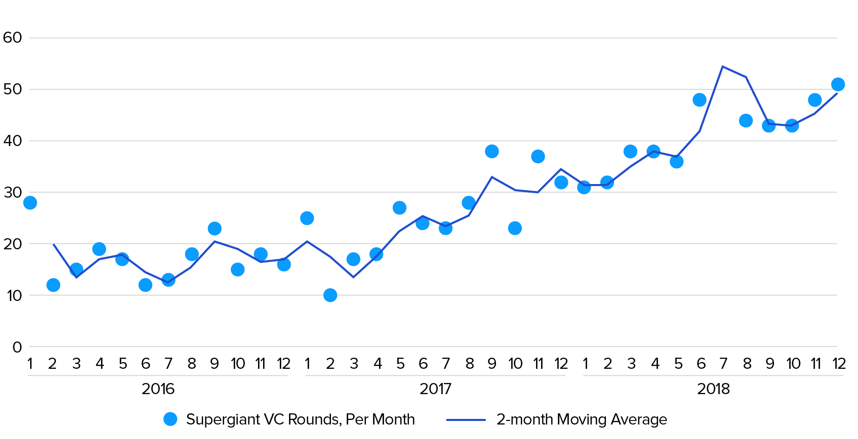

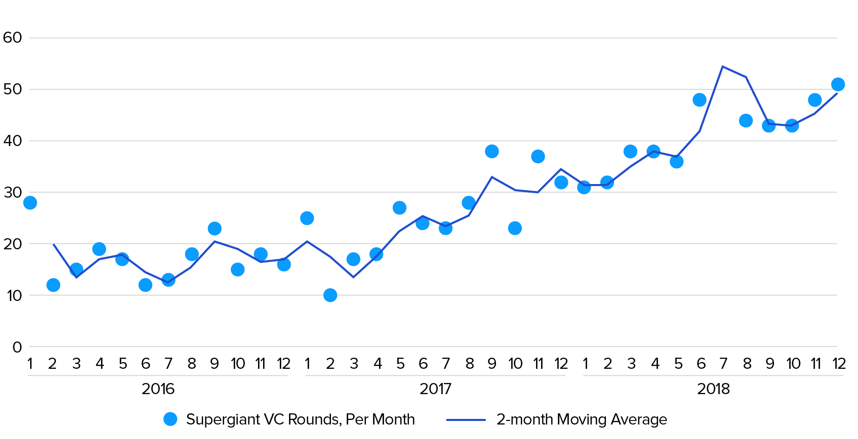

The topic of Private IPOs is getting a lot of interest and is something we have examined before. We previously wrote about the rise of unicorn (private $1B+) valuations and the impact of mega rounds on exit dynamics within private markets. We have spent the last 18 months thinking about what a new normal might look like as companies choose to remain private for longer. A Private IPO is defined as a financing round of $100M or more. While we do not have a crystal ball, we think that the Private IPO is here to stay (for now).

$100M+ Fundraising Rounds

Several Factors have Converged to Create this Environment:

Increased Allocation to Venture Capital

- As of 2018, overall Venture Capital allocation has grown at a 17% CAGR since 20081

Increased willingness of non-traditional players (mutual funds, PE funds, SWFs, etc.) to participate in later-stage opportunities

- From 2016 to 2018, non-traditional players have grown VC allocation by 164%

Non-traditional investor participation in VC deals

Start-ups are more hesitant to IPO

- Public markets are historically more scrutinizing than private markets, founders are less inclined to risk embarrassment or potential insolvency in light of a failed IPO (e.g., – WeWork’s failed 2019 IPO was the catalyst for an unprecedented write-down in company value)

- CEOs can retain better control and focus in a private-market environment – increased investor scrutiny and regulatory burden can be distracting for CEOs

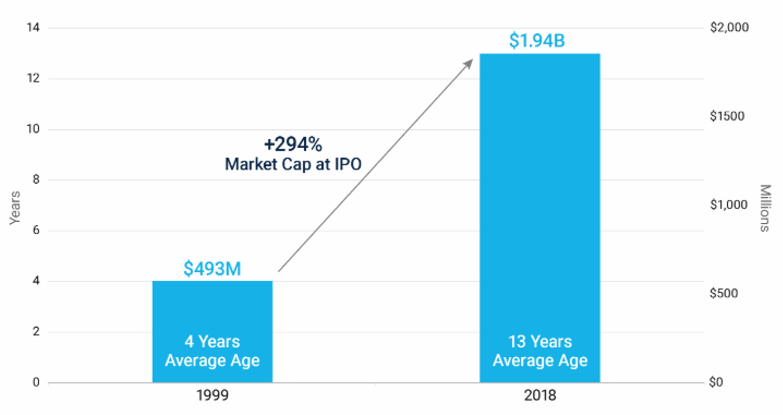

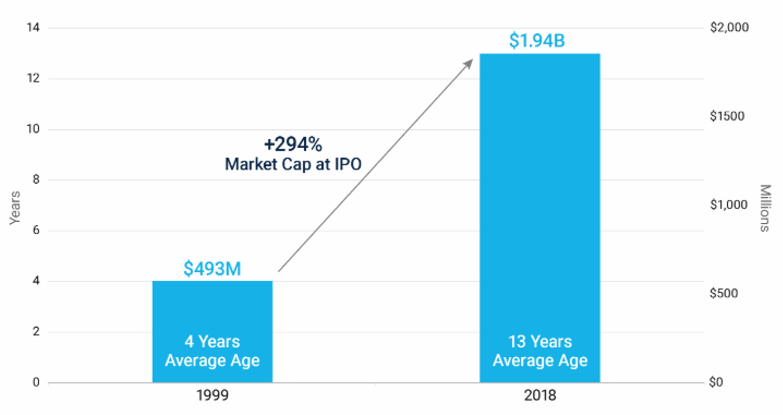

These factors, taken together, have contributed to an increase in both average age and market cap at IPO. Companies are raising an average of $246M pre-IPO, up from $89M in 1999.

Private company median age and market cap at IPO

The growing secondary and growth markets expand the VC surface area…[creating] a virtuous cycle that allows companies to stay private for longer while allowing VC, in general, to enjoy much more value accretion.

These Trends do not Appear to be Slowing

While every alternative asset class has its “moment,” we think that some of the structural shifts are here to stay. The continuing development of the secondary markets could create liquidity opportunities for early-stage funds and investors, while giving later-stage and non-traditional funds uncorrelated risk with still-significant upside. Further, growth and expansion strategies could continue to expand as mutual funds and other non-traditional players look for alternatives to the equity markets. The growing secondary and growth markets could expand the VC surface area and, consequently, allow LPs to right-size VC allocations. We believe all of this creates a virtuous cycle that allows companies to stay private for longer while allowing VC, in general, to enjoy much more value accretion.

Series D+ median valuation growth vs Russell 2000

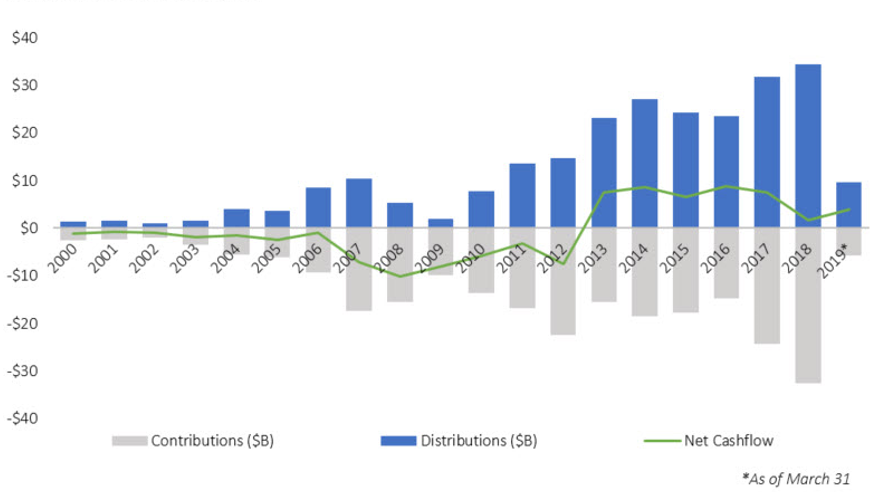

Secondary transaction contributions accounted for $16B in 2013 vs. $33B in 2018 (15% CAGR)

It is important to choose proven managers who have experience investing in all markets and at different stages in the company lifecycle.

Where Does This Leave Venture Investors?

While company median age at IPO has increased three-fold, fund durations have remained the same. In general, this means that earlier stage funds will see more exit opportunities in the form of secondary transactions instead of IPO or M&A. For vertically integrated platforms like TTCP, this new normal could allow venture investors to participate in much of a company’s value accretion. We believe winners from early funds can exit via secondaries; while secondary and growth and expansion vehicles can invest at fair valuations and still have significant upside2, with less public market risk.

We believe these dynamics give early stage managers unprecedented opportunities to exit investments at good valuations. TTCP encourages managers to take advantage of more of these liquidity opportunities, as prudent portfolio management is often more important than squeezing the last dime of upside out of an investment.

How Long will this Environment Last?

While there are clear advantages and strong reasons for founders to delay the IPO and remain private, investors are driven by returns. Like any asset class that has been through a cycle, returns will normalize and, with them, exit routes (IPOs will make a comeback). Although we believe that some structural changes are here to stay, (i.e., the growth and secondary markets will continue to grow and thrive as LPs continue to grow allocation), we think venture returns will normalize. Thus, we believe it is important to choose proven managers who have experience investing in all markets and at different stages in the company lifecycle.

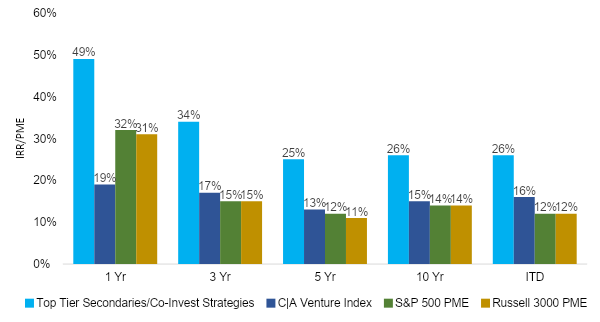

Venture Returns vs. Benchmarks3

While the future may be uncertain, experienced and prudent managers will be able to take advantage of the environment and navigate solid returns, despite the exit route.

Conclusion: How Might the Future Look?

If Private IPOs, as currently defined, will ebb and flow with the popularity of venture capital (we suspect they will), then what will replace them? Well, traditional IPOs. But, perhaps not in the traditional sense. While traditional IPOs are not going anywhere, we think that Special Purpose Acquisition Companies (“SPACs”) and direct listings (“Direct Listings”) are coming of age as viable alternatives for companies in a position to take advantage.

SPACs offer price certainty with significantly reduced listing costs for a company (SPACs are already public). SPAC acquisitions are more akin to M&A exits in that they provide liquidity for existing shareholders, but do not necessarily provide adequate growth or balance sheet capital. Thus, companies that list via SPACs may come back to the capital markets for balance sheet capital. We saw this recently with the DraftKings, Inc. secondary offering. We believe SPACs are likely a good option for companies who: a) do not need significant new balance sheet capital, or b) do not foresee themselves having problems raising additional capital. U.S. SPACs raised $13.5B in 2019 (vs. $10.8B in 2018) and took 28% of IPO proceeds (vs. 20% in 2018)4. Top Tier is an active investor in this market, having participated in recent SPAC acquisitions.

Direct Listings are attractive because they allow companies to go public without paying bankers for underwriting services. Of course, this means that a company’s name must generate sufficient investor demand without the benefit of an underwriter’s roadshow and distribution.

Direct Listing is a valid option for companies that have balance sheets and primarily want liquidity for their employees and investors. We find that Direct Listings are attractive because they allow companies to go public without paying bankers for underwriting services. Of course, this means that a company’s name must generate sufficient investor demand without the benefit of an underwriter’s roadshow and distribution. The most notable companies to go public via Direct Listing are Spotify and Slack. Both are very popular companies with business models that are easier to understand – something that is important with Direct Listings.

Currently, we don’t think Direct Listing is a good option for many companies because they do not allow companies to raise primary capital. This may change as U.S. exchanges are lobbying regulators to adjust the rule. We are less than confident that this will happen because it will effectively cut out underwriters (a powerful lobby themselves). However, if this happens, then Direct Listings may become a real competitor to traditional IPOs, particularly for more well-known companies (these companies are likely larger and as a result, more lucrative for underwriters).

While the future may be uncertain, we believe experienced and prudent managers will be able to take advantage of the environment and navigate solid returns, despite the exit route.

1 Source: Daily Telegraph2 Setter Capital estimated 20% target IRRs for secondary transactions in 2019

3 Data as of December 31, 2019. Top Tier Secondaries/Co-Invest IRRs entail both venture partnerships held by VVF1, VVF2, VVF3 as well as strategy carve-outs within TTIV, TTV, TTVI, TTVII, TTVIII, TTIX, EVCF managed pari passu with the former group. Performance is calculated net of underlying manager’s fees but gross of TTCP fees. Data for Top Tier II, III, and SOF are not included as they have a differing strategy than the funds above. C|A Venture Index denotes an aggregation of Cambridge Associates pooled horizon return, net of fees, expenses, and carried interest. CA Modified Public Market Equivalent (PME) replicates private investment performance under public market conditions. The public index’s shares are purchased and sold according to the private fund cash flow schedule, with distributions calculated in the same proportion as the private fund, and PME NAV is a function of PME cash flows and public index returns. Comparisons to the indices are for information purposes only. Unlike indices, the Fund will be actively managed and may include substantially fewer and different securities than those comprising each index.

4 Source: ICR