Key Points

We began this data newsletter at the start of the Covid-19 pandemic in 1Q 2020. Top Tier Capital Partners (“TTCP”) believes data analytics can help marry science with the art of venture capital investing. In 2010 we built a proprietary database, The Mine, to monitor all of our direct and indirect holdings, i.e. thousands of holdings globally. This enables us to use analytics to evaluate what’s worked historically, what (we think) makes a good investment, optimal portfolio construction and how to actively manage our funds post investment. The database is also a critical asset in sourcing what we believe are the world’s best opportunities. And The Mine is especially additive in evaluating pricing of privately-held businesses and/or predicting potential venture fund outcomes.

If you would like more information about these blinded analytics, please do not hesitate to let me know. Jessica Archibald – [email protected]

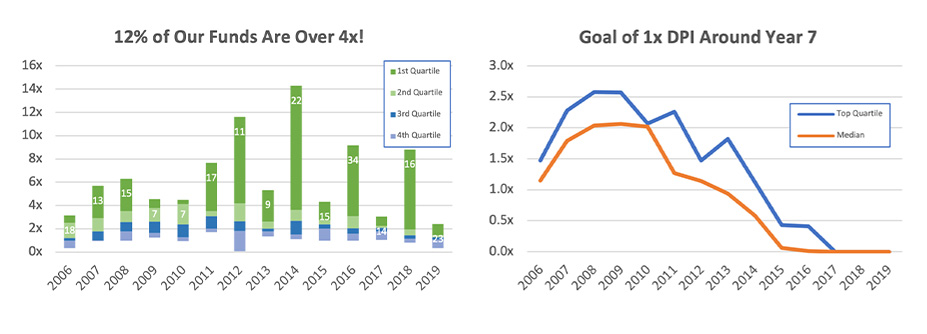

Performance Rankings1

1Left hand graph shows the MOIC (Multiple of Invested Capital), segmented by quartiles, of venture funds in which at least one Top Tier fund has invested. Right hand graph shows DPI (Distributions to Paid in Capital) for the same peer universe. All returns are net of underlying manager fees. Graphs are for illustrative purposes only.

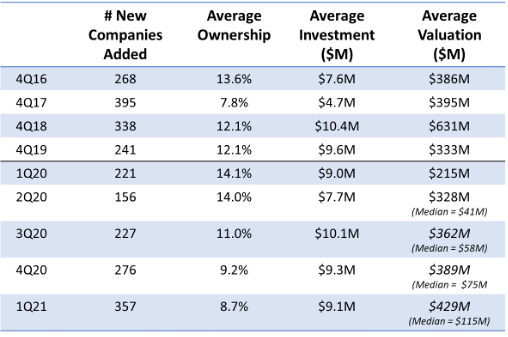

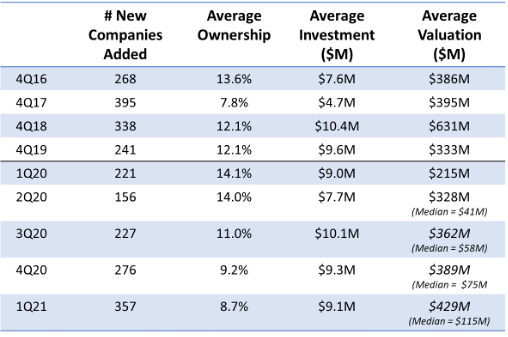

New Companies2:

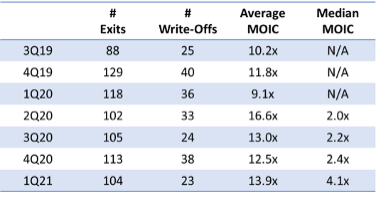

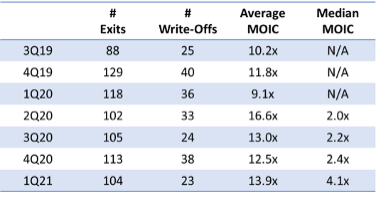

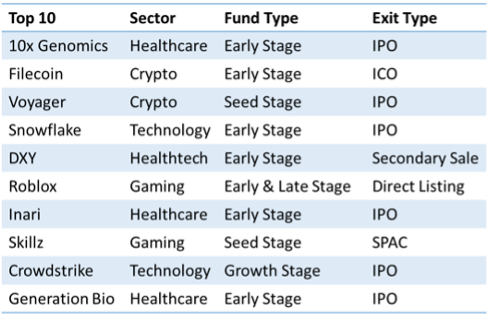

Realizations

Among these 104 partial or full realizations in the quarter, the top ten by multiple are an impressive bunch. The highest return is a whopping 120x with the median at 70x and the tenth coming in at a 28x! Most of these were from public sales, including the results from an initial coin offering of a couple of years ago.

Looking further down the list of realizations, the top 20% of outcomes generated $5.2B of value, or 74% of the total value created. While not quite the 80/20 rule, we believe this is still an impressive feat to have so few companies return so much value.

2The companies and corresponding data shown for New Companies and Realizations charts on this page represent investments made by Venture funds in which at least one Top Tier fund has invested. A Top Tier fund may also have a direct investment in one or more of these companies.

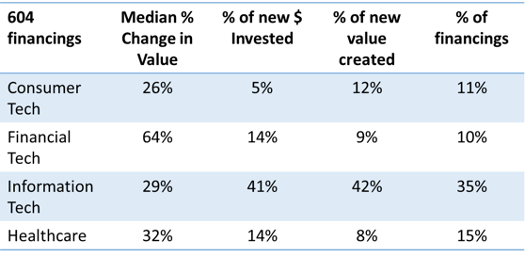

Financings

One of the data metrics we monitor on a quarterly basis is the number of financings. Top Tier may have multiple venture funds investing in the same financing round of the same company. Keeping an eye on new financings can be a helpful predictor of new trends when they emerge, e.g. crypto a few years ago and digital mental health companies in 2020, and an early potential indication that climate-tech is gaining traction in 2021.

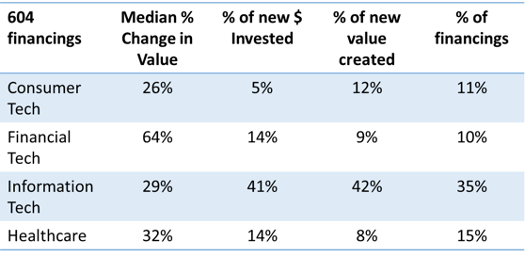

The below chart shows the 604 financings in 1Q21 within our portfolios. One item to note is that in consumer tech the sector only had 5% of the new capital invested in these rounds; however, it was responsible for 12% of the value created. Conversely, fintech invested a higher share than of value created. IT was about equal and healthcare also created less value per percentage of capital invested. We do not believe there is a lot to read into these, but were simply interesting metrics to keep an eye on, especially the delta with consumer tech.

Notes

Disclaimer: Performance data for fund families are not audited. Returns are shown net of managers fees and gross of TTCP management fees, expenses and carried interest. Individual investor performance may vary from reported fund or fund family performance because of such factors as the timing of subscription to the fund, foreign exchange, differing fund expenses or fees and the ability to participate in certain investments. The data in this document may represent a small percentage of the portfolio funds and underlying portfolio companies in which the Top Tier Funds have invested. Additional detail regarding the portfolios of the Top Tier Funds and their respective performance is available upon request. Data is as of March 31,2021. Graphs and images provided are for illustrative purposes only and do not constitute any guarantee. Past performance is not indicative of future performance. This material does not constitute an offer to sell or the solicitation of an offer to buy any securities. Please refer to relevant offering memorandum and other related documents for additional information. Any reproduction or other distribution of this material in whole or in part without the prior written consent of Top Tier is prohibited. This report is for informational purposes only and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy or investment product. Our research for this report is based on current information from what are considered to be reliable sources, but we do not represent that the research or the report is accurate or complete, and it should not be relied on as such. Our views and opinions expressed in this report are current as of March 31,2021 and are subject to change. Past performance is not indicative of future results