Portfolio Observations

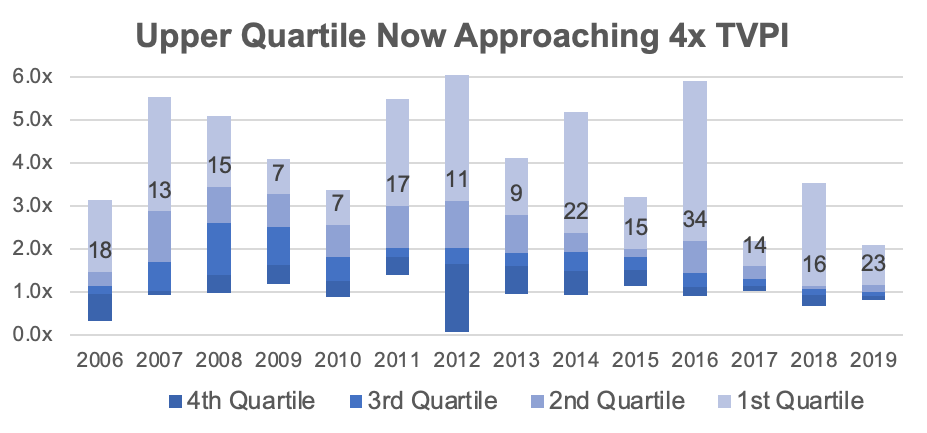

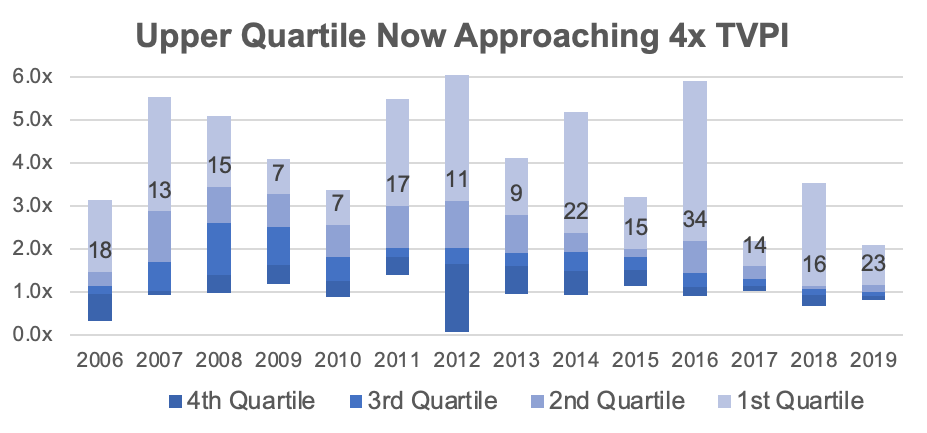

The graph above shows the performance of TTCP primary investments by vintage year. The number of funds is shown at top of each bar. Data from TTCP commitments as of September 30, 2020.

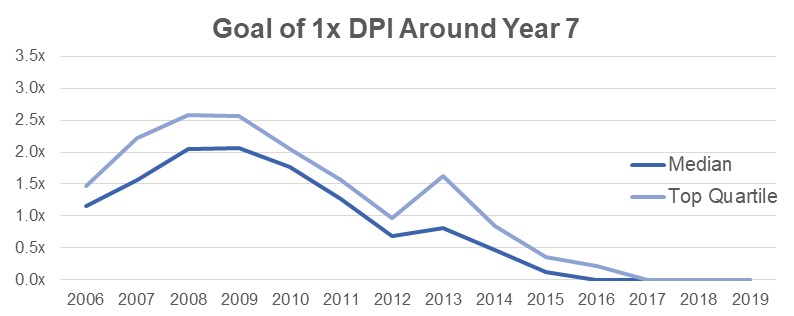

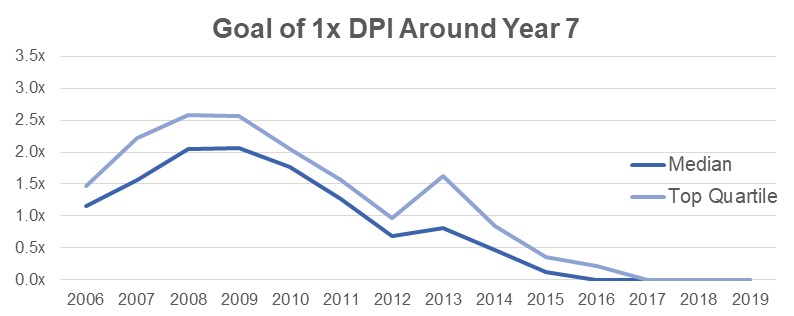

This graph depicts the DPIs of TTCP primary investments with vintage year on the x-axis. The lines represent the DPIs of our median and top quartile funds. As is shown, TTCP funds are generally above the 1x mark by year 8 in our median funds and as early as year 6 in our top quartile funds. Data from TTCP commitments as of September 30, 2020, net of managers’ fees, gross of TTCP’s fees.

Industry Observations

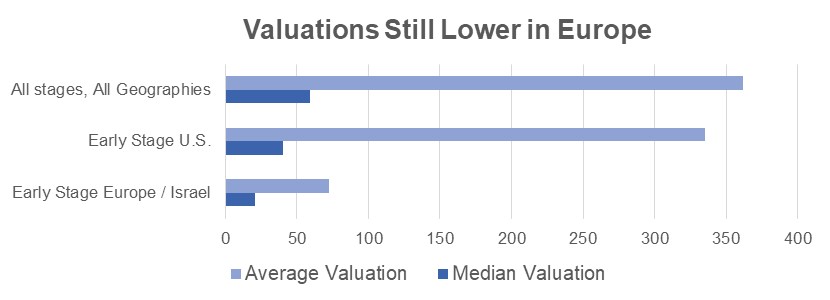

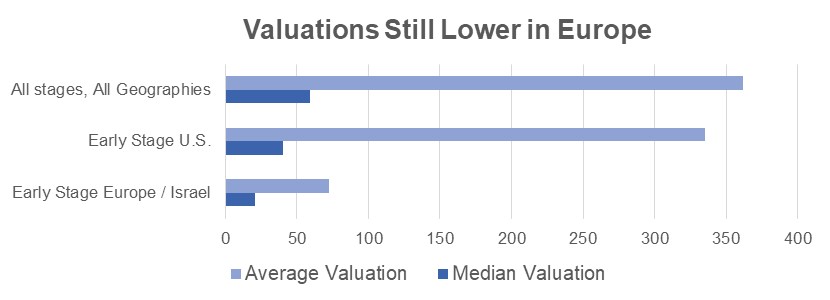

Upon examining 77 new portfolio companies with known valuations from manager allocations, median early-stage valuations in Europe and Israel remain at about 50% of their U.S. early-stage counterparts. We are hearing anywhere from a 30-50% discount to the U.S. which is in line with anecdotal evidence. The companies are all of comparable quality, but less competition in Europe drives valuations lower. In terms of deal count, 40% were from Europe. However, some of this is skewed by Top Tier allocation and fundraising timelines.

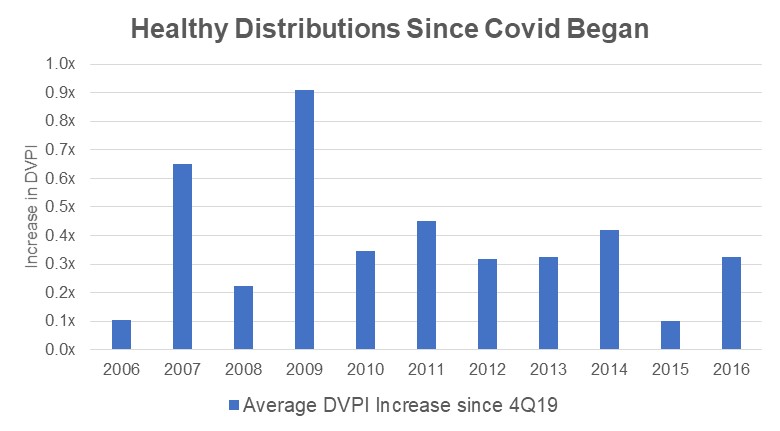

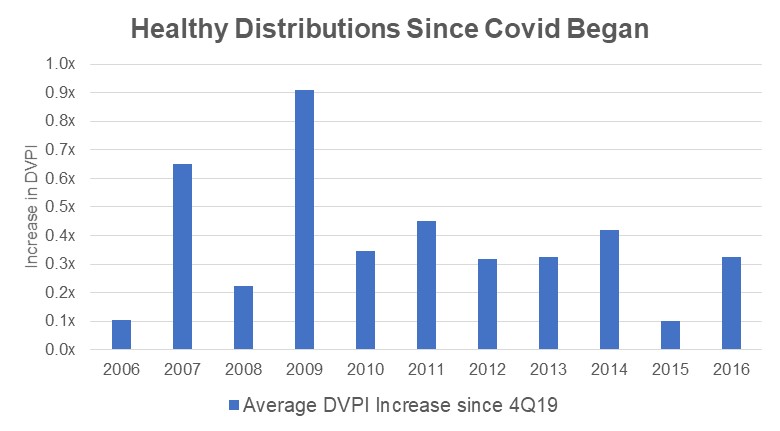

Despite the implications of Covid-19, TTCP distributions are up across the board. The graph above illustrates the change in DVPIs across all TTCP funds by vintage year. Each bar represents the increase in average DVPI from the fourth quarter of 2019 to the third quarter of 2020. As the data shows, the DVPIs of our funds have undergone significant climbs, especially 2007 and 2009 vintage year funds. The Data Team sees this growth as quite an extraordinary feat, as increases like these require distributions to grow faster than capital is paid in, and as is shown above, distributions from TTCP funds are growing significantly more quickly than capital is called. Funds with vintages later than 2016 are not included as they are still calling capital, making their DVPIs non-meaningful.

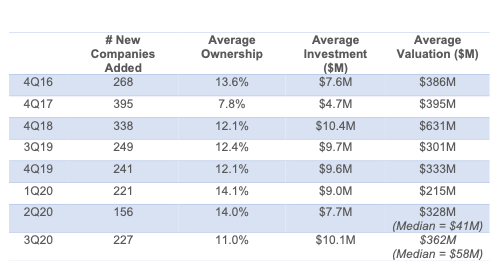

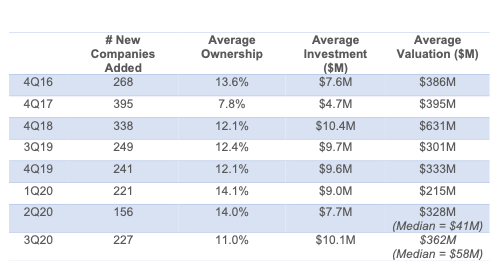

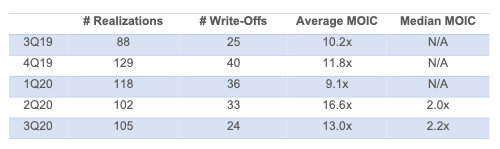

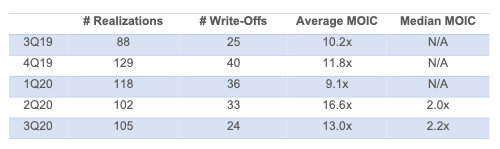

Updates to Our Internal Database this Quarter

Data from TTCP manager commitments as of 9/30/20.

Copyright © 2021 Top Tier Capital Partners, All rights reserved. Disclaimer: Performance data for fund families are not audited. Individual investor performance may vary from reported fund or fund family performance because of such factors as the timing of subscription to the fund, foreign exchange, differing fund expenses or fees and the ability to participate in certain investments. Data is as of 9/30/20 and is net of managers fees and gross of TTCP fees.