Israel are both now experiencing the same growth and are benefiting economically from it. Due in part to the global financial crisis, the European economy’s decline created an acceleration of the entrepreneurial ecosystem, forcing talented people to think about ways to enrich themselves instead of working for large stagnant corporations.

We think Europe is also an attractive place to allocate capital because of where technology markets are headed. Mobility and mobile activity is continuing to become more and more prevalent across everything we do. Europe operates in one of the best mobile environments on the planet. Additionally, an increasing number of activities are going to be done in silicon chips as devices get smaller and smaller. We believe both these trends are favorable to the Israel and Nordic markets, as they are world leaders in wireless and chip technologies. Also, cyber security is a well-known sector in which Israel excels, in part because of their military. In addition, we observe the healthcare area to be one of Europe’s strongest markets, as its regulatory environment is an easier place to navigate and operate than in the U.S.

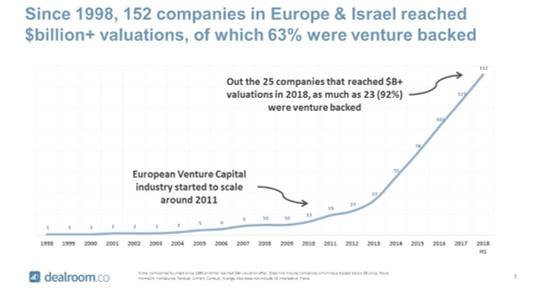

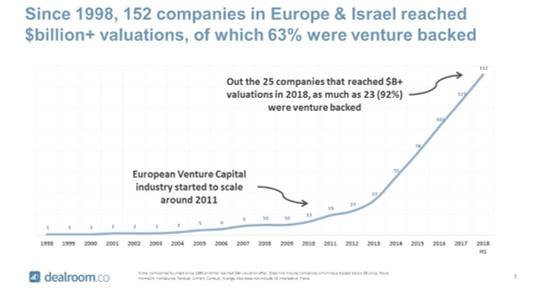

As shown above, over the past several years, the number of sizable companies created in the Europe and Israel has risen meaningfully. Today, both regions are creating companies that are competing and succeeding globally, and this success is key as it leads to increased valuations, and increased attention from buyers and public markets. Success begets success, so we anticipate this trend of innovation to continue.

Capital:

When the times are good, capital often flows into a market. However, before capital began flowing in Europe and Israel, the venture markets struggled to support the companies started in those regions. The good companies left for other markets, often times heading to the U.S. or China where capital is more plentiful. Other companies would often go out of business or fail to grow. Some managed to survive.

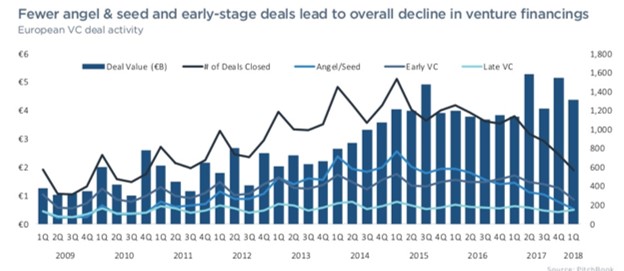

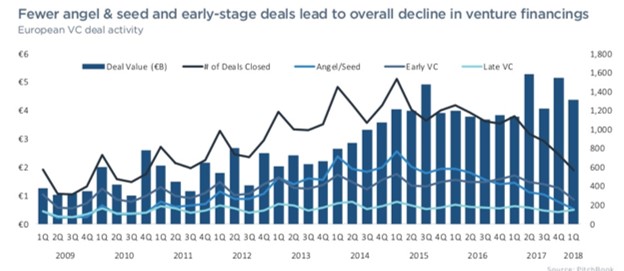

While there is more capital flowing in to start-ups in Europe and Israel, there is actually a scarcity of capital for mid-stage venture rounds, such as Series C. As the chart shows below, there have been relatively few later-stage deals in Europe for quite some time. Total deal values are increasing, but there are fewer total venture financing’s, indicating the average deal size is increasing. As we stated earlier – companies need to grow to a large enough size to attract the attention of investors and buyers, as well as to compete globally.

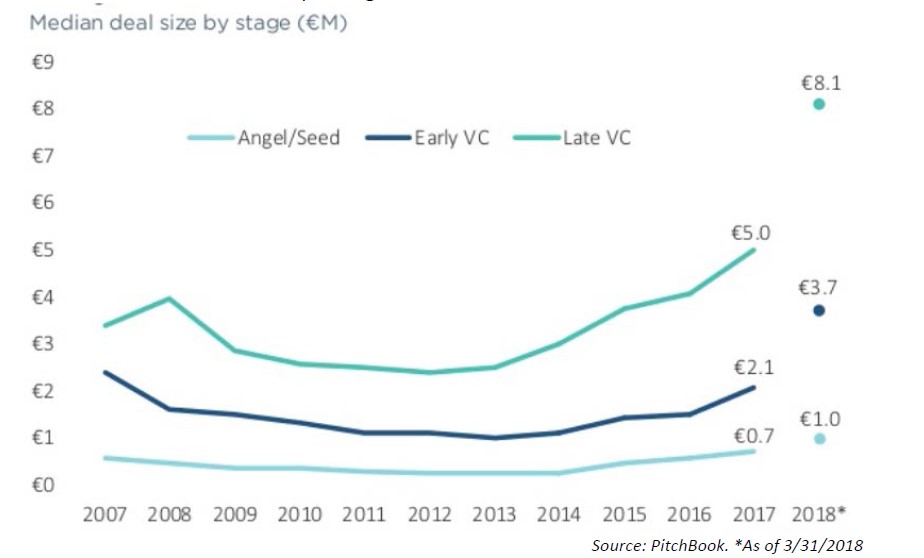

One of the gaps that still exists in Europe, in particular, is the funding for mid- to late-stage companies. PitchBook shows data indicating that the median deal sizes are increasing for all rounds, especially in the later stages. Today, a large portion of this capital is actually coming from U.S.-based venture funds who see a market opportunity to invest in fast growing companies at an underserved attractive market pricing.

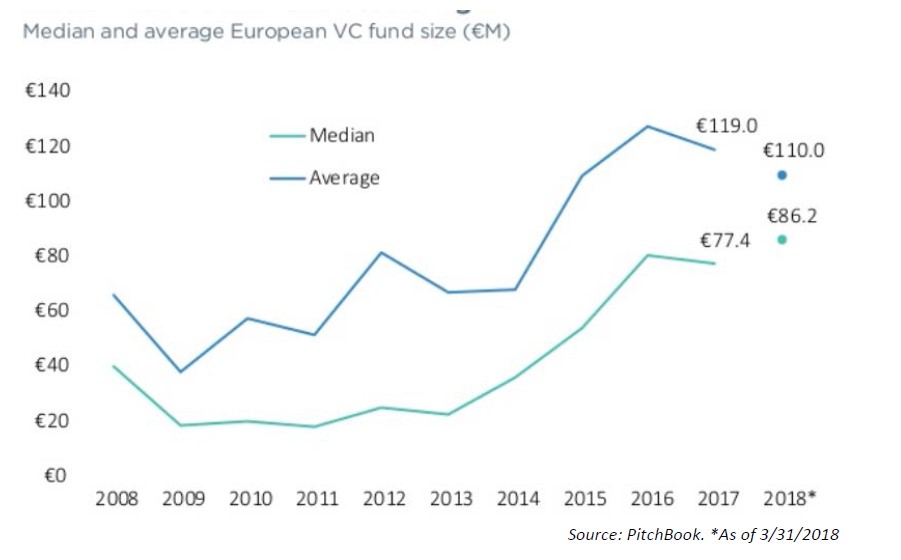

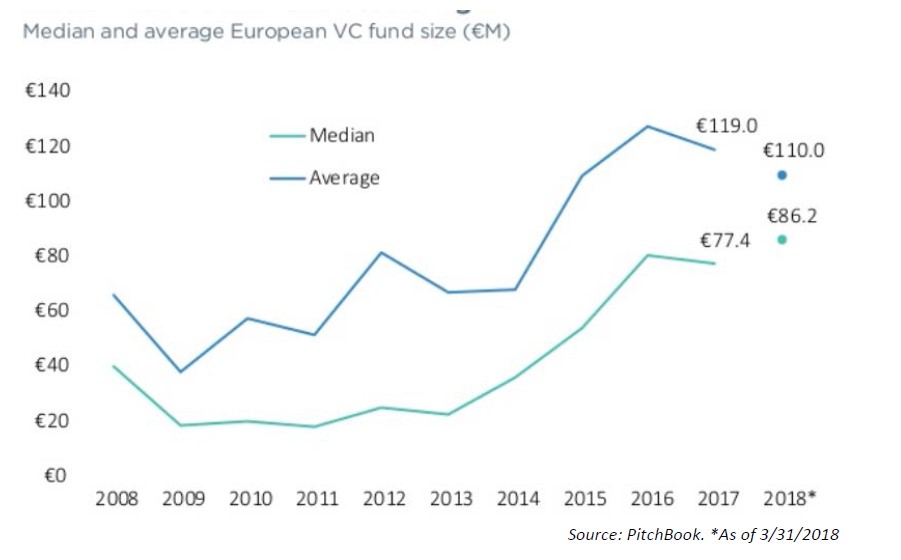

Finally, one of the elements that contributes to capital levels is fund size. If a market is full of small funds (<100M), it tends to lack the capital for growth companies. If a market is full of large funds (>500M), then too many companies get funded, performance wanes and investors lose interest. The below chart from Pitchbook shows the average European fund size to be above €100M, and growing, which is a good level of capital.

TTCP believes the capital levels in both Europe and Israel are at appropriate levels to support innovation. Less capital would create potential concerns, but more capital could be absorbed in both cases without negatively affecting the markets.

Liquidity:

Liquidity is perhaps the most recognizable aspect of a successful venture market. The Israeli venture ecosystem has seen some good liquidity over the past several years from the security sector. Europe has lagged in comparison, but the European markets are more receptive to smaller companies going public, which is helpful to the ecosystem. The businesses being built are more able to compete globally which leads to purchase valuations with that frame of reference in mind. Acquirers are looking for value and are finding that in Europe, especially as compared with the U.S. and China.

An easy way to see if the venture market is “working” is if people in different markets recognize the brands of the top exits. For Europe a decade ago, Skype was the most recognized name, and none come to mind for Israel. That all changed a few years ago. With the popularity of Angry Birds, King.com and Supercell, those companies became global brands. The same happened with Spotify, and to some degree, Funding Circle and Just Eat. In Israel, Waze woke up the venture community in 2013, followed by the equally successful exit of Trusteer in the security space. More recently, Intel acquired Mobileye for a record $15B in the autonomous vehicle space.

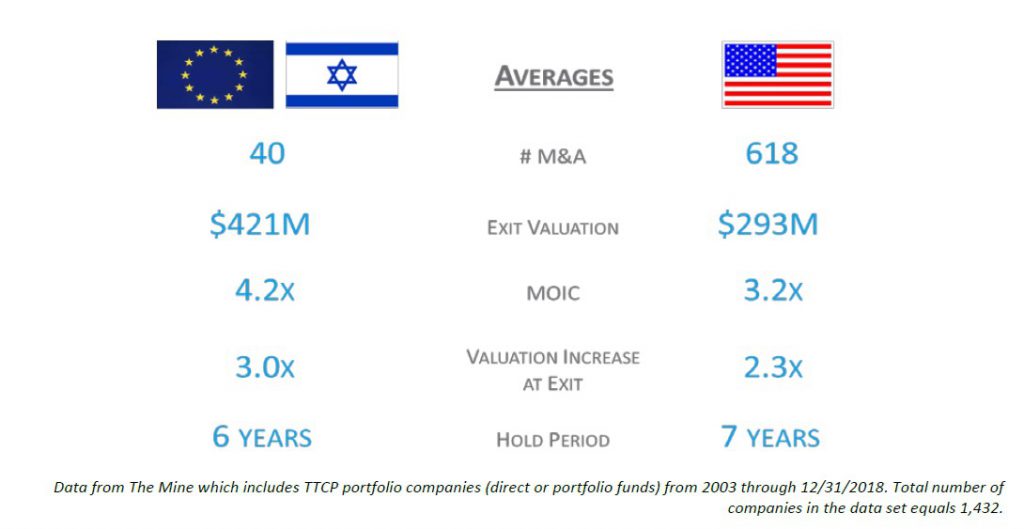

Both markets have continued to produce high-quality exits, whether via acquisition or IPO. As the below statistics show, within the TTCP portfolio, which includes investments in Europe and Israel since 2005, has outperformed the U.S. portfolio across several metrics. Though, the number of exits is much smaller than that of our U.S. portfolio, that is in part because we invest about 80% of our over $4 billion in the US, compared with about 10% in Europe and Israel. This was a surprising, but exciting, finding on our part when we evaluated our portfolio company level data.

Summary:

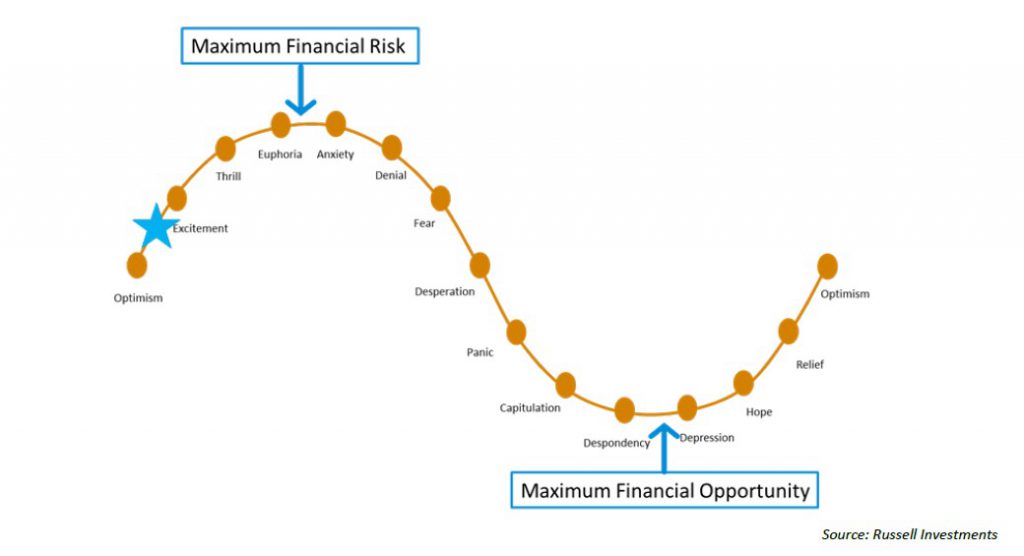

The investment team at TTCP believes both Europe and Israel have venture capital ecosystems which are facing a nice balance of innovation, capital and liquidity. Russell Investments has been publishing their market cycle of emotions (below) for many years. Based on our assessment of the markets, we are facing the movement from “optimism” towards “excitement”. There was hope the ecosystem could grow, relief when liquidity started to materialize and then optimism that the market has matured enough to create sustainable returns.

TTCP remains excited about the prospects of investing more in Europe and Israel over the coming investment cycle, and has opened an office in London as a result. We are always happy to discuss our thoughts on global venture managers, or on the market.