Since the New Year, the team at TTCP has received several questions regarding our view on the recent volatility in the public markets and how it might impact our portfolios. While we typically invest 65-75% of our funds of funds portfolios in early stage venture capital, we inevitably have exposure to the public markets through venture-backed companies that have gone public and late stage companies which are marked to public comparables by our underlying fund managers. As we discussed in a previous post, we historically have preferred cash distributions to in-kind distributions for several reasons, including the volatility that comes with holding public stocks in our portfolio. Our strategy has generally been to manage out of these positions as quickly as is practical, but the current market cycle is causing us to reiterate to our managers that we prefer cash.

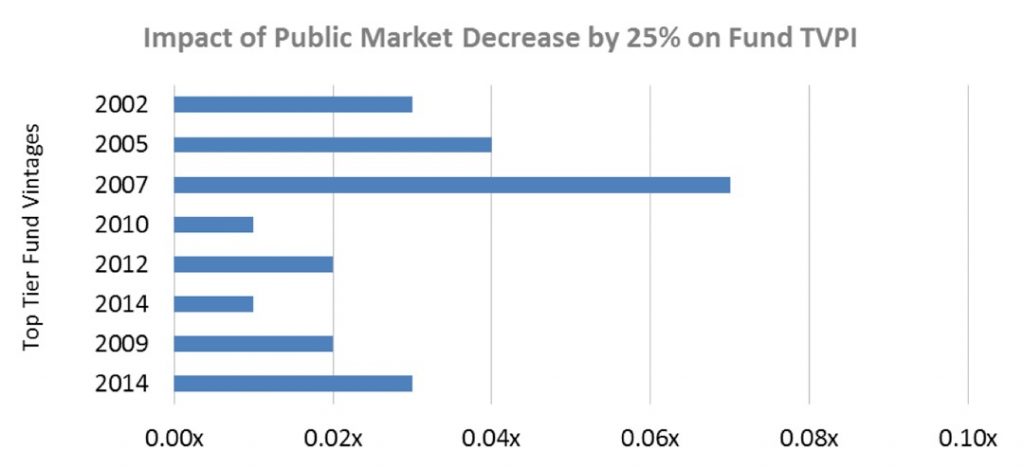

With regard to the impact on the Net Asset Value (NAV) in our funds, we looked at both the short term and long term. In the short term, our public exposure is actually small enough in relation to the overall size of our funds of funds such that even a 25% decline in the public market would have a minimal impact on the overall fund of funds’ TVPI.

Our older funds (2002 and 2005 vintages) are well into their peak distribution periods such that the value in publics is only 11%-12% of the total value in the fund. Should the public market value decline by 25%, the impact on our funds’ TVPI is between 0.01x and 0.07x, depending on the fund. However, this does not account for the potential impact on late stage public market comps.

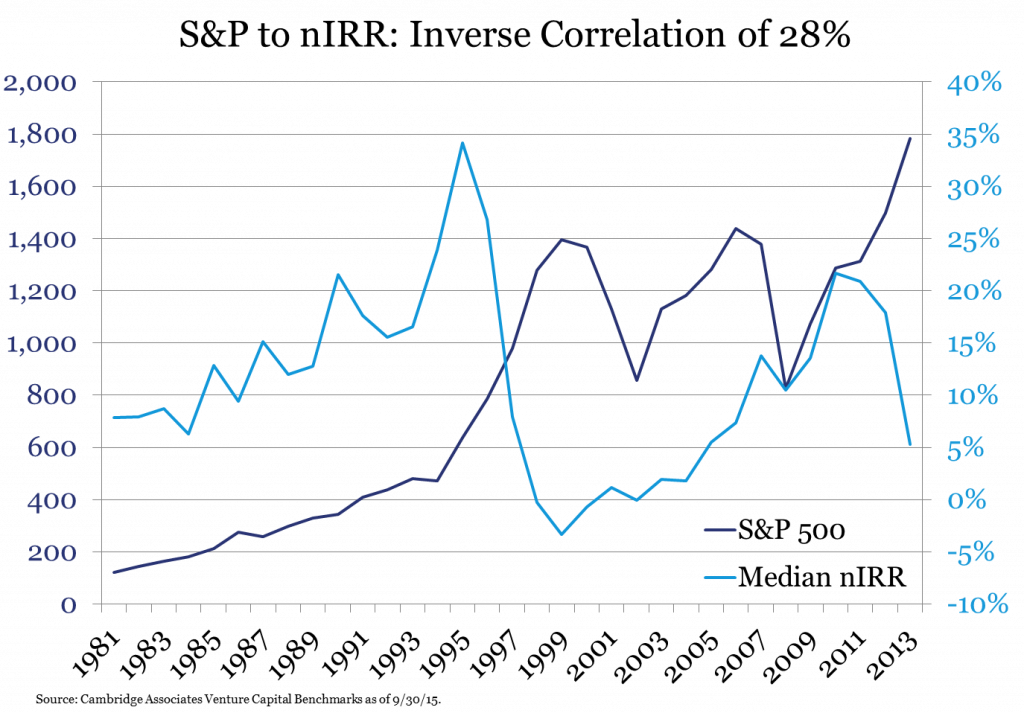

To gauge the longer term effects, we looked to the correlation between public markets and venture returns. When comparing the performance of the S&P 500 index over the past 32 years with the Cambridge Associates’ median VC returns over the same period, we calculate an inverse correlation between the two of 28%.

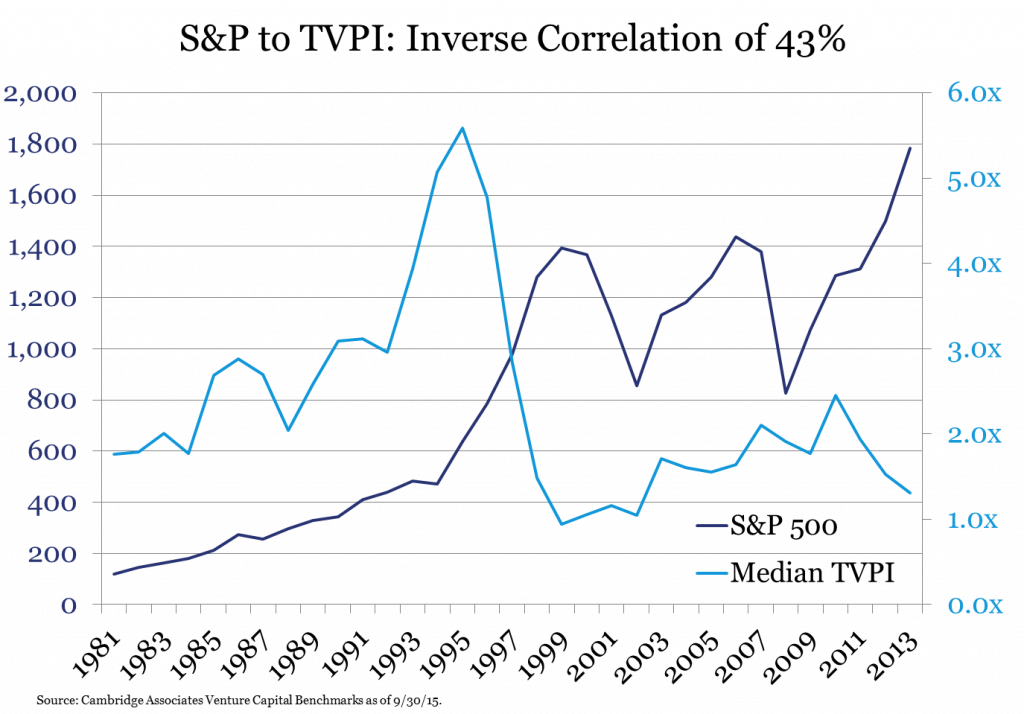

When comparing the S&P 500 Index with Cambridge Associates’ median VC TVPI numbers, the inverse correlation is even stronger at -43%. This implies that as the public markets increase, venture returns for those vintage years decrease. This makes sense, as we commonly see private market valuations increase as public markets increase. The good news for our industry and our funds is that lower public markets valuations have historically been a good indicator for increase performance among those vintage years.

The bottom line is that venture capital is a long-term investment thesis that should not be compared to the public markets at the close of each afternoon bell. We continue to remain calm, as ultimately market volatility and the correlated lowering of public valuations can create opportunities for our venture partners.