The healthcare venture capital market continues to be an exciting area of focus for Top Tier. Being located in the heart of San Francisco, we’re lucky that we are able to enjoy the heavy saturation of healthcare investors.

In this blog we’ll outline some of the trends that we saw earlier this year at the J.P. Morgan Healthcare Conference, an annual gathering in San Francisco of tens of thousands of healthcare investors, entrepreneurs and executives. Our focus here is how those trends are impacting our deployment decisions as we look through 2018 and beyond. First, we’ll start with a few of the healthcare innovation trends that our team is most excited about:

- The convergence of big data and biology will continue to change the life sciences sector. We believe diagnostics and drug discovery will be the most notable applications for this trend in 2018. We believe that valuations may rise for these businesses as both traditional life science and technology investors find these companies attractive, hence raising competition for investors to get into these deals.

- Immuno-oncology 2.0 has arrived. Immuno-oncology approaches have been used for many years, but here we refer to the next wave of immunotherapy discovery that is focused on identifying the right patients and discovering how to overcome resistance and toxicity, an approach made possible through our increased understanding of the tumor microenvironment.

- The economics of cell and gene therapy businesses are evolving. As new technologies have the potential to be single-use cures, innovative business models will develop as companies work with payers and providers to determine proper economic incentives for these groundbreaking therapies. Current gene therapy technology is advancing more rapidly than many people predicted, so it is important that the industry gets this pricing decision right.

- Artificial Intelligence (AI) / Machine Learning (ML) solutions targeting overall care delivery will become commonplace. Sales cycles will continue to be longer than in traditional technology, but we’ve heard that more and more hospital system administrators are looking for next-generation solutions that can cut care delivery costs while driving the greatest efficacy. Patient engagement and revenue enhancement solutions are less of a focus in the short term; instead, solutions that have a cost cutting aspect will help drive early adoption.

- Improved understanding of the human microbiome will cause a significant shift in the way many treatments are delivered. The tools and processes around the microbiome continue to advance, and an interesting recent development in the space is Thermo Fisher Scientific’s launch of the Applied Biosystems Axiom Microbiome Array. This diagnostic tool has significant advantages over previous next-generation sequencing tools used to process the genetic code of the various microorganisms that inhabit the human body. We continue to be intrigued by the progress of this emerging scientific field.

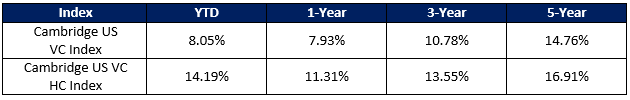

Next, we’d like to discuss general investing themes that we think will help drive our allocation decisions in the near term. Historically, Top Tier has allocated a significant portion of its funds to healthcare managers, and we believe this strategy has proven to be successful due in part to the market cyclicality of healthcare and technology. We’ve historically seen that healthcare and technology markets maintain different liquidity cycles, and we are currently in a strong period of liquidity for the healthcare sector. Looking at the Cambridge Associates US VC pooled return index versus the Cambridge US VC Healthcare Index as of 9/30/17, healthcare actually outperformed technology over the past 1, 3 and 5 year timeframes.

Top Tier conducted a similar analysis earlier last year comparing funds within our own portfolios, and we found the same to be true. Generally, our healthcare and diversified managers have recently had stronger performances than our technology funds. Institutional investors may find these results surprising.

As we dug deeper we found the firms focused on biopharmaceuticals with early, asset-based development models have by far been the most successful in this recent cycle. Asset development focused firms like Atlas, Medixci and Third Rock have some of the better performances that we’ve seen across the venture landscape, and their efforts should be applauded. The consistency of these managers’ approach to developing assets, combined with the continued macro trend of outsourced research and development by ‘Big Pharma’ in the form of asset acquisitions, makes this sector an incredibly interesting investment opportunity.

Some in the industry believe that biopharma investors will slow their deal pace in 2018. We disagree as we believe deal pace will continue as impactful developments in science continue to be made. That said, we think an increase in competition may make it difficult for some existing biopharma investors to win deals. Specifically, we have seen an uptick in new firms in recent months and diversified healthcare funds are shifting or even overweighting their capital to this asset-focused strategy. Possible risks also include the fact that Big Pharma may be less willing to spin out shelved clinical assets for a low price, historically a large source of these asset-focused strategies, and we’re also seeing increased structuring and pricing in these types of deals as Big Pharma tries to participate in more of the upside.

We also think it’s helpful to talk about some of the things that haven’t been working in our healthcare portfolios. Notably, medical devices and life science assets that require survival trials, including neurology, continue to be difficult investment areas for healthcare venture capital firms. Survival trials are problematic as they increase the amount of time and cost it takes to conduct clinical trials and demonstrate certain endpoints that are beneficial for achieving a successful exit. Medical device companies also represent a unique challenge as they are typically required to demonstrate commercial traction before significant acquisition prices are offered. Demonstrating traction requires product-market fit and adds business operational risk to the already uncertain process of bringing a novel treatment to the market. This is in contrast to the early biopharma strategy referenced earlier, where assets can often be sold without the need to develop sales teams or distribution networks.

Healthcare is truly a global market. While the U.S. remains the leader in healthcare innovation, noteworthy scientific developments can be found in academic and corporate labs all around the world. China continues to move towards becoming a healthcare innovator, eschewing the idea that the country has been an ‘imitator’ in the healthcare market historically. China’s scientists are heavily supported by the Chinese government, and there is a large push to privatize many of the healthcare services and hospitals in the nation by 2020. Additionally, the Hong Kong stock exchange is changing its public listing rules to allow non-profitable, Phase I stage life science companies to access broader pools of capital than ever before. We believe that diversified global exposure in the healthcare sector is a sensible approach to this fragmented market, and we continue to allocate our capital in that manner.

Overall, it is our opinion that the healthcare sector will continue to thrive in this wave of deep tech innovation. The current pace of advancement in areas of AI/ML, genetics, advanced materials and nanoscience give us confidence that this sector will continue to produce positive returns through the development of novel therapies and care delivery systems.