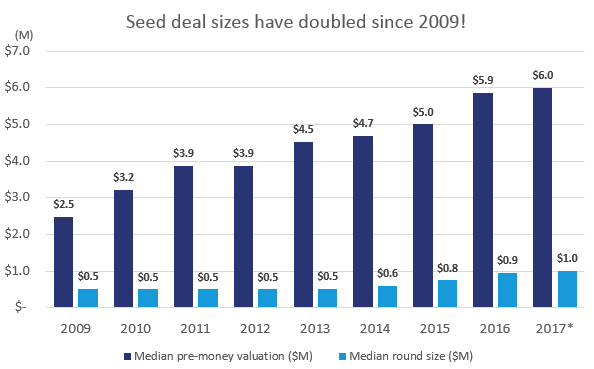

The evolution of early stage VC ecosystem has led to the proliferation of many new venture funds started by former angels, operators, and existing VCs. According to Pitchbook, since 2014, there have been nearly 100 first-time funds which raised a total of $7.3B. As many of these funds come back to market, the micro VC landscape has matured and adapted to changing deal dynamics. We’ve seen this play out before in early stage venture where the increase in capital efficiency, the syndicate approach and the emergence of multiple seed-stage financing rounds have blurred the lines between a large seed and Series A round. Seed-stage funds have raised larger pools of capital to deploy larger initial checks to avoid the “Series A Crunch” and maximize their ownership in a company. Both pre-money valuation and deal size have doubled at the seed stage since 2010 (Pitchbook), creating a funding gap for pre-seed investors to fill the role of what used to be a seed-stage deal.

There are many similarities between a pre-seed stage company and trying to make it as a professional athlete. Both require thousands of hours of hard work knowing that while the odds of success are low, the reward is high. Take baseball for example: professional teams scout and draft amateur players with limited track records and sign them to cheap contracts, taking the chance that they can develop into impactful team players. Similarly, pre-seed investors make bets on talented entrepreneurs and unproven ideas at low valuations. Most players will start their career in the minor leagues to hone their skills with the hope of getting called up to the majors. Companies spend time at the pre-seed stage building towards the milestones needed to graduate to a Seed round. While baseball teams have coaches that train and develop the skills of aspiring major leaguers, pre-seed funds provide companies with the requisite expertise, experience and contacts to take them to the next level of funding. At this early stage of development, entrepreneurs and minor league players are more open to taking feedback, since early guidance and support are more critical than the amount of funding or size of their contract at this point in their careers.

In essence, pre-seed investors that can guide companies to subsequent funding rounds are scouting their players who are ready to start in the Major Leagues. The payoff for baseball teams is that these young players have the potential to become All-Stars. The payoff for pre-seed investors is that companies can scale into “dragons*.”

Of the 898 active U.S. VC firms in 2016, 464 manage less than $100 million (Pitchbook). As the micro-VC landscape becomes crowded, we see more micro VC’s play a specific role to add differentiated value to portfolio companies by specializing in sectors, geographies or stages. Many micro-VC funds have come to market, but a few with a decidedly pre-seed focus have stood out including Precursor Ventures, Unshackled Ventures and Notation Capital. Precursor Ventures is one of the first institutional investors with a strategy dedicated to the pre-seed stage. Unshackled Ventures was founded by two immigrants who want to help fellow immigrant entrepreneurs build companies in the U.S. Lastly, Notation Capital was founded out of Betaworks and can build companies from scratch, backing technical founders in the NYC tech ecosystem. Within our portfolios, we partner with Material Impact and Compound, two managers that have some allocation of their capital to pre-seed.

As an investor in what we define as Alpha managers (fund sizes < $250M), we believe that differentiated pre-seed funds provide a compelling investment opportunity into micro-VCs given the risk/return profile. Pre-seed investing can be de-risked by successful VC’s who know how to coach and guide companies towards quantifiable milestones that signal product market fit while also providing access to follow-on capital. We believe that investors that can find these All-Star companies early will find attractive returns – being the first check in at under $5M valuation can mean graduating to a large seed or Series A. In doing so, the companies can be a quick 3x step-up in valuation and reach the Series B at a $39 million valuation (median pre-money according to Pitchbook) in 3-4 years, and would be near a 6x return on investment, assuming minimal dilution. TTCP believes that pre-seed funds provide upside to our portfolio and we will continue to watch as those with the ability to properly coach will emerge as winners at the pre-seed stage.

*Dragons are companies that can return a manager’s entire fund value.