Will the golden years get eclipsed by smog?

Introduction

What do air and water quality have to do with venture capital investments? Quite a bit, actually!

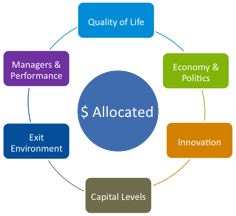

Untitled18Many assume that investment decisions hinge solely on manager quality and historic performance, but other macro-factors can have an enormous effect on investment decisions, particularly international investment decisions. In this paper, Top Tier Capital Partners identifies some of the macro-factors in China and how they might affect an allocation decision.

Several of these macro-factors are clouding China’s venture investment climate, including quality of life concerns, economic and political uncertainty, and an unpredictable exit environment. Despite these considerations, innovation remains robust and Chinese growth is still expected to strongly exceed that of other developed economies. Even in the wake of widespread news of China’s slowing growth, it is still expected to represent about two-and-a-half times the estimated U.S. growth from 2011 to 2014.

Will the mixed macro-factors eclipse the Chinese growth advantages? It’s difficult to say at this time, so we are cautious. When evaluating Chinese and other potential investments worldwide, TTCP remains focused on opportunities where we can find appropriate risk-adjusted returns.

Quality of Life

When do quality of life issues start to outweigh economic and manager issues?

It’s no secret that the quality of life in China is becoming hazardous to its citizens’ health. Pollution is rampant, food quality is tainted, and increasing costs have made it difficult for the population to remain in the country when other options are available.

Pollution: Severe health issues in China, resulting from prolonged exposure to high levels of pollution, have motivated many investment professionals and their families to relocate to the United States or other countries with higher environmental standards. This outflow will, in turn, have a bearing on investments and returns in the country. Even as the Chinese government grapples with these quality-of-life challenges, no short-term fix is in sight.

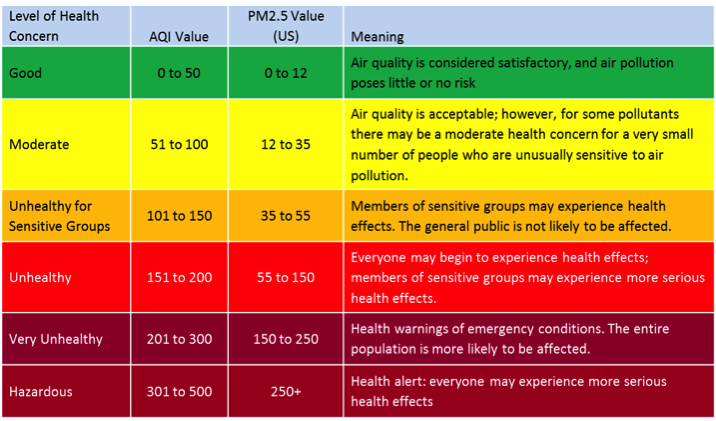

The air quality index (AQI) and particulate matter (PM) are primary indices for measuring pollution.

Air Quality Index: AQI is a yardstick that runs from 0 to 500—the higher the AQI value, the greater the level of air pollution. In January 2013, AQI measurements of over 700 were recorded in parts of China, and in February 2014, AQI of 500+ was observed, leading scientists to say the air resembled a nuclear winter.[ii]

Particulate Matter Index: Particle measurements are often reported in terms of “PM2.5”, a concentration of tiny particulate matter measuring less than 2.5 microns in length – small enough to lodge deep in the lungs and enter the bloodstream, causing respiratory infections, asthma, lung cancer, cerebrovascular disease, and possibly damaging children’s development. In October 2013 in Harbin, China (located in the northeast), PM2.5 levels around 1,000 were recorded in some parts of the city. Traffic visibility was impacted, all schools were shut, and the airport was closed.[iii]

The Wall Street Journal reported that data collected for 2,028 days between April 2008 and March 2014, only 25 days were considered “good” air days in China by U.S. standards. Of the more than 2,000 days surveyed, about 311 days were “very unhealthy” and about 94 days were “hazardous.” [iv]

Food and Water: Toxins in food including melamine-laced baby formula, salmonella-tainted seafood, and clenbuterol-treated pork in China were reported in Food Quality & Safety Magazine.[v] Recently, the Chinese government released an official statement reporting that nearly one-fifth of the country’s farmland is contaminated with toxic metals. The report was previously deemed so sensitive it was classified as a state secret and names the heavy metals cadmium, nickel and arsenic as the top contaminants.[vi] Pollution in China extends to drinking water as well. The New York Times reported that China’s more than 4,700 underground water-quality testing stations show that nearly three-fifths of all water supplies are “relatively bad” or worse.[vii]

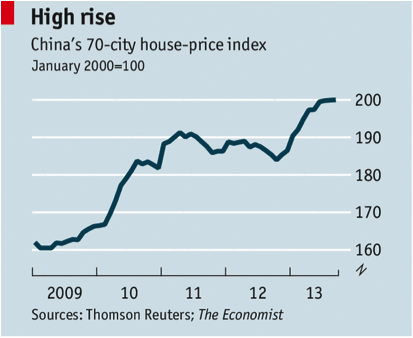

Escalating Housing Costs: Housing prices are reaching all-time highs and fewer people are able to afford apartments in high-priced cities like Beijing or Shanghai. At the same time, real disposable income per capita is declining, as shown in the following figures.

Economy / Politics

Often, particularly in emerging economies, quality of life is traded for high growth. While the Chinese market still has significant potential for upside, the questions of quality of life, economic concerns, and political dynamics create uncertainty.

Economic Growth: On the economic front, a more measured pace of growth has set in with recent GDP numbers showing a reported 7.4% growth in the first quarter of 2014, slowing from a 7.7% expansion in the previous period. The government’s efforts to drive domestic consumption as the largest component of growth away from export-led growth and its attempts to restructure the economy have yielded mixed short-term results.

Untitled22Debt/Credit: Debt levels are also very worrisome, resulting from an expansion of money supply fueled by the government. This is similar to the U.S. Federal Reserve efforts, but with significant credit flowing to local Chinese companies that might otherwise become bankrupt. This postponement may foreshadow an inevitable shakeout of weak companies and banks.

Political Leadership: It is still too early to know how President Xi Jinping, who took office in March 2013, will steer the Chinese dragon. Some indicate he is the most powerful leader since Mao, and he appears to be trying to lessen corruption and improve prospects for the country. However, short-term pressures of a slowing economy and a focus on reducing government corruption may distract his ability to address environmental and other challenges.

In addition, China has recently taken a very aggressive stance in some geographic areas in which it considers it has a territorial claim, such as the South China Sea. According to some reports, such acts only fuel the view that China would not hesitate to use its growing power to bully its neighbors and challenge U.S. leadership in Asia.[viii]

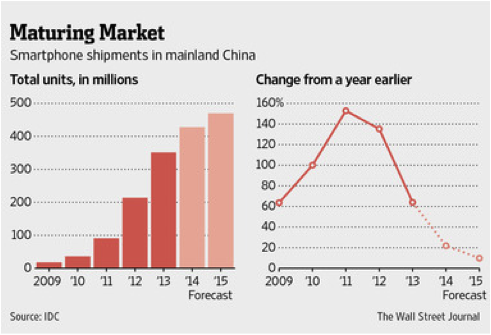

Innovation

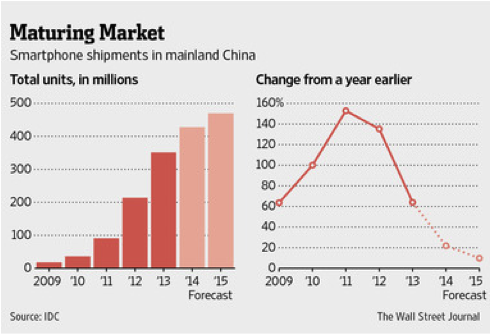

Innovation and technology consumption within various sectors continues to thrive. Market estimates from research firm IDC count 400 million smartphone users in China in 2014. The rapid growth is plateauing, but has fueled the social, local, and mobile waves of opportunities. Online dating and e-commerce segments also are demonstrating healthy investment trends. In addition, healthcare market opportunities are now attractive to venture capitalists, especially given the 50% incidences of diabetes in China. The China Food and Drug Administration (CFDA) is also actively focusing on corruption, cracking down on illegal activities relating to medical device registration, production, distribution and use. For example, the head of CFDA was executed in 2007 for accepting bribes. In clean technology, the Chinese government plans to invest $80 billion each year for the next 10 years. These factors are all very good for innovation and create a strong foundation for venture or “risk” capital.

Capital Levels

Untitled22Between 2010 and 2012, new private equity and venture capital RMB funds flooded the market. In the third quarter 2013, 33 new PE/VC funds in aggregate of $1.2 B were raised with only one foreign currency fund (Sequoia), the lowest level of foreign funds reported since the third quarter of 2010. Overall, fund sizes continue to increase, but there is a general feeling that an inverse relationship exists between returns and fund number. On the positive side, capital is starting to flow back to investors out of China from local IPOs, foreign-based IPOs of Chinese companies, and even a few billion dollar M&A exits.

Exit Environment

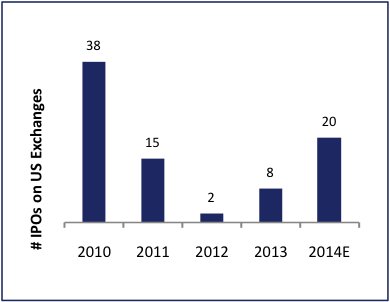

Untitled24The IPO market was shut down in China for nearly two years between 2010 and 2012, which significantly affected sentiment and returns. The local IPO market is now open again with ~700 companies reported in the pipeline, but questions remain about pricing because regulators can shut down an IPO at any time, making it a very unpredictable process. For example, the Chinese government pulled an IPO because the company’s P/E ratio at 65x was deemed too high. However, IPOs in the U.S. of Chinese companies are on the rise again, as noted in the chart on the right.

Managers and Performance

Talent: The good news is that Chinese serial entrepreneurs, some on their third company in China, are growing in number. Although caught between speed of execution and strong ethics, investors have mixed views of the entrepreneurial talent pool. Some seek younger and hungrier entrepreneurs; others seek the mature, established ones, or as is said, those with a “stronger ethical mindset.” Experienced CEOs who are Chinese nationals and educated and trained in United States, have returned home to China, and many of these individuals demonstrate a healthier approach to business. But in order to get everything right, such CEOs may take longer to reach the exit point.

Out-migration of Mangers: With quality of life on the decline, many people who can are voting with their feet. In discussions with managers based in China, we have noticed a growing concern over quality of life issues. Several managers have either re-located, have sent their families away, or are actively planning their exit to the United States or other regions. In conversations, one manager bluntly pointed out ‘…just assume everyone has a departure date.’ Those who choose to continue to work in China often decide not to venture outside and stay indoors when AQI crosses 150. Water and food safety affect families’ everyday decisions. Air purifiers are widely used in homes and offices, as are respiratory masks.

Ethics: With fraud rampant in China, concerns are rising that the moral fabric of the society may be irretrievably damaged and may take years to fix. Financial and operating numbers are often inflated with two sets of books—making it difficult to evaluate opportunities and performance results that meet western standards for IPOs.

Performance: Venture managers in China have been performing well recently, especially with the increase in distributions from Chinese companies going public on US exchanges. When TTCP first started investing in China in 2006, return expectations were for 3x to 5x, compared with 2x to 3x in the U.S. Today, expectations for China have come down to about 3x, compared with an increase to 3x+ for US managers. With the increased risk in China as outlined in this paper, we believe the risk-adjusted returns are greater in the U.S. than in China. In the TTCP portfolios, the average return for our managers in China is 1.37x (as of December 31, 2013), the same for all of our managers worldwide.[ix]

Conclusion: Cautious Trotting in the Year of the Horse

From what we previously considered a high-risk/high-return market opportunity, we now believe China is settling into a medium-return category, yet the risks continue to be high. We believe the Chinese market continues to be attractive, but for now, we remain in a “wait and watch” mode. In 2014, the Year of Horse, we trot cautiously, smog masks included.

Legal Disclosures

The information set forth in this document is proprietary and shall be maintained in strict confidence. Any reproduction or distribution of this document, in whole or in part, or the disclosure of its contents, without the prior written consent of Top Tier Capital Partners, LLC (“TTCP”) is prohibited. This document will be returned to TTCP upon request.

Certain factual statements made herein are based on information from various sources prepared by other parties. While such sources are believed by TTCP to be reliable, TTCP does not assume any responsibility for the accuracy or completeness of such information.

Recipients of this document are not to construe it as investment, legal or tax advice, and it is not intended to provide the basis for the evaluation of any investment. Recipients should consult with their own legal, investment, tax, accounting, and other advisors to determine the potential benefits, burdens, and risks associated with any transaction involving any TTCP-managed investment fund or any other issuer referenced herein.

This document does not constitute an offer to sell or the solicitation of an offer to buy any security; it is neither a prospectus nor an advertisement, and no offering is being made to the public. Offers to sell any interest in a TTCP-managed investment fund shall be preceded by distribution of a private placement memorandum the contents of which shall supersede any information provided herein.

The historical performance achieved by any prior investments made by the Top Tier funds is not a prediction of future performance or a guaranty of future results. The investments made by the Top Tier funds involve a high degree of risk, including the loss of all or a portion of the principal invested.

The information in this document should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any of the securities will remain in the Top Tier Funds’ portfolios at the time you receive this report.

Investments noted in this document represent only a portion of the overall investments made by the Top Tier funds and the venture capital funds in which the Top Tier funds invest and in the aggregate may represent only a small percentage of any Top Tier fund’s portfolio holdings.

It should not be assumed that investments made by the Top Tier funds and the venture capital funds in which the Top Tier funds invest are profitable or will be profitable in the future. The investment performance of companies should not be considered representative of the overall performance of the TTCP funds. Additional information regarding the investment performance of companies in the TTCP funds’ portfolio as well as overall investment performance of the TTCP funds may be obtained by contacting the persons listed above.

Source: Financial Times http://www.ft.com/intl/cms/s/0/d79ffff8-cfb7-11e3-9b2b-00144feabdc0.html#axzz31tsD03qO

[iv] Source: Wall Street Journal http://blogs.wsj.com/chinarealtime/2014/04/14/beijings-bad-air-days-finally-counted/ By comparison, China’s limit for a “good” day is 34 micrograms per cubic meter. While such measurement tactics may be politically motivated, the fact remains that high levels of pollution impacts respiratory symptoms, aggravation of heart or lung disease and premature mortality.

[v] Clenbuterol impacts the muscle-to-fat ratio making pigs appear leaner. While approved for use in some countries via prescription as a bronchodilator for asthma patients, it has also been used as a performance-enhancing drug in sports resulting in cases where athletes have been suspended from respective sports. In some parts of the world Clenbuterol is used for the treatment of allergic respiratory disease in horses.

[viii] Source: Wall Street Journal http://blogs.wsj.com/chinarealtime/2014/05/20/what-the-u-s-and-china-arent-saying-about-the-south-china-sea/

[ix] Top Tier Funds performance data as of December 31, 2013. Includes primary investments only; excluding side funds and secondary investments. Returns reported are net of underlying managers’ fees, but gross of Top Tier fees.