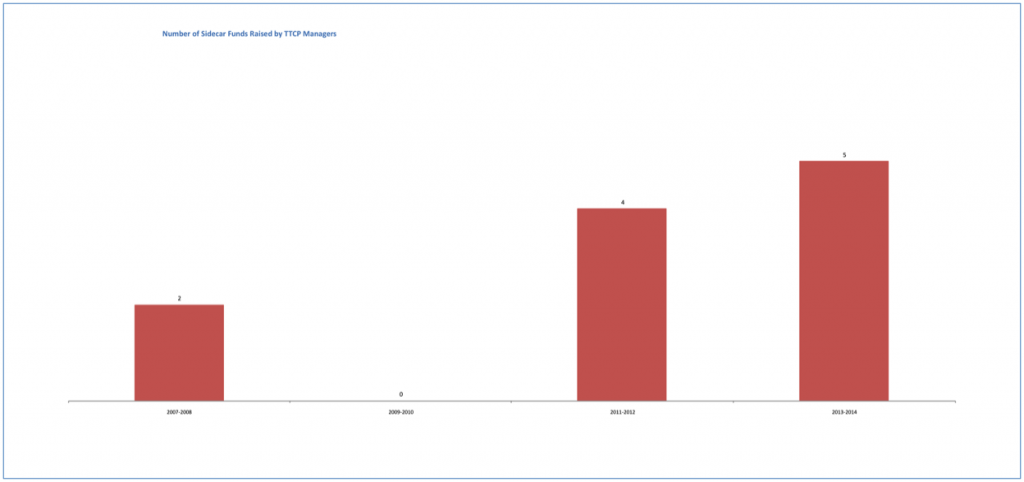

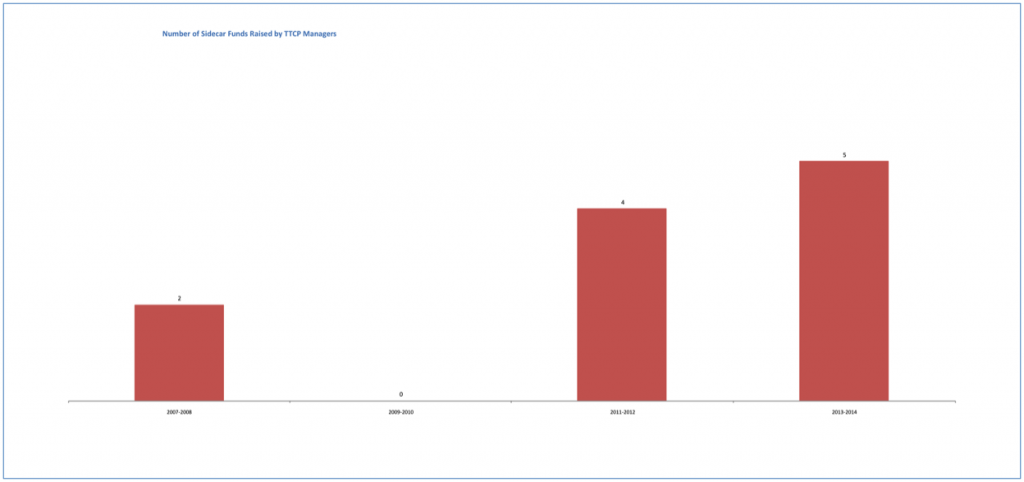

In the wake of growing valuations and escalating deal sizes, we are seeing an increase in the number of sidecar, annex, or special opportunity funds being raised by VCs. From 2007 to 2010, only two of our underlying managers raised sidecar vehicles, but since 2011, we have been asked to participate in nine sidecar vehicles and there is talk of others coming to market. While the size of these funds varies considerably manager-by-manager, the range is generally one-third to two-thirds the size of the main fund. We’ve found, however, that these funds rarely become 100% called.

There may be several different reasons for raising a sidecar fund, but the common theme is that these pools of capital are being raised to take up excess pro-rata allocations that could not otherwise be fully used by the main fund vehicle. It’s important to understand that sidecar funds are being raised by seed, early, and late stage investors, not solely by small micro-VCs that have run out of reserves to back their winners or have grown tired of creating individual special purpose vehicles for follow-on investments.

We would expect these sidecar funds to have fewer companies, a higher average cost basis than the main fund, and lower loss ratios. Our data found this to be true: the average cost per company in the main funds of our underlying managers is $9 million, but the average cost per company in the side funds is $15 million. Furthermore, there are, on average, 45 companies in the main funds (including seed investments for some managers), but the average number of companies in the sidecar funds is 9. Most importantly, we are seeing lower loss ratios in the sidecar funds in which we have participated (about 11%) versus the average of all of our fund investments (26%).

Our investment team is split on what we think about sidecar funds. We are all cautious about the trend for a number of reasons, primarily that sidecar funds are increasing the amount of capital coming into the market, which is expected to reach $30 billion this year. We’ve already seen the increase in capital from both traditional VCs and other non-traditional investors push up valuations. (See our prior blog post “The $13B Delta” discussing some of the issues around the increase in capital.) We are also concerned that some managers may now have too much capital to support their companies—instead of using careful reserve planning and attracting new follow-on capital from outside investors.

Furthermore, some of us are negative on sidecar fund strategies for philosophical reasons in that these strategies almost always represent at least some level of strategy drift. For instance, early stage investors moving into late stage. In a worst-case scenario, the later stage investment activity is a different business altogether and requires a separate team with highly-tuned skills.

Take the example of an early stage investor with a $250 million fund, raising a $150 million sidecar growth fund. Even if the firm is thoughtful in the allocation of opportunities between funds, our view is that it takes a very different skillset to invest the later stage sidecar fund than it does the early stage main fund. The issue is perhaps made clearer by answering the question: Would I hire the same person to run my early stage fund as my growth stage fund? Maybe, maybe not. But it is certainly a different business with different types of execution risks, exit opportunities, timeframes, and fund construction targets. But in many cases, these sidecar funds are operated by the same individuals that manage the main funds. Those on our team in the negative camp prefer the managers of our money to be obsessively focused on one strategy by which they live or die.

Those on our team that are positive on sidecar funds see that these funds allow our managers to double-down on promising fund drivers. In addition, side funds generally have more attractive economics than the main fund—fees are only charged on called capital, not committed capital, and carry is at a significantly reduced rate, especially if the strategy is to invest in the later stage rounds of companies already in the current portfolio.

More importantly, these sidecar funds look like they are making money. Broad performance data is always difficult to find, but we gathered some return data from Pitchbook, Preqin, and our own proprietary database, The Mine, to find out more. In Pitchbook for example, we found 70 funds with annex, opportunity, side, or parallel in their name that were raised between 2000 and 2014. The average fund size was $64 million. However, only 10 of them had performance data and one was a complete loss of capital. Combining our own data on sidecar funds with the Pitchbook and Preqin data sets yielded some interesting results, albeit on a small number of funds as shown in the table below. We found that the sidecar funds raised to support portfolios immediately following the Internet bubble did not perform well, but those raised over the past several years have done quite well, with an average DPI of 0.31x and net IRR of 24%.

Sidecar Fund Performance

| DPI | TVPI | IRR | No. of Funds | |

| Vintage 2000-2006 | 0.68x | 0.86x | -25% | 6 |

| Vintage 2007-2014 | 0.31x | 1.46x | 24% | 11 |

Source: The Mine, Preqin, and Pitchbook for 17 funds with the words Annex, Opportunity, Opportunities, Sidecar, Side Car, and Parallel in the fund name and larger than $50 million in size.

So the question we struggle with is: Are sidecar funds just ill-conceived cyclical bets on beta or are they something truly additive to our portfolios? We acknowledge that early signs in this decidedly bullish market show that these sidecar funds are allowing managers to focus on a few break-out companies from their main funds and double-down on their winners. However, time will tell if this is true as the funds mature. Currently, we are cautious but have selectively participated in some sidecar opportunities on a case-by-case basis in managers we believe are best positioned to execute on their sidecar fund offerings.

What do you think? We welcome your views on the implications of sidecar funds and their potential to drive performance. Please let us know via Twitter: @TTCP_SF.

Legal Disclosures

Certain factual statements made herein are based on information from various sources prepared by other parties. while such sources are believed by TTCP to be reliable, TTCP does not assume any responsibility for the accuracy or completeness of such information.

The historical performance achieved by any prior investments made by the Top Tier funds is not a prediction of future performance or a guaranty of future results, and there can be no assurance that comparable future performance will be achieved in any fund.

Recipients of this document are not to construe it as investment, legal or tax advice, and it is not intended to provide the basis for the evaluation of any investment. Recipients should consult with their own legal, investment, tax, accounting, and other advisors to determine the potential benefits, burdens, and risks associated with any transaction involving any issuer referenced herein.

This document does not constitute an offer to sell or the solicitation of an offer to buy any security; it is neither a prospectus nor an advertisement, and no offering is being made to the public. Offers to sell any interest in a TTCP-managed investment fund shall be preceded by distribution of a private placement memorandum the contents of which shall supersede any information provided herein.