2020 will go down as a memorable year for venture capitalists, entrepreneurs, and the limited partners who support the asset class. The beginning of the year was marked by uncertainty and hardship brought on by the pandemic, but VC activity roared back to life in the second half as the world adjusted to working remotely. It will be a few months before audited financials come out, but it is our expectation that many VCs had record years for liquidity and value accretion across their portfolios.

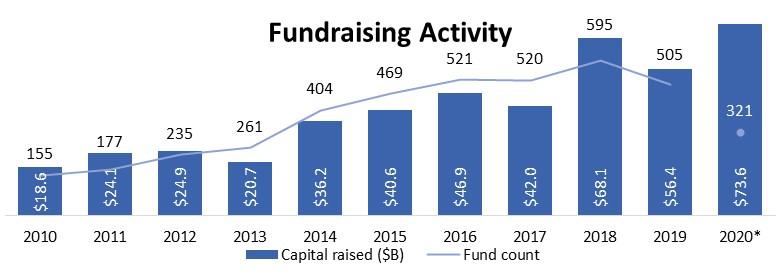

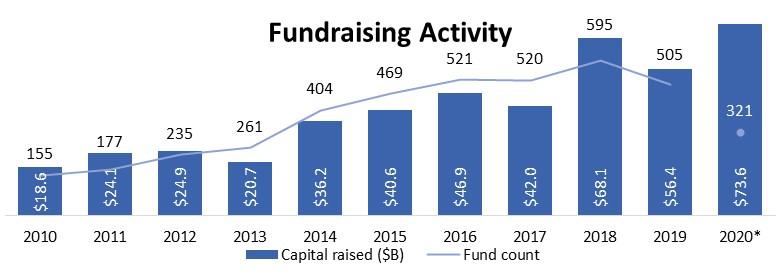

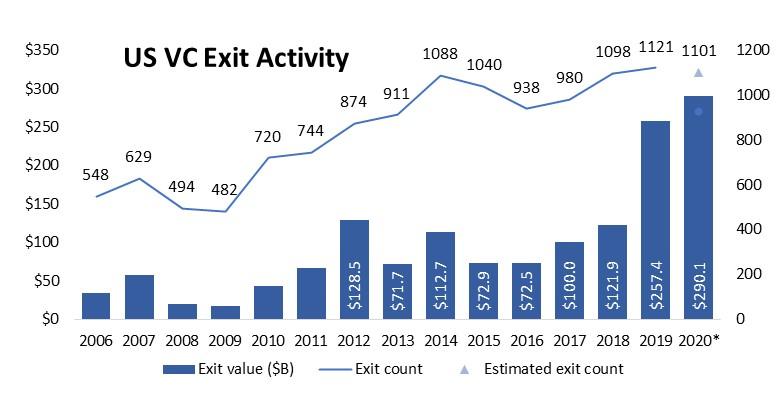

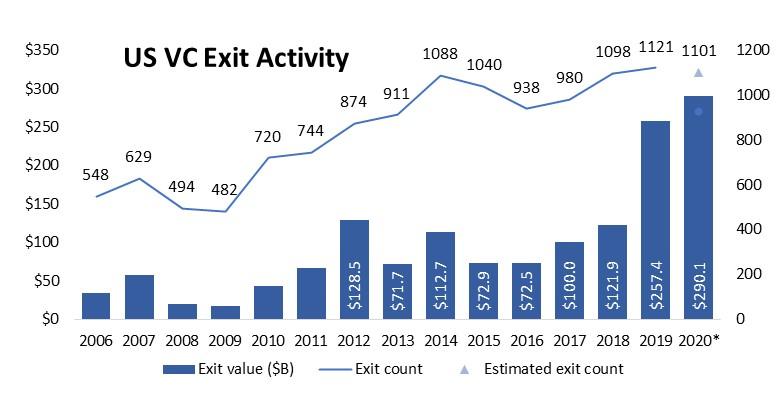

Despite the headwinds largely brought on by the COVID-19 pandemic, investor, founder, and customer resiliency pushed the market forward to shatter records, norms, and predictions for the year. US VC fundraising remained strong during the year, breaking a prior record set in 2018 with $74 billion closed during 2020, catapulting the industry into 2021 with $152 billion of dry powder. Overall, investors deployed $156 billion into startups, favoring more developed, later-stage companies, which accounted for 67% of the year’s deal value, and 29% of the total deal count. This vast disparity between late and early-stage deals can be attributed to the increase in mega-deals (financing rounds of $100M+), which reached $71 billion for the year, surpassing the $65 billion record set in 2018. This surge in late-stage investing pushed 71 companies over the $1 billion valuation mark, with 28 companies reaching unicorn status in Q4 alone (PwC/CB Insights). The exit market remained robust throughout the year, buoyed by high-profile Q4 IPOs of Airbnb and DoorDash, creating $290 billion of realized exit value for private investors. The major highlight of the year could be awarded to advancements in Biotech & Pharma as the sector raced to find a vaccine for COVID-19. Enabled by advancements in artificial intelligence and machine learning, biopharmaceutical companies mass-tested the virus’ structure and enabled faster vaccine design, leading to two vaccines’ authorized within 12 months of the United States’ first lockdown.

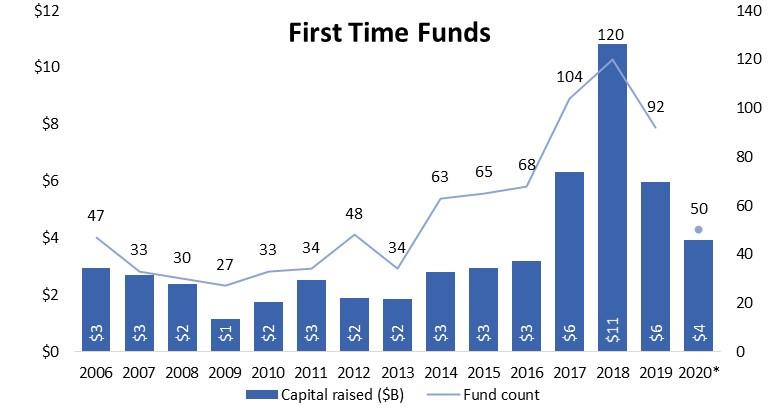

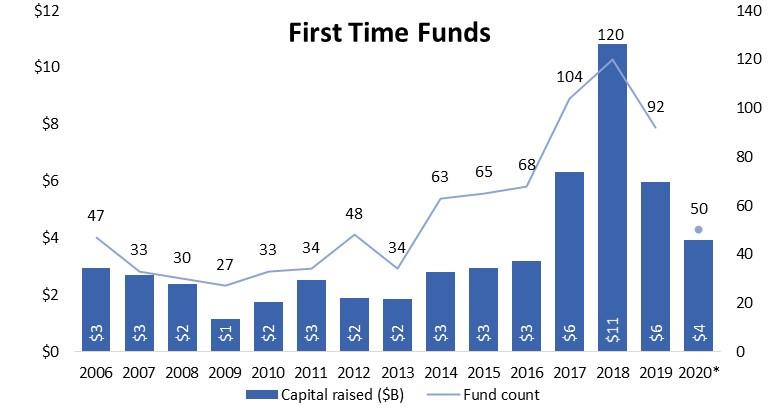

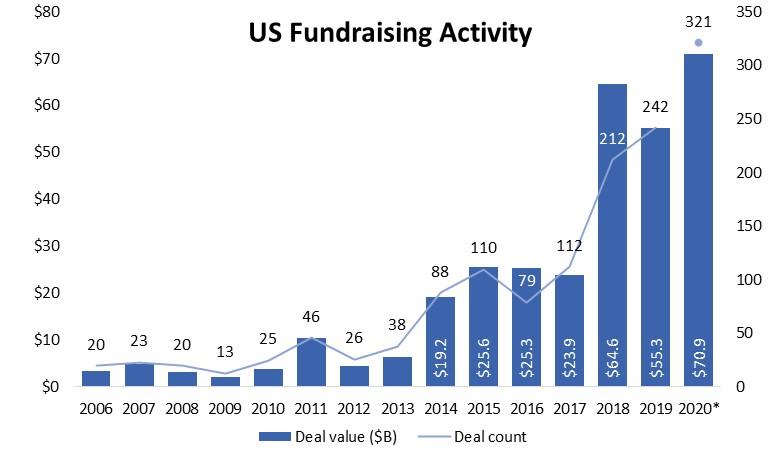

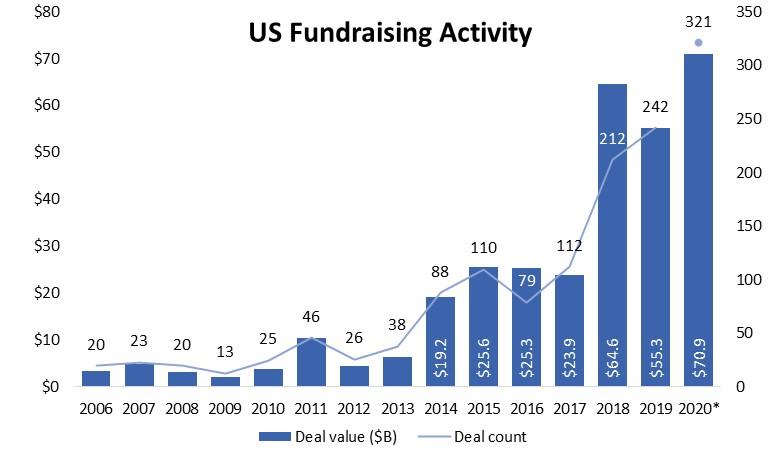

US VC fundraising remained strong during the year as LPs showed continued confidence in the asset class’ performance. VC firms raised a combined $74 billion 321 funds, setting a new record over 2018’s $68 billion raised. Nevertheless, all firms did not share allocations equally as emerging managers had trouble raising money from new LPs they could not meet with in person. The introduction of virtual diligence and the uncertainties brought on by the pandemic led LPs to find sanctuary in venture managers they know well. This harboring of capital led to LPs writing larger checks to their current managers as they concentrated capital into re-ups with developed firms looking to increase their fund sizes. The concentration of more capital into fewer funds is a trend we have seen develop since 2018 and continued through 2020 as the number of mega funds (funds with more than $500 million) nearly doubled from 24 in 2019 to 44 in 2020, while the total number funds raised during the year decreased from 505 to 321. As noted in a prior blog, many of these ‘platform’ VC Firms are looking to become full stack capital providers from the Seed to IPO.

Late-stage financing rounds were up year over year as investors poured capital into existing portfolio companies with more proven operating metrics. For the first time, more than $100 billion went into late-stage deals in a single year, representing 67% of the total US VC deal value. Mega-deals were a significant factor in driving late-stage activity, closing $71 billion of deal value, which surpassed the previous record set in 2018 of $65 billion. It’s worth noting that this “flight to quality” is not a new trend as talking heads in the space have been calling for a reckoning of unsustainable company fundamentals since 2018 (WeWork anyone?). Some even before then. Mobility tech was the sector most benefited by mega-deals, with self-driving car companies like Nuro and TuSimple raising a $500 million Series C and a $250 million Series D, respectively. Similarly, aerospace company Relativity Space raised a $500 million Series D to support their mission of 3D printing rockets.

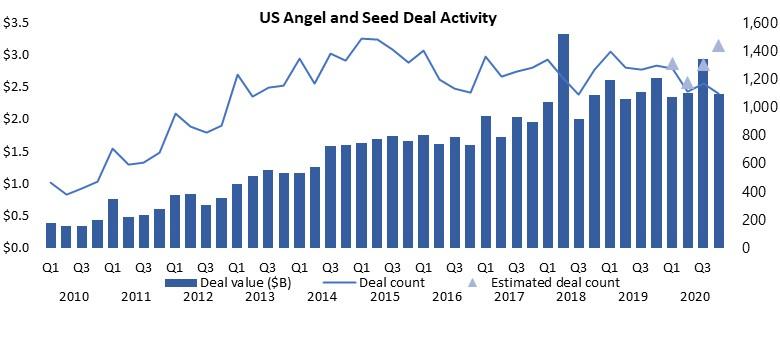

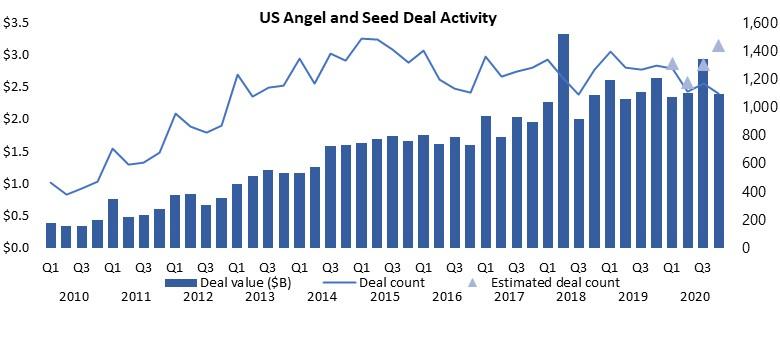

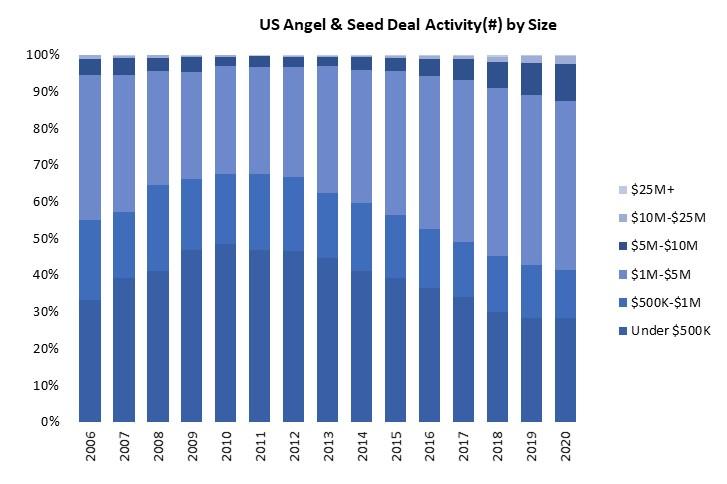

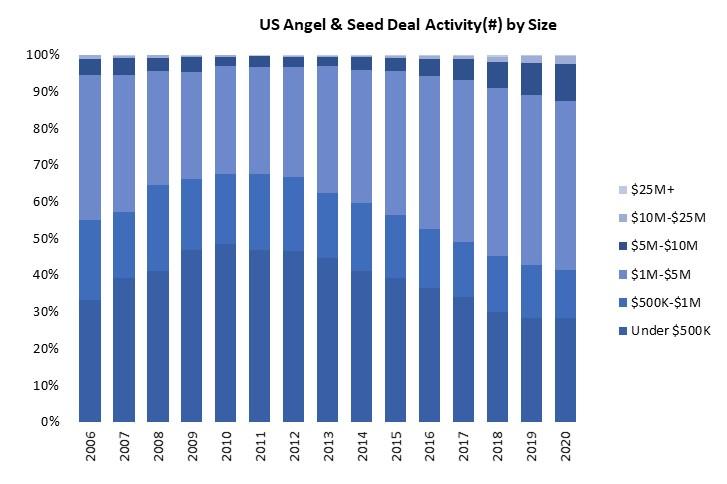

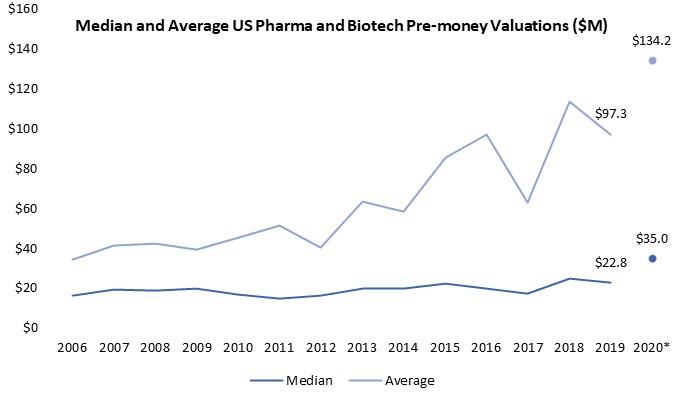

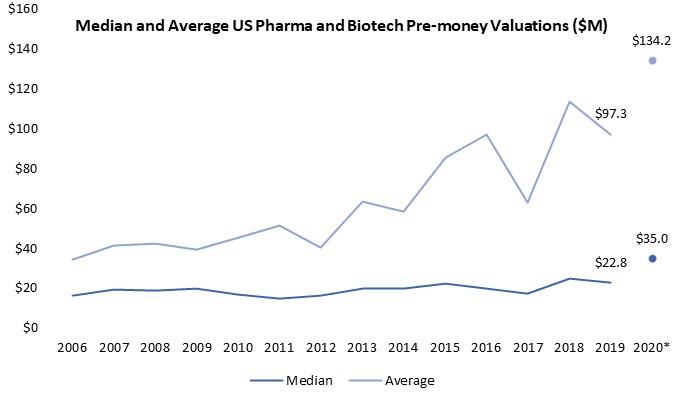

Early and seed-stage entrepreneurs, however, did not enjoy the same tailwinds as their later stage counterparts. Due to their inability to meet and evaluate each other in person, investors were much more apprehensive about deploying capital in companies without proven financial track records or even much of a product to go on, in turn, leading to a dip in seed-stage financings. As economic conditions worsened at the beginning of the year, high-risk seed-stage investments became even more unstable. This compounding effect of increased risk from economic headwinds coupled with the smaller number of investors taking meetings allowed VC firms to demand more equity for their capital, leading to lowering valuations.

Anecdotally, Top Tier has seen many of our Seed managers focus on working with repeat founders this year. Overall valuations lowered year over year at this stage, but quite frankly the best founders and companies are still raising at pre-pandemic valuations.

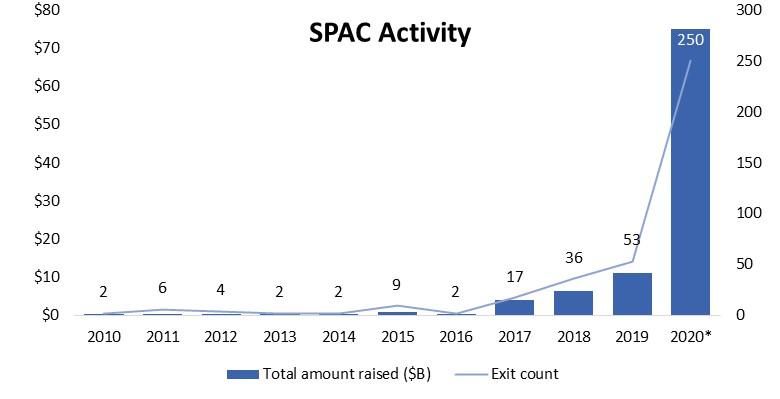

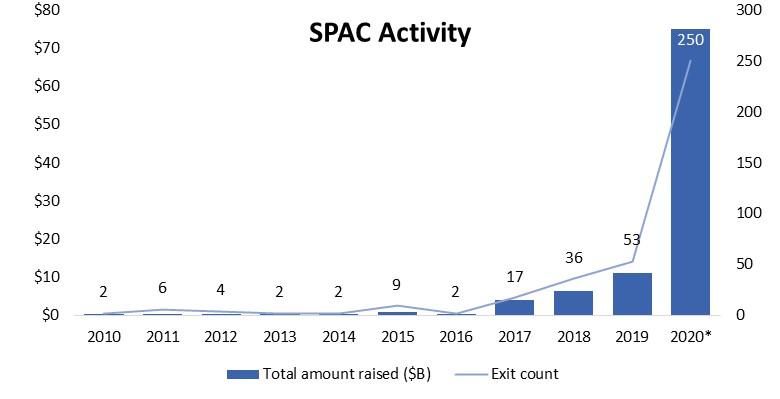

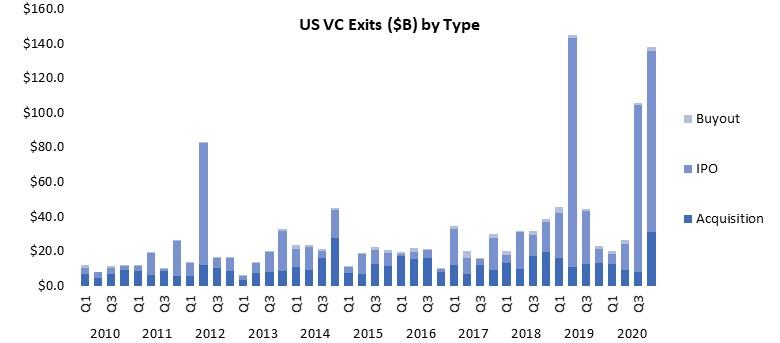

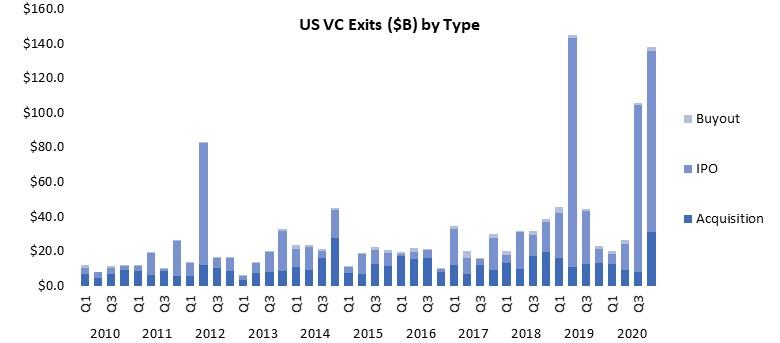

In 2020 M&A activity and public listings thrived, driving exit values to new highs. Notable IPOs included the likes of Snowflake, DoorDash, Unity, Palantir, and Airbnb. Non-public exits showed promise as well, with the largest VC-backed acquisition ever, the sale of Credit Karma to Intuit for $8.1 billion. A discussion of the exit market in 2020 would not be complete without Special Purpose Acquisition Companies (SPACs). Venture Capital firms such as 5AM Ventures, FirstMark, Foresite Capital, Lux Capital, and Ribbit Capital quickly joined the rush to sponsor new SPACs as they target companies within their specific sector expertise. The data on the rise of SPACs is clear with the number of these vehicles quintupling to 250 from the previous year, accompanied by approximately $75 billion of total value, a 580% increase over the prior year. Going forward, we believe there will be continued competition between late-stage investors and SPACs for late-stage growth rounds. We continue to look to SPACs as a potential force against the trend of companies staying private longer.

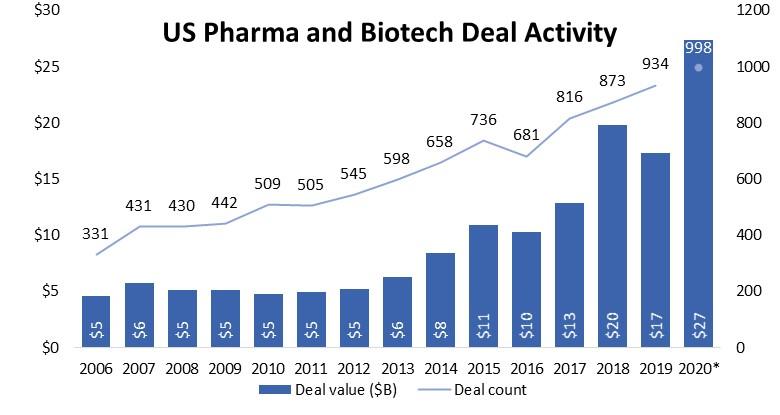

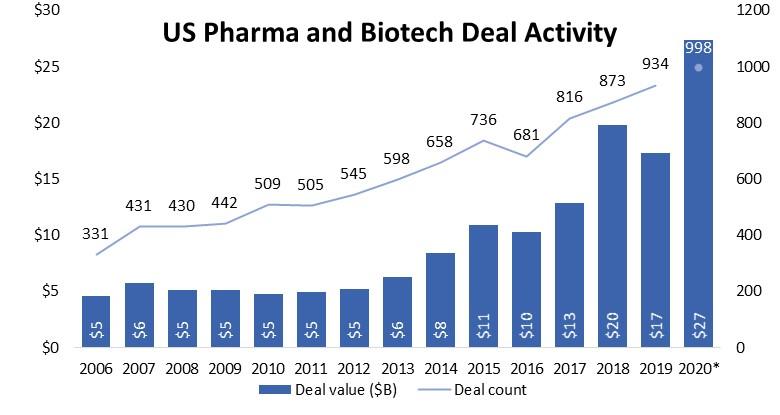

Biotech and Pharma led the charge as companies quickly went to work finding solutions to problems posed by the novel coronavirus. On the heels of public demand for these products and services VCs went to work providing the necessary capital. In 2020 VCs committed $27 billion across almost 1,000 deals. In the second and third quarter, 16 of the 25 highest valued early-stage deals were in the healthcare space, which dropped to 14 in Q4 but remained high enough to set a record as the highest value and count for biotech and pharma deals in a year. It should come as no surprise that exit value within the space soared, jumping from $33.8 billion in 2019 to $49.7 billion in 2020.

As 2020 set new records in total deal value, exit value, and capital raised for VC funds, the industry saw the gap between the winners and losers in the market widen. Tailwinds following the flash crash in March 2020 led to a robust recovery of the public markets and a strong IPO market in the second half of the year. Near 0 interest rates and a number of LPs under-allocated to the asset class led to a quick recovery for VCs. We believe the dry powder in the industry will work through the system as many of the brand name firms rushed to raise capital ahead of the uncertain US election. We are more bullish on the state of the innovation economy than ever as it is clear that every company is a technology company today – and, if not, don’t worry: your industry is next. As VCs and entrepreneurs took some time to collect their thoughts with many forced away from the daily grind in 2020, we are excited to play a role in what they build next.

*indicate estimates for that year.