Like many around the world, TTCP is actively adapting to the ever-changing work environment, which has become our new norm. It’s during unique times like these that we, as institutional investors, are trusted by our Limited Partners to remain ahead of the market, and invest their capital responsibly. To do so, TTCP has conducted update meetings with managers and compiled data to provide our supporters with a snapshot of how venture firms are measuring COVID-19’s impact on the industry, responding to this new environment, and how we at Top Tier plan to navigate today’s market.

COVID-19’s Impact on the Venture Market

While it was impossible to anticipate the COVID crisis in early 2019, the market largely recognized the likelihood of an upcoming correction, and many of the industry’s leading managers took preemptive steps to lessen the blow of an impending downturn including:

- 2019 was characterized by colossal fundraises for market-leading companies and venture funds alike, providing many companies with sufficient runway, and dry powder to reach an all-time high

- Venture funds typically discount public valuations by up to 30%, lessening the decrease to fund performance

Regardless of how venture funds prepared, no one was equipped for what some have characterized as the most unique economic event in history (Courtesy of Scale Ventures). While a worldwide recession of this magnitude and velocity hasn’t been experienced in the past, the immediate market impacts largely resemble that of previous recessions:

- An accelerated emphasis on attractive margins and sight to profitability, building on the learnings from non-profitable high growth tech IPOs in 2019

- A tightened exit market with M&A likely recovering before the IPO market

- Tourist VCs and CVCs re-evaluating the risk/reward of participating in a market full of unknowns

One positive sign for the tech industry is the performance of the NASDAQ versus other indices, which is down 14% on the year compared to the S&P 500 down 20% and DOW down 23% over the same period. The NASDAQ hosts many of the world’s best technology companies and is where most of our exposure lies.

How are VCs Responding to the Crisis

Many of our General Partners are experienced investors that have navigated various market conditions, including the 2000-2001 Dot-com Bubble, the aftermath of 9/11, and the 2008-2009 Global Financial Crisis. Institutional learnings and experiences serve as a foundation and offer our managers an upper hand in advising their portfolio companies through today’s unique environment. Unlike previous experiences, companies will need to navigate through a period of time where in the worst case, revenues have dropped to zero overnight with unclear visibility to when they will turn back on. In this respect, each of our managers are using a common framework to conduct on-going evaluation of their venture funds and portfolio companies to protect positions and maximize fund performance against the impact of the current pandemic.

- Ongoing board meetings with portfolio companies to understand COVID impact, cash position and future outlook.

- Typical cash runway buckets are 0-12 months, 12-24 months, 24+ months

- Re-evaluate and categorize the health of their portfolios according to a Green, Yellow, Red ranking

- Re-evaluate reserves and a “cull the herd” mentality

Some of the best practices shared with managing portfolio companies include:

- Urging companies to reassess all 2020 forecasts to account for a likely decline in short-term revenue and worsening customer renewal rates.

- Cut costs and slow your burn to extend runway, and stress a renewed focus on fundamentals.

- Evaluate competition. Competitors may be in more unfavorable positions than you are, so you may end up in a better position if you survive.

- For companies in a position of strength, this is a great time to hire talent.

- Stay close to your customers. Consumer behavior will likely change in response to the pandemic. Those that can stay close to their customers and play to their needs will likely thrive.

Some of the best practices shared with managing venture funds include:

- Allocate sufficient fund reserves and measured portfolio triage.

- Slowing investment pace as the industry figures out what fair market value is in today’s environment.

- Increase in-kind distributions of public positions and distribute cash not needed for reserves. It’s unclear what LPs need in this market, so let them decide.

- Communicate with LPs on the health of your funds and any impacts to investment pace and fundraising timelines. LPs can often also help VC portfolios by co-investing.

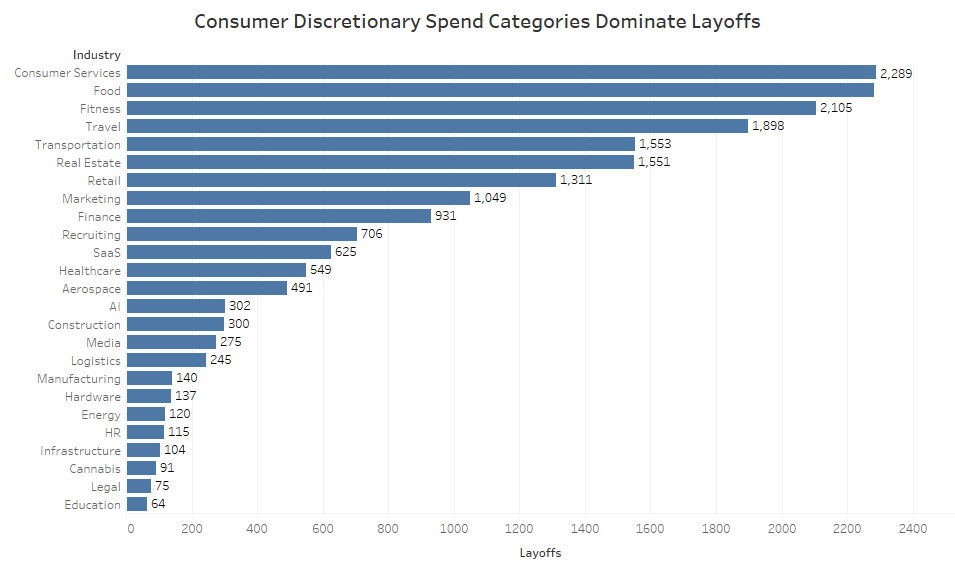

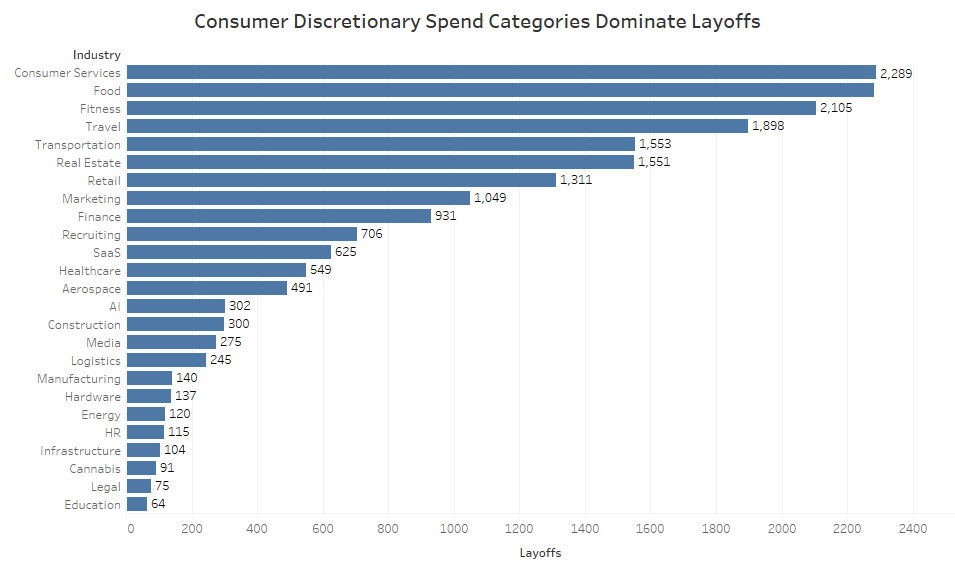

Not all companies are responding to the pandemic equally. Many companies offering “must-have” products have beat Q1 forecasts, while others with troubled customers have missed their numbers by up to 75%. Similarly, the pandemic has shown to affect early-stage, high growth companies less dramatically than their later-stage, low growth peers. Headcount reduction has been a common practice across the startup ecosystem as companies look to cut costs. To this effect, large-scale layoffs have been seen across industries with Consumer Services, Food, Fitness, Travel, Transportation, and Real Estate among those most dramatically affected.

In line with many in the market, TTCP has adjusted our 2020 model to reflect our views of today’s condition and the changing capital needs of our managers and companies.

Our Views

While the list of unknowns seemingly expands, one thing we know is that the spread can be slowed and even stopped. Unlike prior economic downfalls, venture managers and companies will need to be prepared for the risk of reinfections, similar to those we’ve seen across Asia, in countries such as Singapore, Hong Kong and Taiwan. However, the COVID crisis seems to have a finite end date for full-recovery which begins with wide-scale distribution of a proven vaccine.

That said, we’re proud to be direct and indirect supporters of companies that are working to aid in the fight against this virus through data, services, insights, potential treatments, or education. We’re big believers that influential companies can be built regardless of the state of the markets and it’s proven that some of the most innovative companies can be built during trying times.

We expect that innovative venture-backed companies will drive economic recovery from this pandemic, and shape our society coming out of it. We hope you continue to stay safe, practice responsible social distancing, and appreciate the positive things in life brought on by the crisis, like spending time with family, and the Tiger King.