Top Tier has planted our European flag in the UK with the opening of an office in London. While venture capital activity is growing in many European cities, London is still widely recognized as the financial epicenter, and we believe it is also one of the top innovation ecosystems in the region due to the start-up activity coming out of the universities that are referred to as the “Golden Triangle” of the UK: Cambridge, Oxford and, in London, primarily Imperial College London (ICL) and University College London (UCL). In this blog post, we discuss three characteristics that make the Golden Triangle an important and prolific center of innovation.

1. An innovation ecosystem filled with research excellence

The universities of Cambridge and Oxford are known globally as elite academic institutions. In particular, both are known for their domain expertise in life sciences and deep technology.

Cambridge University is the largest biotech hub in the UK and probably in all of Europe. There have been 107 affiliates of Cambridge who have received a Nobel Prize, which would be the third most prolific country if Cambridge was categorized that way1.

Compared to Cambridge, Oxford is generally thought to be less acknowledged for natural science (physics, mathematics, materials, engineering, chemistry etc.) and more recognized for humanities, but in reality, today both universities are spinning out incredible and diverse start-ups. Oxford University also is known for being one of the top research institutions globally; the university’s external research income, including grants and contracts, is consistently higher than any other UK university, with £579M received in 2017-182.

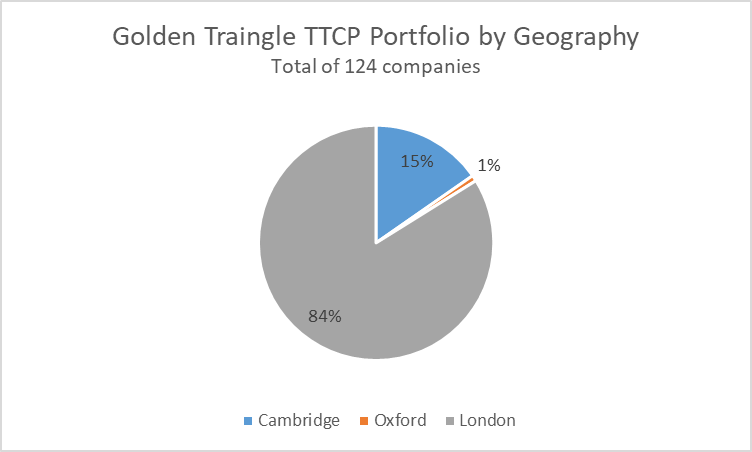

When taking a look at Top Tier’s underlying portfolio companies, our managers have made investments in 124 companies in the region; 20 of these investments currently are located in Cambridge or Oxford. Of these 20 companies still located in the two university research cities, the vast majority are based in Cambridge (95%) versus Oxford and there are more healthcare (90%) versus technology companies3. The overweighting of Cambridge likely can be explained by the robust ecosystem that exists there for both the creation and development of biotech companies. While this data implies that our VC fund managers are much more active in the Cambridge ecosystem, we note that we do not track where the technology was developed/spun-out of, only where the company is located today. Our data demonstrates London is a clear venture ecosystem and a natural epicenter connecting the Universities in the Golden Triangle, with 104 companies headquartered in the city today4.

We also find that the tech start-ups in London are most often traditional software companies, with fintech being a key sector, compared to Cambridge and Oxford. However, the Cambridge and Oxford ecosystems are much more balanced by sector today with impressive companies being created across life sciences, software, engineering, digital health, etc. Also, we found that spinouts are less prevalent in London compared to the University ecosystems.

2. Financial support is growing in the Golden Triangle.

The Golden Triangle universities all have tech transfer offices, dedicated venture funds and local venture funds committed to investing in ideas and research projects at the earliest stages. Tech transfer offices help facilitate the commercialization of research that takes place on campus and helps them achieve their goal of increasing/facilitating the impact of these innovations in society.

The first tech transfer activities were conducted on an ad-hoc basis by existing University administration before tech transfer offices were formally established in the UK in the late 1980s due to favorable regulatory changes. In 1986, Imperial Innovations was founded to fund spin-outs from Imperial College, and has since been acquired by IP Group, which over time has formed long-term partnerships which several universities across the UK. At University College London, the tech transfer company was founded in 1993 and became UCL Business (UCLB) in 2006. Today, Albion Capital manages venture capital funds for UCL. The funds have a strong focus on two areas of technology where the university has exceptional strength: cell and gene therapy and artificial intelligence. Altogether, according to UCLB, UCL’s spin-outs have raised over £1B in funding over the last 10 years5.

At Cambridge, commercialization was first accomplished in 1988 when the University had the earliest form of its tech transfer office, which was originally ran by a department in the University rather than as a wholly owned subsidiary like it is today. Since its founding in 1995, Cambridge Enterprise spin-outs have raised £1.7B in follow-on funding6. At Oxford, Oxford University Innovation (OUI) manages tech transfer. OUI has facilitated 162 total spin-outs since 1987 and its portfolio companies have raised over £1.9B in external investment for spinouts since 20117.

Alongside the tech transfer offices, both Oxford and Cambridge have preferred investors for their university spin-outs. At Oxford, Oxford Science Innovation (OSI), which is the university’s preferred investment partner to bring Oxford’s ideas to the world, has raised a £600M fund. Similarly at Cambridge, there is Cambridge Innovation Capital (CIC) which has a formal agreement that establishes preferential access to deal flow and has raised £275M to date. They are also co-located within the tech transfer office on campus. There are also external fund managers with contractual relationships at these universities, such as Albion Capital which manages and administers the fund at UCL, Parkwalk Advisors which manages and administers Enterprise Investment Scheme (EIS) tax-advantaged funds focused on Oxford, Cambridge and Bristol, and IP Group which continues to partner with research institutions to commercialize life science and technology research from universities.

Lastly, there are traditional venture funds with investment thesis focused around these ecosystems. Examples include Amadeus, Cambridge Venture Partners, Future Planet Capital, IQ Capital, Longwall Ventures, Parkwalk, and Sussex Place Ventures. These university-focused venture capital funds typically syndicate with financially motivated local or London-based funds because the university focused funds lack scalable capital to support the full life cycle capital needs.

3. Creation of high quality companies.

According to Dealroom.co, London, Cambridge and Oxford have created 55 unicorns since 1990; 45 of these were created in London, and 5 in Cambridge and 4 in Oxford8. History shows that Oxford has been more prominent in creating a large number of successful spin-outs while Cambridge has exceeded in the level of success of their spin-outs. Notable successes from the Cambridge and Oxford regions include Autonomy (acquired for $11.7B by Hewlett-Packard), ARM Holdings (acquired by Softbank for £24B), Improbable (last round done at £1.5B valuation), Dark Trace (last round done at £1.6B valuation) Oxford Nanopore (last round done at £1.5B valuation, and Nightstar Therapeutics, which was sold to Biogen for $877M in June 20199.

These ecosystems have a lot to offer together as the Golden Triangle – similar to how many of the world’s most successful companies have roots tying back to Stanford and UC Berkeley around Silicon Valley and Harvard and MIT around Boston. Top Tier encourages venture investors – both LPs and GPs – to notice the word-class innovation taking place in the Golden Triangle and the companies being formed and funded as this ecosystem continues to mature.

Sources:

1https://www.cam.ac.uk/research/research-at-cambridge/nobel-prize

2https://researchsupport.admin.ox.ac.uk/information/income

3 TTCP’s the Mine Database data as of 3/31/19.

4 TTCP’s the Mine Database data as of 3/31/19.

5 Annual Review UCLB’s 25th Year, April 2019

6 Cambridge Innovation In Numbers infographic, January 2018.

7 Oxford University Innovation Annual Review 2018, October 2018.

8 Dealroom.co Unicorn Update – London Tech Week, June 2019.

9 Pitchbook data as of 8/19/2019.