As a Fund of Funds manager, we at Top Tier focus on constructing our portfolios with what we believe are the right types of managers (healthcare/tech), investing in the right stage (seed, series A-C, Growth), in the right geography (New York, San Francisco, LA, other) for the current market. We also consider our manager’s ability to exit their investments.

As we dug into the distribution/exit data from our portfolio, we came across some interesting statistics on the average hold periods of our underlying managers. Generally, our healthcare investments have shorter hold periods than our technology investments by over a year! Just over 30% of these distributions were in-kind, the rest were cash, including public stocks sold by the GP and proceeds distributed in cash.

A note on the data: the data set comprises distributions from January 1, 2015 through August 31, 2016 from funds in which TTCP has committed, totaling 437 distributions across 351 companies from 104 venture funds with vintages 2005 through 2014. Hold periods are measured as the first investment date until the date of distribution. In the case where there are multiple distributions of the same company, we treated those as different hold periods.

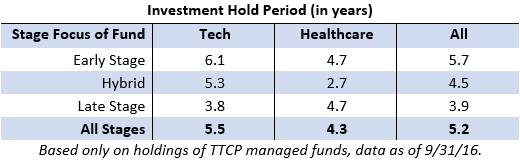

Our healthcare managers have shorter hold periods. Accounting for 23% of the distributions (our portfolios contain 15-25% healthcare), we found that average hold periods for healthcare were unexpectedly short, 4.3 years, when compared to technology companies at 5.5 years, irrespective of stage. There are many possible explanations for this, including the shift in healthcare venture investing models over the last several years away from investing in pre-clinical companies and holding through to FDA approval. We’ve seen more healthcare managers either sell up the food chain (invest pre-clinical and selling at Phase IIB) or invest later in life (invest at Phase IIB and hold through approval). Also, we’ve seen more investments in healthcare services, a segment of healthcare which can have shorter investment horizons than that of pharmaceuticals.

Furthermore, one would assume that managers investing in early stage technology would have slightly longer hold periods, as these young companies may take longer to gain traction. Based on our internal data, this is true, as the average hold period decreases by nearly 2.5 years with late stage tech funds versus early stage tech funds. Regardless, hold periods of slightly over 5 years across the board for both healthcare and tech managers across all stages is much shorter than we expected to see.

By exiting investments in short order GPs can focus their time on existing investments, wrap their funds in their intended life span, and lock-in returns – ultimately distributing capital back to their LPs.