As investment professionals we were attracted to venture capital years ago and we were inspired by the potential to make outsized returns alongside some of the smartest and most entrepreneurial investors in the world. For the right to do so, however, we agree to be locked up for at least ten years and pay handsome fees and carry. The fees are a necessary evil in what are normally smaller funds that do not generally provide for additional fee sources such as ‘equity arrangement fees’ that have been common in the buyout world. In addition, the carry we pay for investing with the very best firms is often higher than 20%. But why not share outsized profits as you make them with an exceptional manager? After all, incentives are aligned.

The venture industry is now cash flow positive, and we are happy to see the IPO and M&A markets enable entrepreneurs, GPs, and LPs to achieve exits in their companies once again. As an LP, however, we find it disturbing that some of our returns are being delivered to us by our GPs in a way that is not at all in the spirit of sharing the wealth as we had anticipated when we signed the limited partnership agreements so many years ago. The issue lies in the practice of in-kind distributions.

Don’t get me wrong. Most general partners handle distributions in an entirely ethical way trying to best maximize value for themselves and their limited partners. There are many legitimate reasons to deliver stock instead of cash to LPs. For example, a GP might feel more compelled to give its LPs a chance to sell the stock themselves, especially when the GP is still sitting on the board of the company. But, many handle in-kind distributions in such a way that maximizes marginal value to the GP while destroying value for its LPs and harming the companies it was supposed to be supporting.

One way that in-kind distributions can be less investor-friendly is through a common contractual term where the distribution value is taken as the average of the last 5-10 day closing prices prior to the distribution. The original logic was that it was fairer to the LP because it made it less likely that a GP would distribute on a single spike in price. However, in practice, this pre-distribution date average pricing term gives the GP a de facto option and the adverse incentive to distribute when the price is falling.

Example 1 below shows one such actual event that occurred recently. This particular GP had terms that allowed for a previous ten-day average price for distributions. Two days after the company announced a poor future outlook and its stock fell, the GP distributed Stock A to its LPs avoiding the 17% drop to its books. This in turn allowed the GP to claim better returns plus charge carried interest on the higher returns. In this case, the GP was able to charge an additional 5% of the distribution as carried interest on profits that the LPs did not receive.

Example 1: Stock A – Price and Volume

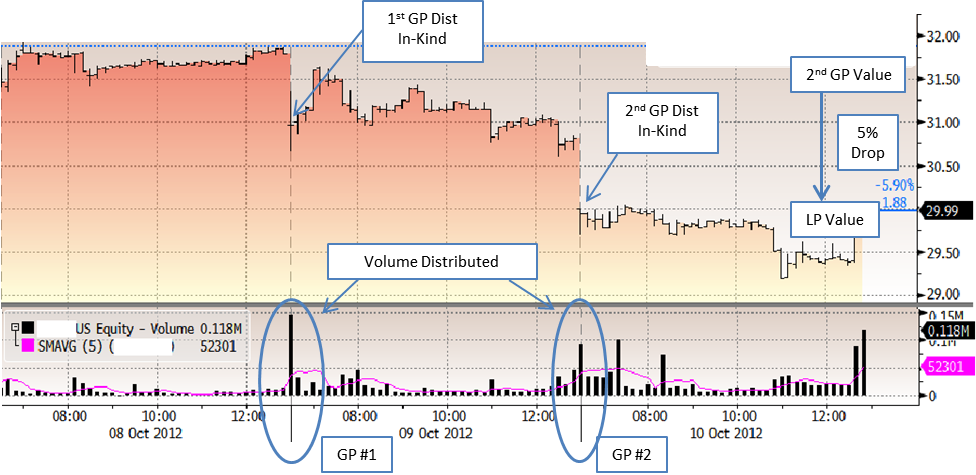

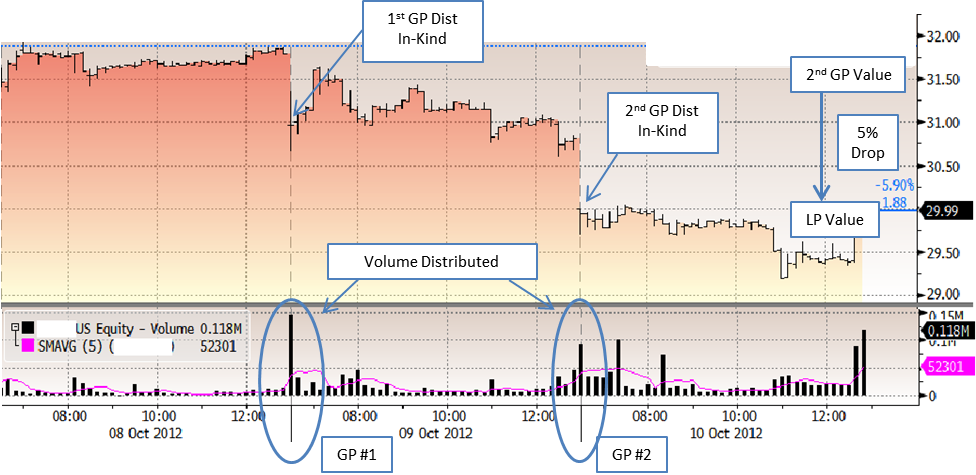

In the separate Example 2 below, a GP distributed stock to its LPs, which significantly depressed the stock as the LPs moved to sell more shares than the market could accept. This is an unfortunate effect that happens in our opinion too often around many venture-backed distributions in-kind where average daily trading volume is relatively thin. To further compound the problem, the very next day, a second GP distributed the same stock to its own LPs, further depressing the stock and the LPs were left “holding the bag”. Like Example 1, this second GP avoided the majority of the loss (five percentage points) that occurred the day before due to its backward five-day average pricing calculation on distributions. The second GP also received carry on profits its LPs did not enjoy.

Example 2: Stock B – Price and Volume

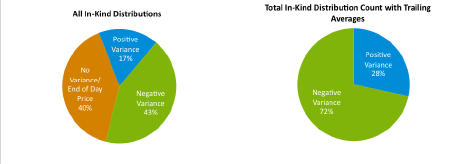

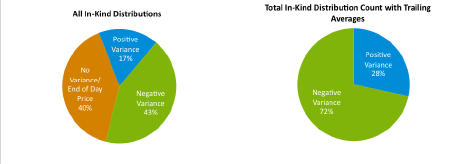

Over the last three years, we have received 35% of our distributions in stock, or in-kind, and the remainder in cash. Of the in-kind distributions, about 60% used some form of trailing day average pricing to determine the distribution price. Looking deeper into those, we found that 72% produced negative variances from our perspective, which suggests that GPs favor distributing in-kind when the variance is in their favor.

In fact, the larger the variance between the trailing average and the stock price on the day of distribution, the more likely the GPs were to distribute after a fall in stock price when they used trailing day average pricing to determine the distribution price. Specifically, for variances greater than 2%, 83% were negative, while for variances of less than 2% only 54% were negative.

Over the last three years, the net negative variance for all of the $275 million of in-kind distributions to our portfolios was 1.93%. Assuming an average carry of 20% (which is likely low), our GPs have had the ability to charge our portfolios an additional $1 million over that time period.

Though we have not performed the analysis, we suspect that additional greater damage was done to our portfolios (and the individual companies) by GPs dumping already weak stock into the market, adding unwanted pressure. This pressure happens just as the limited partners try to sell their shares. To get a sense of the activity level, we estimate that LPs sell one-third of their distributed holdings in the first day and a total of two-thirds is sold in the first week of a distribution in-kind. In some cases like Example 2 above, this results in drops of 5-10% or more in the first day of trading after distribution and can even be persistent in many thinly traded stocks.

To counteract this practice, we are now negotiating in-kind distribution language that either prices at the close of markets the night before a distribution or, better yet, the average closing prices five days prior and five days post an in-kind distribution. The former at least removes the de facto put option from the GP. The latter, which is more difficult to negotiate, forces the GP to think about the full market reaction to the sale of stock and to more closely align the results of GPs and their LPs.

What do you think? We welcome your views on the practice of in-kind distributions and how they affect returns. Please let us know via reply e-mail or e-mail Dan Townsend at [email protected].

Legal Disclosures

Certain factual statements made herein are based on information from various sources prepared by other parties. while such sources are believed by TTCP to be reliable, TTCP does not assume any responsibility for the accuracy or completeness of such information.

The historical performance achieved by any prior investments made by the Top Tier funds is not a prediction of future performance or a guaranty of future results, and there can be no assurance that comparable future performance will be achieved in any fund.

Recipients of this document are not to construe it as investment, legal or tax advice, and it is not intended to provide the basis for the evaluation of any investment. Recipients should consult with their own legal, investment, tax, accounting, and other advisors to determine the potential benefits, burdens, and risks associated with any transaction involving any issuer referenced herein.

This document does not constitute an offer to sell or the solicitation of an offer to buy any security; it is neither a prospectus nor an advertisement, and no offering is being made to the public. Offers to sell any interest in a TTCP-managed investment fund shall be preceded by distribution of a private placement memorandum the contents of which shall supersede any information provided herein.