At TTCP we are seeing more venture firms both in the U.S. and abroad focus on team succession. There are several probable catalysts for increased succession planning: (1) VCs are finally seeing carry which allows individuals to make way for the next generation of partners; (2) the epicenter of startups has moved from the suburbs to the cities where the younger generation often lives, and the average age of entrepreneurs is now a generation below the age of the typical VC1; and (3) the funds created in the late ‘90s have matured to a point that they need to add fresh ideas and energy.

Carry. The current generation of partner-level VCs started in the business 15 – 20 years ago, a less exciting time for venture capital investors (at least in terms of returns). While this generation may be receiving carry now, they probably didn’t own enough of the early funds to make a significant impact to their personal wealth. The generation above them, VCs in their 50’s and 60’s, are probably old enough to have been in the business during the heyday of the late 90’s. We’ve often heard complaints from the younger generation claiming they are the ones hustling today and making most of the investments, but that they see the least carry. A lot of departures occurred a few years ago when it was more fruitful to go start a company than work at a VC firm. Times have changed.

City life. With the average age of entrepreneurs seemingly getting younger every year, we are seeing an increase of startups moving into major cities like San Francisco, New York, Boston and Los Angeles. With the continued growth of ride sharing, fewer millennials own cars (compared to Baby Boomers or Gen X), and are thus less willing to drive to Silicon Valley from San Francisco or to Waltham from Boston. We’ve seen a noticeable rise in VCs opening offices in San Francisco in an effort to source deals and attract talent. Similarly, it is rare that we find ourselves in Waltham anymore, as most of the VCs have moved to Boston or Cambridge.

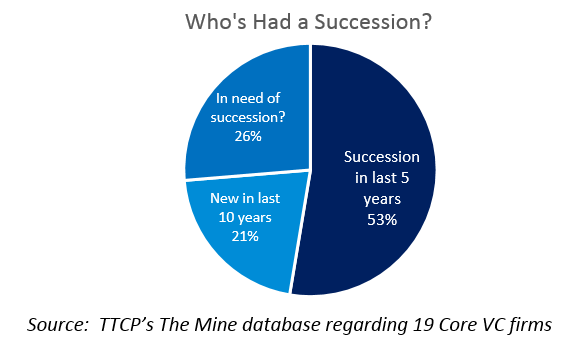

Maturation. The average age of the VCs we invested in over the past two years, as best we can tell, is just under 50 years old. Using data from Top Tier’s The Mine database, the average tenure of the managing partner(s) at these firms is eight years, which implies that succession took place eight years ago, on average. Of the 19 core commitments in our current fund of funds, 53% have had a team succession in the last five years and an additional 21% are new firms within the past ten years, thus not expected to have gone through a team succession yet. Of the remaining five firms, two have experienced higher-than-average mid-level turnover. These are the firms that appear to be in need of succession planning.

TTCP believes team changes are healthy when they come about in a well-thought-out manner. Markets evolve and venture capital teams should evolve with them. Internally, we’ve employed a strategy of hiring a multi-generational team, tasking each TTCP employee with building relationships and knowing their peers so that changes within our firm, and at our managers’ firms, can happen seamlessly. While the younger generation has been trained and mentored by our more mature team members, we believe the insights from our young team members have had a meaningful impact to the development of our firm and reputation in the market.

1. Y Combinator states the average age of its founders is 29. Disclaimer: This data represents a small percentage of the portfolio funds in which the Top Tier Funds have invested. Additional detail regarding the portfolios of the Top Tier Funds and their respective performance is available upon request. The data in this presentation is obtained from sources believed to be accurate and reliable. However, Top Tier Capital Partners does not guarantee the accuracy, adequacy, completeness or availability of the data and is not responsible for any errors or omissions in it or for the results obtained from its use.