Introduction

The Top Tier team is excited to continue to increase presence in Europe by opening an office in London! After evaluating the global VC landscape in preparation for our last venture fund of funds in 2017, our team uncovered some interesting facts amongst our portfolios. We found that our portfolio companies in Europe and Israel were performing much better than we expected. These findings sparked our interest in the region and got us excited about digging deeper. Since then, as a team, we have canvassed the market – meeting with GPs and LPs alike. Our excitement with the market has continued to grow with every meeting!

European Venture Market

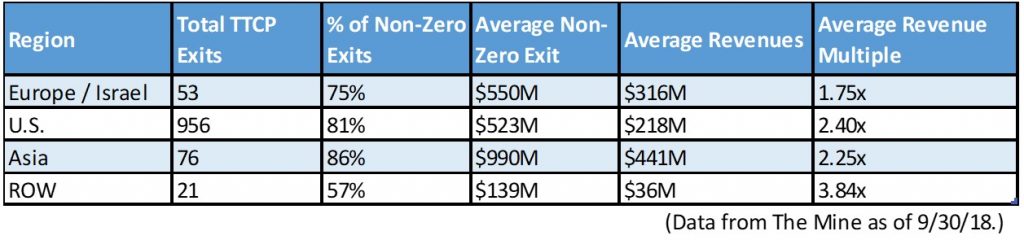

As the venture market becomes more global, we continue to see a proliferation of highly qualified managers coming out of Europe. The data behind the exits in Europe and Israel shows that they outperformed the exits in the US. There are fewer exits in Europe and Israel, but the following are interesting data points that caught our attention:

- Average exit valuations were higher in Europe

- Time to exit was shorter in Europe by 1 year

- Average revenues are higher in Europe and multiples were lower

- Percent of write-offs was not materially higher in Europe

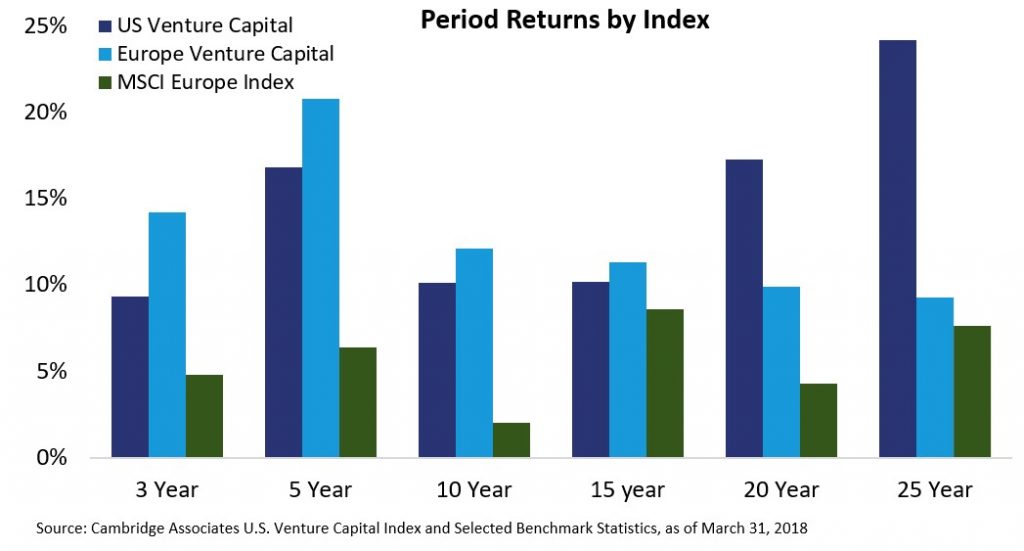

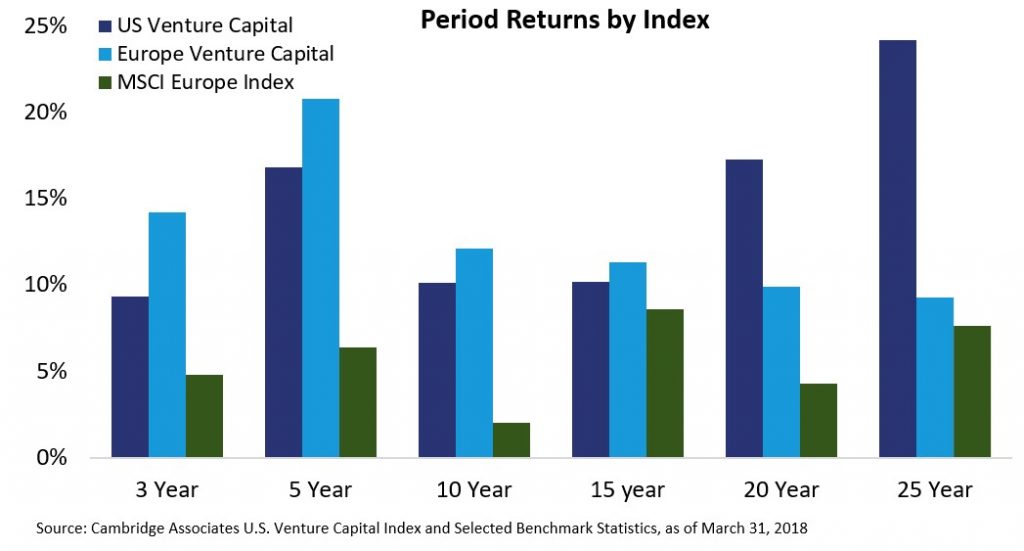

European venture is also performing well against the MSCI Europe Index and we are optimistic about the forward-looking comparison of returns from US VC, European VC and the MSCI Europe Index.

All of these data points indicate an interesting and valuable market to invest in, regardless of the reputation Europe had developed during the last 15 years as a difficult market to make venture returns. Data due diligence combined with several multi-week trips to the region proved to Top Tier that Europe now has the trifecta of experience – experienced entrepreneurs, VCs experienced at delivering returns and a market experiencing significant liquidity.

We believe the European and Israeli venture market will continue to grow and we look forward to continuing to build a strong portfolio of European venture managers.

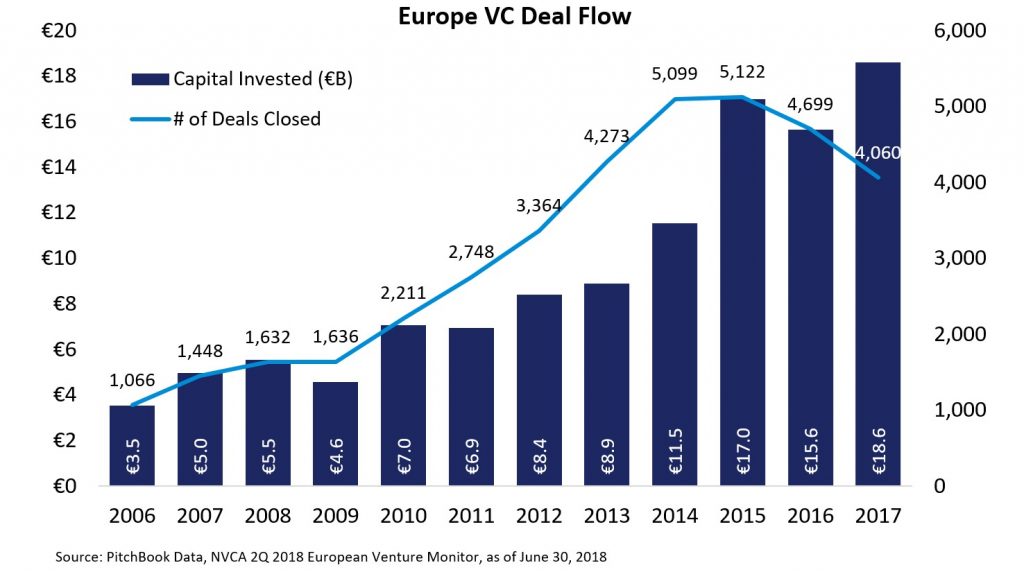

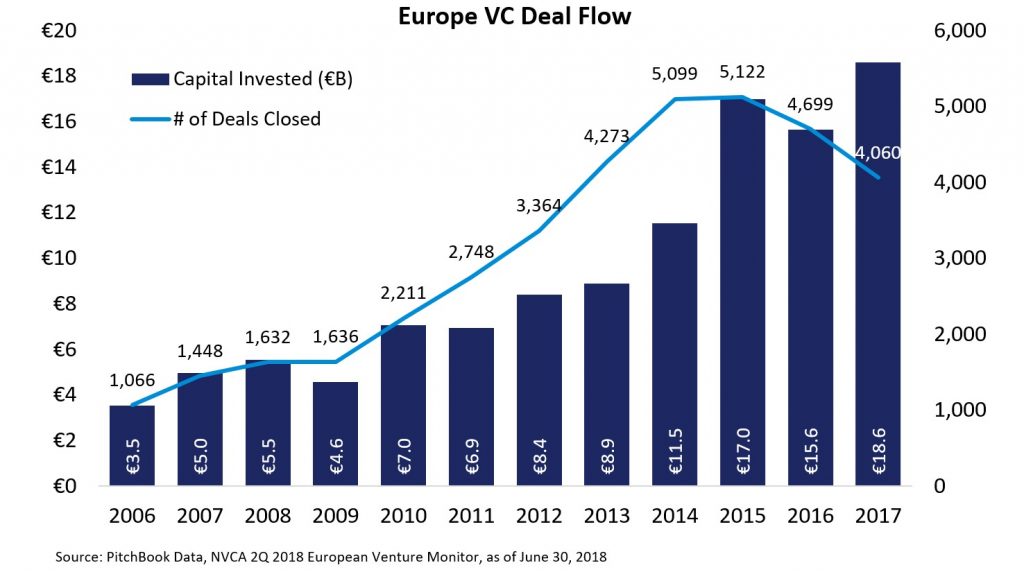

European Venture Deal Flow

Increased capital is an overarching trend in the venture ecosystem; Europe is experiencing this increase as well as there continues to be an upwards trend of capital invested in European VC-backed companies. Similar to the US, the deals are becoming more concentrated, dollars-wise.

European Fundraising and Exit Activity

European venture funds raised 4.6 billion euros in the first half of 2018, which is on track to outpace 2017. Despite recent political events, the UK is continuing to maintain strong numbers for capital raised and fund count. According to PitchBook, fundraising in Germany and Israel is gaining strong momentum due to increased local talent and promising emerging technology ecosystems. The European VC exit activity has remained strong as exit values were boosted by unicorn exits. Two companies that illustrate this trend are iZettle and Adyen.

Why Europe and the Benefits of Expansion

As we mentioned before, we also are excited to expand into Europe to be closer to our LPs – 6 of our 10 largest LPs are in Europe. Additionally, European VC has matured and its start-ups are competing globally. We also believe the combination of promising companies, VC fund performance and potential new LPs make Europe an attractive geography for expansion.

By being closer to the European market, Top Tier can provide institutional insight, Silicon Valley best practices and liquidity to LPs through secondaries. Europe will also create opportunities for us to invest in promising new managers, get access to untapped technology and gain exposure to a new and growing market.

Conclusion

We are very excited to continue to grow our presence in Europe and be closer to our LPs and GPs in order to both build relationships and understand the trends that are happening in the European venture ecosystem. Last week we finished celebrating our opening of our new Top Tier London office and we plan to hire a local team in early 2019. We believe that being local is paramount to successful venture investments. To ensure this is a successful endeavor, current Top Tier team members will also be rotating full time in the London office throughout 2019. In the meantime, we are all spending a considerable amount of time based in London.

If you are located in Europe and excited to talk about the venture capital market, please reach out to a member of the Top Tier team!

Please feel free to share all your comments and feedback. Follow @TTCP_SF for the latest updates and insights!