Over the last 12 months, we have been vocal on our opinions of the market, especially regarding the current trend of “private IPOs” and the fear that venture capital is in another bubble. As we have stated in the past, Top Tier does not believe we are in a bubble like we were 15 years ago. As a matter of fact, our internal data shows that revenue multiplies are actually declining for many U.S. venture-backed technology companies with revenues under $100M.

We are finding that revenue growth is outpacing valuation growth for these companies.

For clarity, we are seeing that revenue multiples, defined as a company’s yearend implied company valuation divided by its yearend revenues, have declined during the 2012-2014 time frame. We are not talking about multiples on forward revenue projections, but early research indicates that forward revenue projections would not disprove our notion.

THE DATA/METHODOLOGY

At Top Tier we use a proprietary database we call “The Mine.” For the purposes of this analysis, we pulled information for all venture-backed U.S. technology companies that are privately held (we excluded pharma and medical device companies) for which we had revenues of at least $1M for 2012-2014.

MULTIPLES ARE DECLINING OVERALL

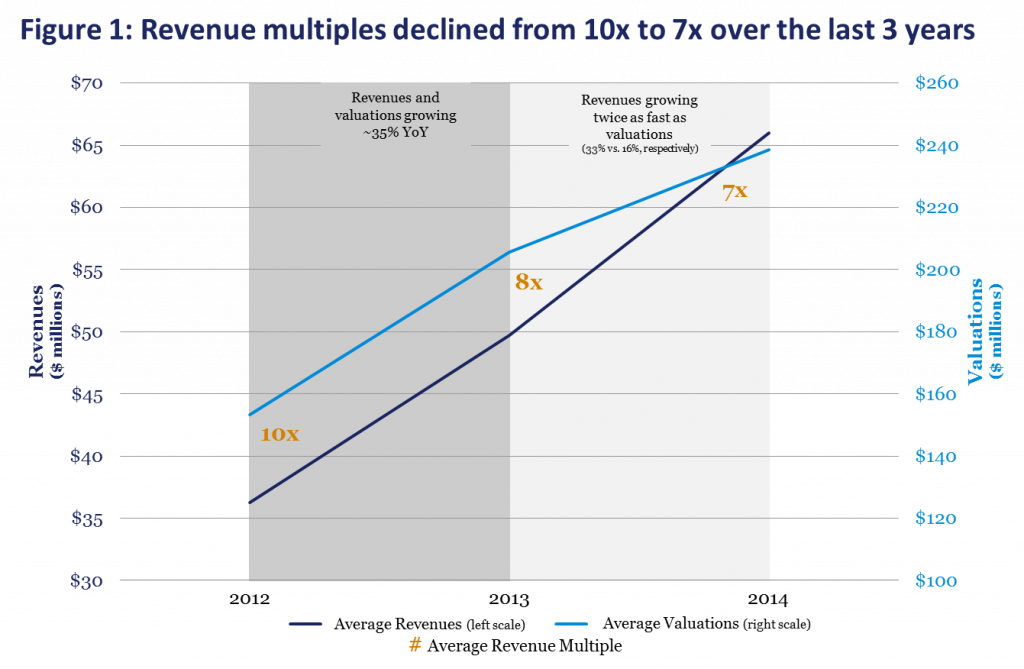

Initially, we looked at the average multiples for the entire dataset, regardless of stage or sector. We found that from 2012 to 2013 both average revenues and average valuations across the dataset grew 35%.

The shift came from 2013 to 2014, where revenues continued to grow at over 30%, but valuations grew at half that rate as demonstrated in Figure 1.

MULTIPLES ARE DECLINING FOR EARLY STAGE COMPANIES

Next, we dug further into the data to determine if there is a correlation between the maturity of the companies in the dataset and how they are valued relative to their revenue.

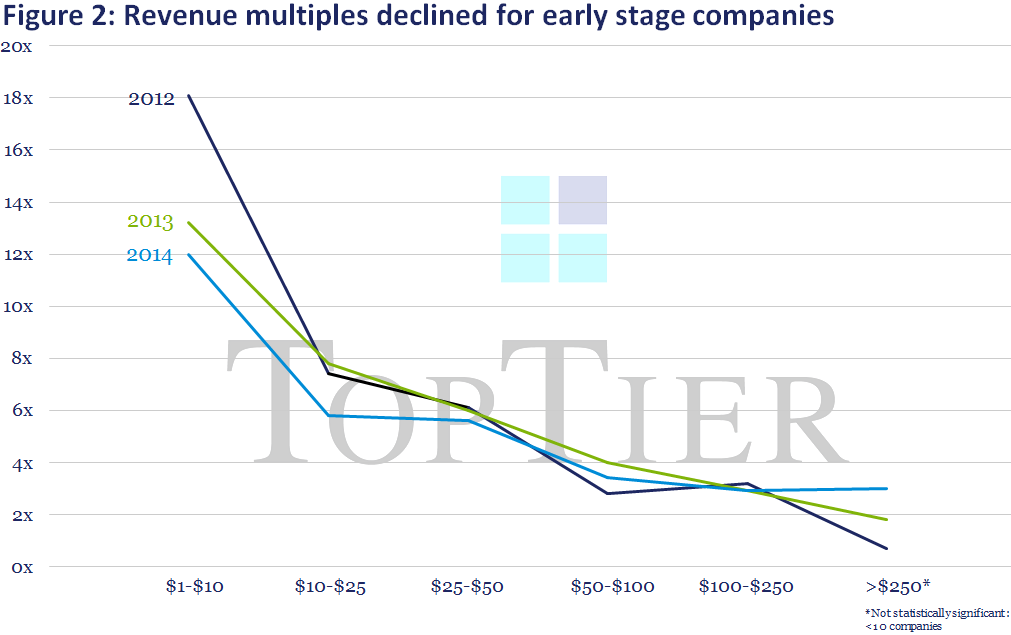

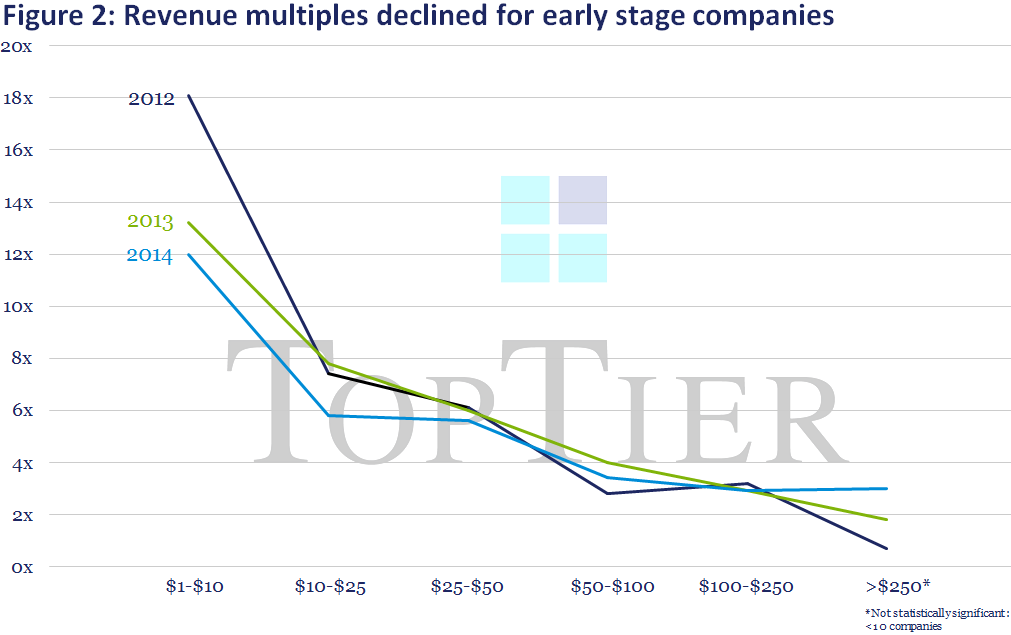

What we found was that from 2012 to 2014 revenue multiples dropped the most for the youngest companies, but still remained higher than that of more developed businesses. Along with higher multiples, we found the greatest dispersion of multiples for companies with $1-10M in revenue, which we theorize is caused by investors investing in future potential and hype of young startups as opposed to customer/user/revenue figures.

The trend of declining revenue multiples remains consistent until companies reach $100 million in revenue. The few companies within the $100 million+ revenue band are companies that are participating in the private IPO phenomenon, driving higher valuations from 2012 to 2014. Higher valuations for later stage, more mature companies may be supported as companies are generating revenues earlier and remaining private longer, as well as accepting larger rounds of funding from typically public investors.

WHAT IS DRIVING THE CHANGES IN MULTIPLES?

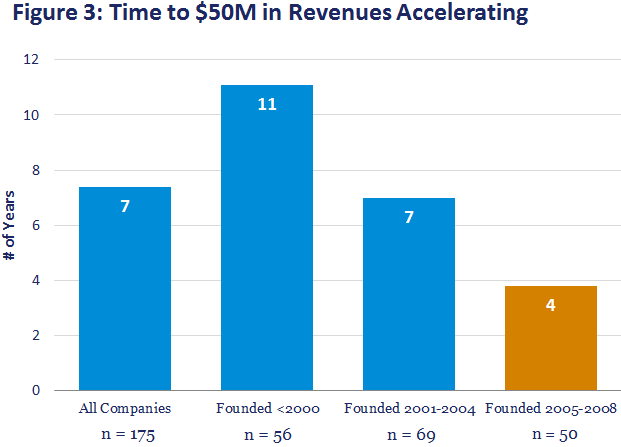

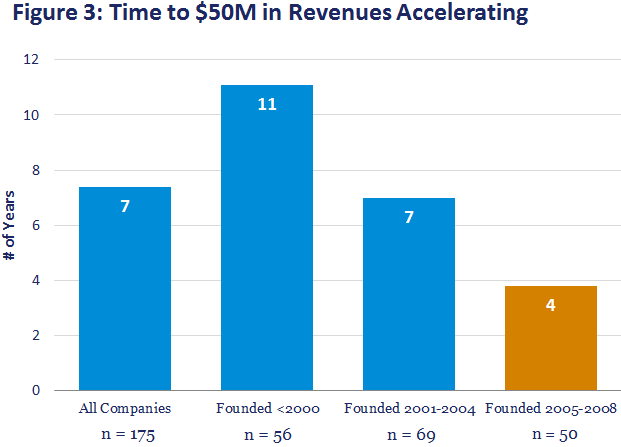

We believe higher multiples for later stage companies can be attributed to their ability to generate revenues earlier in life. According to our data, companies founded between 2005 and 2008 have been able to reach $50M in revenues in just 4 years on average, three years faster than companies founded between 2001 and 2004 and 7 years faster than companies founded before 2000.

An earlier path to revenue for companies founded from 2005-2008, combined with an average time to exit that is at par with or even longer than the companies founded earlier, have led to a jump in multiples. Simply put, higher valuations are understandable if companies are achieving substantial revenues 3 years earlier.

For example, let’s compare two companies with the same revenue profile, but one company generates revenue three years earlier than the other. If the company with earlier revenue is growing 35% per year, for each additional year the valuation after 8 years (average time to exit) is 2x higher than that of the company slower out of the gates.

While the public sentiment remains focused on high valuations, our research shows that once again news is focusing on hype not data. When evaluating the health of the venture market, we believe revenue multiples are a better indicator, and our data shows that revenue multiples have been declining since 2012 for a majority of the U.S. venture-backed tech companies. We attribute this phenomenon to young companies growing revenues earlier than before; with revenue growth rates outpacing valuation growth rates. It is only in the later stages where we see the opposite effect, which is easily explained by early revenues leading to increased valuations for the attention grabbing private IPO companies.

For all these reasons, as we have stated in the past, Top Tier does not believe we are in a bubble like we were 15 years ago and we are optimistic that 2015 will be another strong year for venture.