Top Tier Capital Partners recently sent a venture market survey to a number of our General Partners seeking first-hand insights regarding both their investments and feelings regarding the overall market.

The Respondents

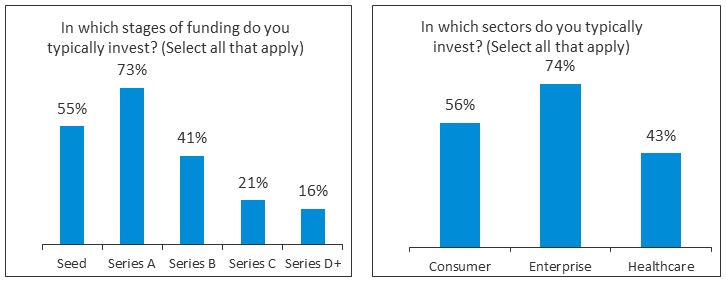

Of the 75 General Partners that responded, most invest in early stage technology companies with a healthy mix of healthcare mixed into a primarily technology cohort. On average, each GP’s firm invests in two adjacent stages and 50% invest in at least two of the sectors shown in the chart. Some 92% of the GPs invest in the western part of the US with 72% investing in the eastern US. Europe had 10% of the GPs as investors with the rest of the US not highly represented. The respondents’ profile was not surprising to us given these overall trends are similar to the make-up of a TTCP portfolio.

The Findings

On many levels, the results were not surprising – we found that entrepreneurs have lowered their valuation expectations and venture capitalists have slowed their investment pace.

When polling our GPs about the current state of the market, we gleaned that (1) they expect markets to remain choppy for 6 to 18 months and (2) roughly 70% of the GPs project the NASDAQ will be down 0% to 10% for the year.

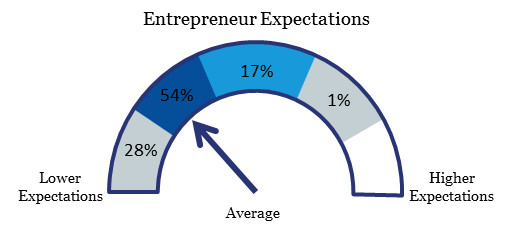

With regard to investments, we found entrepreneur expectations are thought to be coming down and GPs are looking for ways to take advantage of current market conditions. Our belief is that some of the best vintage years were during, and immediately after, the Global Financial Crisis for these reasons.

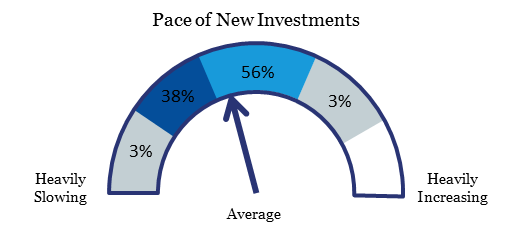

With this as a backdrop, we asked each GP if its pace of new investments was increasing or decreasing as a result of the current market conditions. Over half said their pace is the same. This may be surprising to some, but in fact, a downturn in a market often provides buying opportunities. During, and directly following the Global Financial Crisis, many of our GPs increased activity as the result of lower valuations. Of note, only two GPs felt their pace of investments was increasing at all.

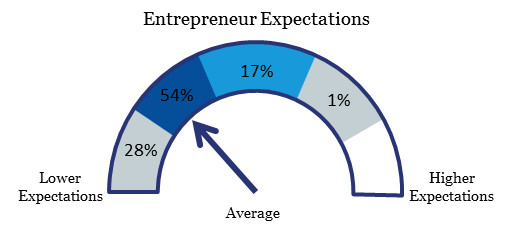

Another positive indicator of rationalization of the markets is that entrepreneurs’ expectations are coming down, with respect to anything from valuations to terms to length of time to raise capital. Over 80% of the GPs in our survey felt that expectations were coming down in contrast to 17% who felt the expectations of entrepreneurs were the same as last year.

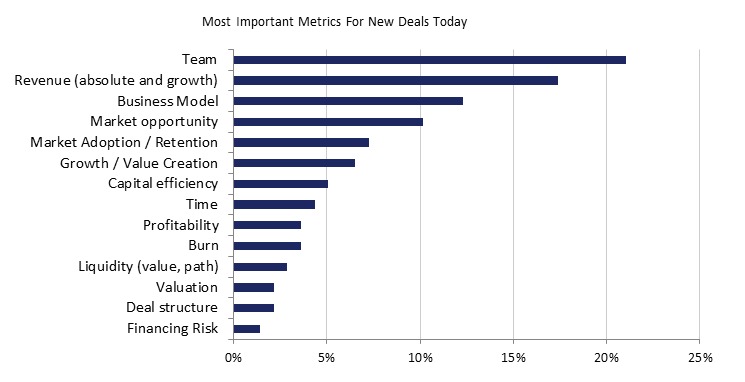

One of the most interesting questions was one that was most likely the hardest to answer: which two metrics are most important when evaluating new investments today? The overwhelming response was for team and revenues, with business model and markets just slightly less important. You will notice at the bottom of the list is path to liquidity, valuation, structure and financing risk. We can surmise that finding great companies run by solid teams overshadows finding strong financial metrics in early companies.

Finally, we asked GPs to predict the future. As we mentioned previously, the overwhelming response was that public markets will remain choppy for 9 to 18 months with nearly 70% believing the NASDAQ will end 2016 down 0% to 10%.

As we have long stated, and it appears our GPs would agree, we do not believe we are in a bubble, but are in a much-needed correction period. We remain cautiously optimistic about the markets and are happy to see the pace of investing either flat or slightly increased as opportunities arise at lower valuations. Entrepreneur expectations coming down combined with predictions by our GPS that the markets will not experience a crash further enforces our hypothesis that we are experiencing a healthy correction in the markets.