When investors are asked how they think about building exposure to venture capital, many say they are quite opportunistic with an overarching goal to get access to the best entrepreneurs, start-up companies, and venture capital funds on the planet. However, at many large, institutional platforms, investments are first driven by portfolio construction models that seek to provide the best risk/return exposure to various public and private asset classes and secondly driven by building appropriate diversification by sector, stage and geography.

Venture capital has become widely recognized over the past several years as the financial engine that fuels the creation of innovative companies and the development of new technologies all over the world, and as a result, investors have sought to ensure that they have diversified geographic exposure. The industry initially started in Silicon Valley in the US, long considered the center of the universe for venture capital, but over the past decade venture capital activity has expanded considerably into high growth technology businesses in China and, more recently, into the innovation hubs in Europe and Southeast Asia.

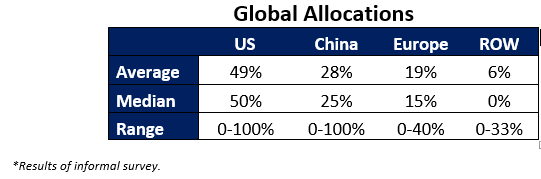

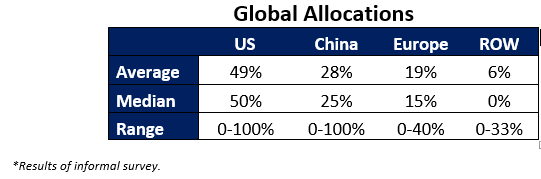

Inspired by a question posed to us last summer, we recently asked a number of Limited Partners from the US, China, and Europe this question: “If you had a dollar (or Euro, Pound, RMB) to invest in VC today, how would you allocate it?” While not completely scientific in nature or in any way an exhaustive survey, the results were instructive and confirm what we’ve been hearing over the past 12 months – compelling venture capital returns are being generated all over the world and investors are waking up to this reality.

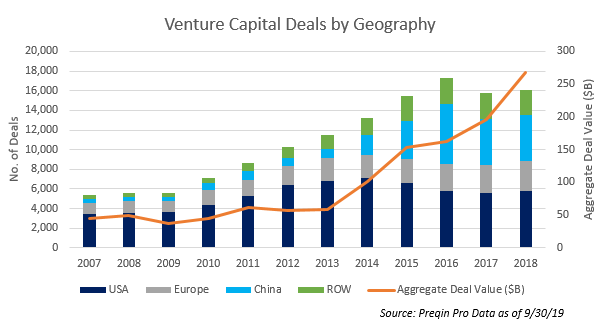

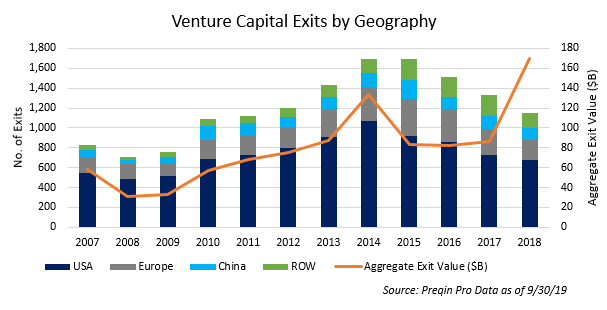

To unpack further the globalization of venture capital, we looked at the aggregate flows of capital and industry performance by geography. We augmented the industry data with our own to show what we’ve experienced over the past 20 years as a global VC fund of funds platform. You’ll see from the table below that the investment activity in the US and China are roughly the same size and Europe is about half as large.

Notwithstanding the current geopolitical climate between the US and China and the resulting drop in investment activity occurring today, it’s instructive to note that investment activity in the US and China had been of equal size, but the table below clearly shows the exits are highly skewed to the US. In China specifically, this has manifested in high TVPI multiples and low DPI multiples for many institutional investors with exposure to the region. The lack of cash-on-cash returns is why some investors have become more cautious about the opportunity in China.

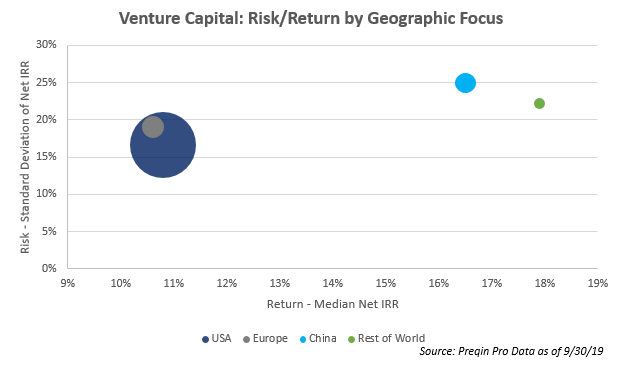

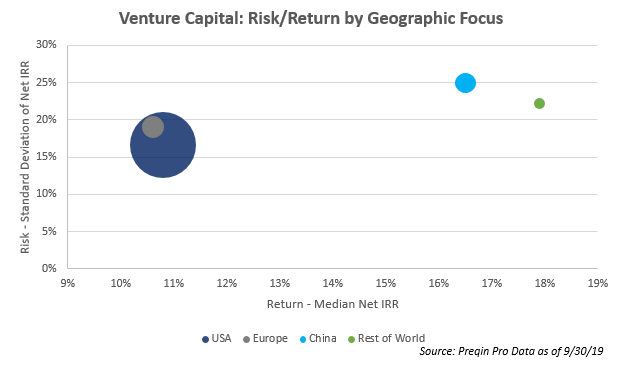

We next considered the historical performance of the various geographies and how that will instruct future expectations and allocations. In our discussions with Limited Partners, we are seeing perceived risks and return expectations in the various geographies begin to change and investors shift their mindsets to where they might want to allocate capital in the future. The chart below depicts the risk/return dynamics by geography as measured by the standard deviation of returns. As expected, emerging markets offer a higher risk/higher return.

At Top Tier, we have experienced similar outperformance from our venture capital investments in China, but as noted, much of the performance is still unrealized, and recent trade tensions and regulations like CFIUS have significantly reduced the levels of investment activity in the region.

With the backdrop of cash flows and performance described above, we were very curious about the results of our informal survey. While we have been thinking about the global allocation question for 18 months when we were first posed the question, we believe that investor sentiment has changed even in that short time, specifically with more interest in developing Europe and ROW exposure.

As expected, most investors will continue to overweight US venture capital as the most established market that not only has strong dynamics for the creation of new, innovative companies, but also a high-functioning exit market (IPOs, M&As, purchases by PE/Growth funds). Given the historical outperformance, size, and deep entrepreneurial drive, we believe China also will continue to be a significant and lucrative place to invest in the long term. But, as investors seek to stay ahead of opportunities and developing markets, we expect to see increased interest and allocations to Europe given its attractive market dynamics (see our March 2019 blog, “Why Europe Now”) and to emerging markets such as Southeast Asia.