One of the most frequently asked questions from our venture managers is “What is market?” Whether market refers to terms like management fees and carry, compensation for employees, number of companies per fund, or the size of LPs, the term that is hardest to find data on is economics. The old adage of “two and twenty,” referring to 2% management fees per year and 20% carry, is now more like “two and twenty-five,” but even that has a number of clarifying footnotes. We set out to try to answer this question, including breaking down the group by size of fund. What we can report right now, is that there is absolutely no correlation between economics and returns in our grouping of managers.

As a fund of funds focused exclusively on venture, we meet with hundreds of managers per year and hear all of the rationales for higher fees: everything from recruiting and retaining talent, to lack of funds under management. In the end, management fees do not return a multiple of capital, but only add to the hole a fund must dig out of, requiring larger outcomes from investments. The bigger the hole, the slower, and less likely a fund will get in the coveted carry and returning multiples of capital to investors.

We looked at Top Tier’s commitments to venture funds from 2011 vintages through current day, for fund sizes $600 million and below. The funds are primarily in the U.S., but are a mix across stages and sectors. We excluded any opportunities/ side/parallel funds and only included the main fund, as these side funds often have reduced terms. There were 75 funds included in the data set.

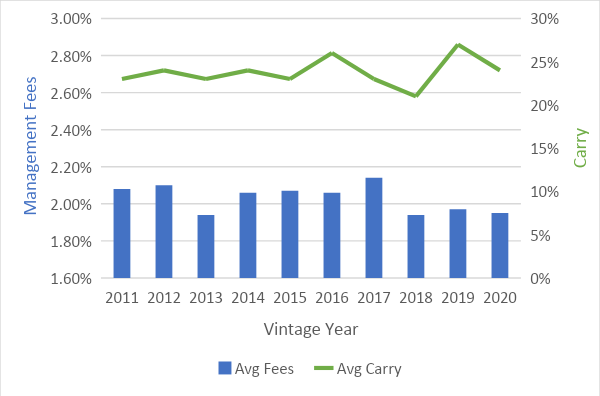

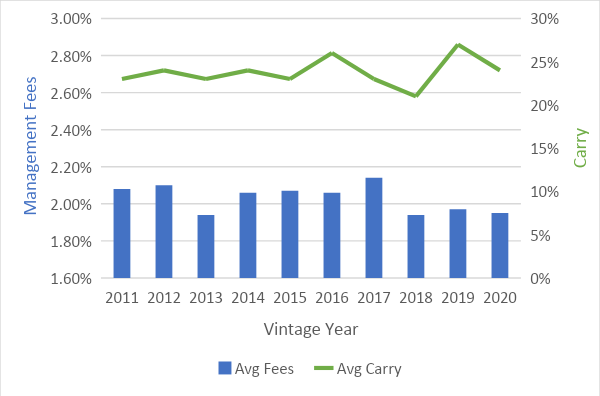

The results were surprising in uniformity, but were similar to what our instinct was telling us. On average, funds today, regardless of focus or size, charge an average of 1.9% management fees per year over a 10-year fund cycle, with an average of 20-22% carry until a 3x, then an additional 5% carry, should that 3x threshold be reached. For the purposes of this blog, we are using carry numbers, which assume the manager reaches the higher tier. Almost all funds in our data set start at 2.5% fees per year, but then decrease after the next fund starts, usually by a set formula such as 90% of the prior year, or a decrease of 0.25% per year. The minority convert to a percent of remaining cost or remaining NAV, since it is typically near impossible for the LP to discern how much will ultimately be paid in fees. Only 40% of our managers have a flat 20% carry, and most have some type of tiered system. Like the rest of the venture industry, this has evolved over time, as shown in the graphic below. Overall, management fees have held steady around 1.9%, but carry has started to increase to 25%. The tiered carry at 3x is appropriate (or respectable) since as an LP, we target a 3x net to be aligned with the GP on profitability.

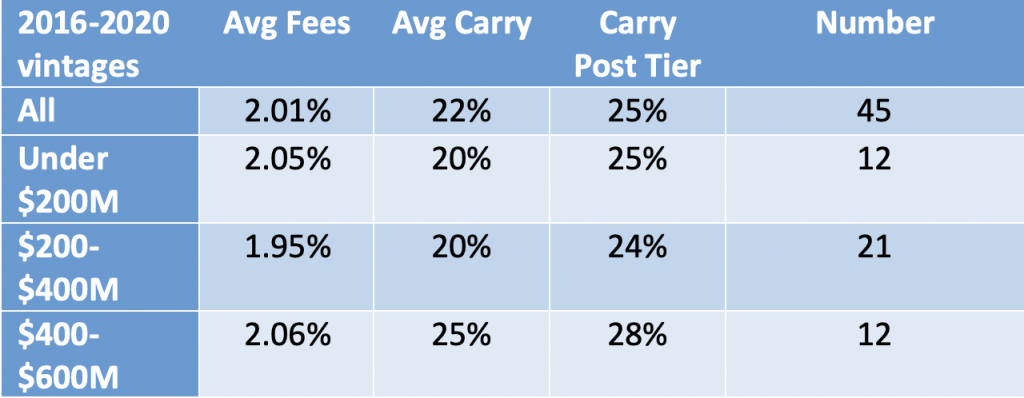

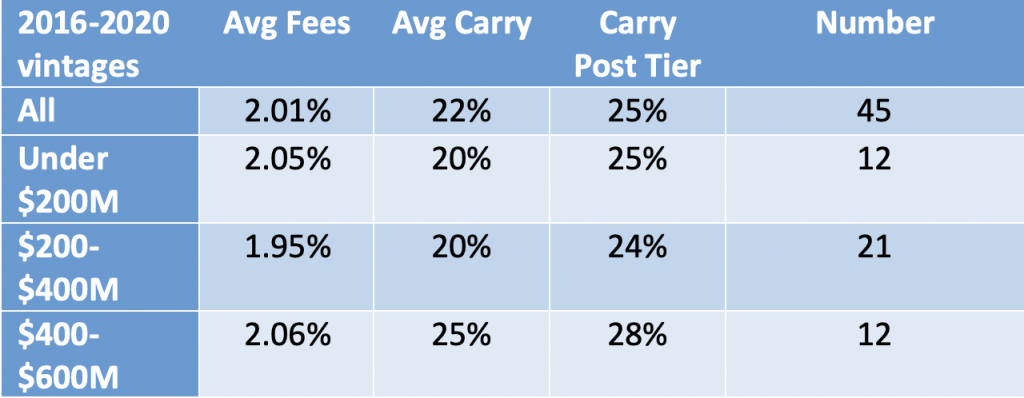

There are two myths that have been widely circulated: the notion that smaller funds have higher fees because they do not benefit from multiple funds under management, and that more mature managers have more funds, and consequently, more fees and do not need as expensive of a fee load? We did not find this to be the case. Rather, we found that the average fees for the dozen managers in the $400-$600 million fund size had higher fees than the smaller funds. When digging further into this data, we discovered it was due to starting out higher for the reason mentioned above, then never reducing fees as managers transitioned to “established” from “emerging.”. Emerging managers typically have smaller teams and less overhead. Larger funds typically have larger teams and back offices, so size does not matter as long as the team increases proportionally with the fund size; that same 2% covers the team and other expenses.

The table above shows the last five years of venture funds in our portfolio. This is approximately the time Top Tier began committing to more emerging managers, which provides a more accurate snapshot.. We excluded the highest and lowest funds for the purposes of this chart to eliminate any outliers. As shown, the 21 managers in the $200-$400 million range have the lowest fees, presumably to demonstrate they are taking a modest approach while increasing fund sizes. Once a fund grows to over $400 million, fees tick up to the highest of any group, but the carry is also nearing 30% after and tiers. Are these larger funds worth 2%+ and 30%?

To put this in perspective, a $500 million fund would charge $103 million in fees over a 10-year life. On a 3x fund at 30% carry, that amounts to $300 million, or $403 million overall. Most venture funds do recycle the fees, but between fees and carry, that is nearly 80% of the total fund going to the GP, which is why some venture funds struggle to raise capital. As a result, many LPs prefer to blend their fees lower with opportunities funds, which often have fee breaks of approximately 50% or greater, and why LPs insist on co-investment which don’t pay fees or carry.

Are high fees and low carry better than the reverse? We evaluated the hybrid of fees and carry by taking the product of the two. The higher the number, the more fees and carry. The average and median were between 0.48% and 0.50%, which is the equivalent of 2% management fees and 25% carry. As mentioned earlier, our preference is for lower fees, resulting in less drag on the portfolio and higher carry at a 3x. That way we are all similarly aligned and share in the upside.

So, what do LPs want, and what does the market look like today? We like to think we are investing in the industry’s best managers, with the evaluated average serving as a pretty good indicator of what we can expect for market average for institutional quality LPs. For example:a venture fund that is 10 years plus two one-year extensions would have fees that start at 2.5% per year, then decrease by 10% per year after the next fund is raised, for a blended annual fee of approximately 1.9%. No management fees should be charged in extension periods. Flat carry at 20% is warranted as a fund earns the ability to charge more, but the market for our portfolio is 20% carry up to 3x net, then 25% carry with a full catch up. In the end, our preference is for managers to charge fees and carry that allow them the persistency of returns of approximately a 3x net to LPs over a 12-year period, at longest.