Recently there has been a lot of discussion in the venture capital industry about valuations. Are they too high? Are venture returns still attractive?

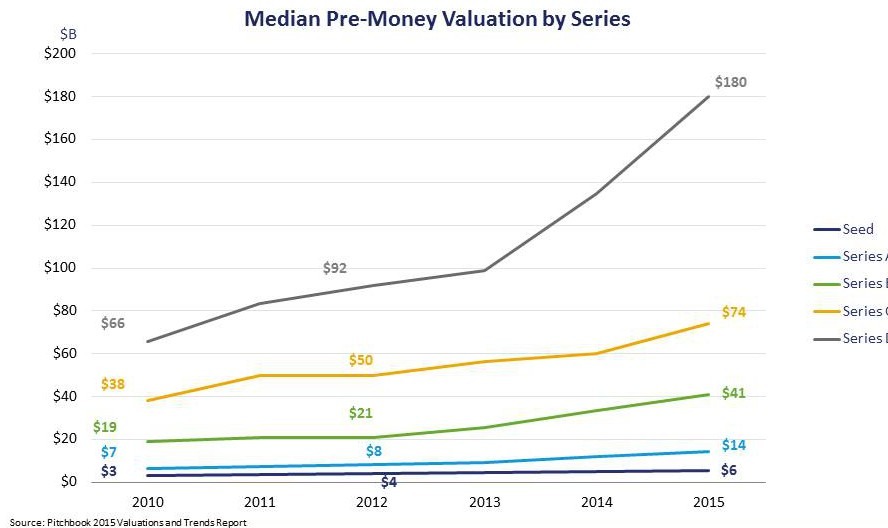

We’ve all seen the charts showing that pre-money valuations are on the rise year-over-year. We find it difficult to draw comparisons over time because a shift in the nomenclature of funding rounds has occurred. What was considered a ‘Series A’ financing (an investment in a pre-revenue company) a few years ago would be considered a ‘Seed’ financing today.

Regardless of the vocabulary, it is hard to deny that valuations have gone up, particularly in the later stages, as seen in the graph below.

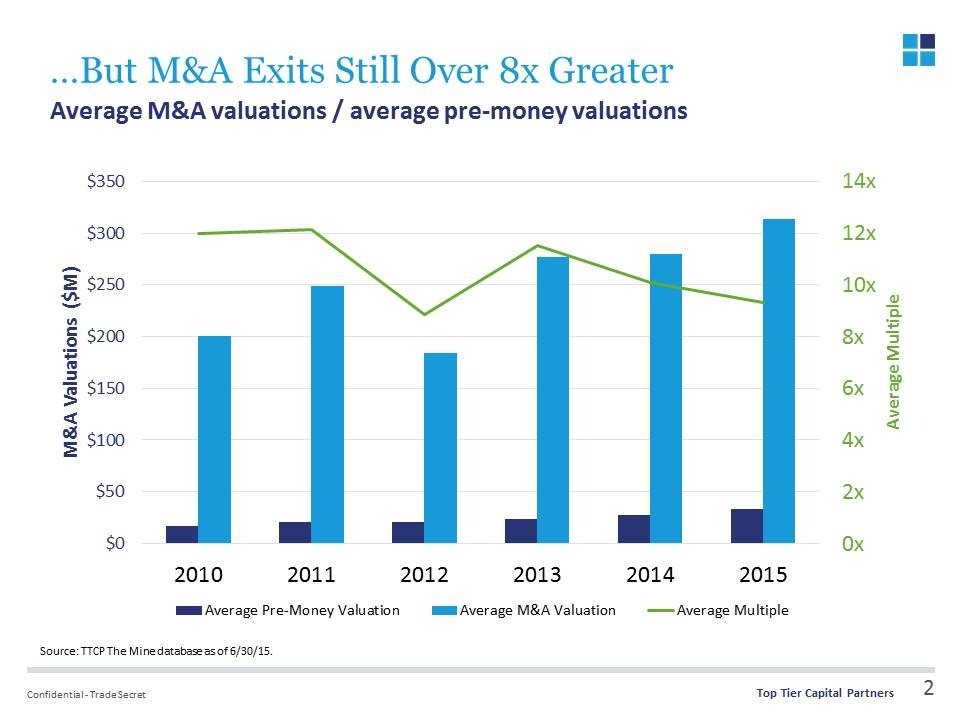

However, in our view the more important statistic is exit valuation, and our data shows that exit valuations are also on the rise. For the M&A transactions that took place in our portfolio between 2010 and 2015, the average valuation increased 57%, from an average of $200 million to an average of $313 million. If one assumes a VC invests an equal amount of capital in each round from the Seed through Series C (when companies are typically purchased) the average exit multiple across both technology and healthcare was 12x 2010 and >9x in 2015. The exit multiple for technology companies alone was 10x over the same period. We consider these to be solid returns, even in rising valuation markets.

Finally, we looked at our average ‘going-in’ price and current exit valuations. According to our data, if an investor invests the same amount of capital per round from Seed through the Series C, public liquidity events could yield 36x returns and M&A could yield 10x returns.

The data above is based solely on the exits, not the losses, in our portfolio. While we realize that more companies will fail than will achieve an exit with a high multiple, knowing there is still the potential for outsized returns despite rising valuations has kept our venture capitalists, ourselves and our investors focused on the venture industry.