Initial Coin Offerings (ICOs) have raised $1.5B in 2017 (through 8/30) and this new fundraising mechanism has generated significant buzz and excitement from mainstream media and investors alike. ICOs’ evasion of financial and legal regulation thus far has allowed for investors to come from all backgrounds including institutional investors, angel investors, consumers, and cryptocurrency miners.

Surely this explosion of interest has regulators’ sirens blaring. Major hacks resulting in the theft of millions of dollars’ worth in cryptocurrencies prompted a regulatory report from the U.S. Securities and Exchange Commission (“SEC”) stating that the digital assets issued through ICOs could no longer be labeled as anything but equity. China, South Korea, and Russia are following suit in a growing list of nations grappling with how to properly regulate the emerging market. As a registered investment adviser, TTCP is closely following the regulatory status of these digital assets.

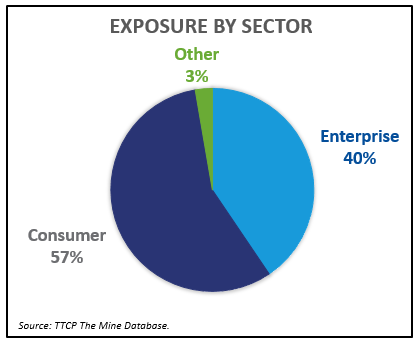

We conducted an internal study on how our managers are approaching and investing into the space. While the emergence of Bitcoin has inspired consumer, peer-to-peer blockchain applications like storage, exchanges, and payment, Ethereum has popularized enterprise applications like data management and decentralized digital organizations. We were not surprised to see TTCP’s managers invested in both. TTCP’s exposure to blockchain companies to date has mostly been on the top of the stack, split roughly 3:2 between consumer and enterprise applications.

For any round of fundraising, a company can choose to obtain capital through an ICO, effectively displacing a traditional venture capital financing. On the other side of the table, venture capitalists have several financing options. VCs can continue to fund blockchain companies’ pre-ICO using a traditionally priced equity round. When VCs anticipate a future ICO, they have increasingly turned to the SAFE note’s newly-minted cousin, the SAFT – Simple Agreement for Future Tokens. As the name suggests, this investment agreement promises investors future tokens. However, because a company can ICO whenever it chooses, early equity investments can be converted into tokens at any point in the future. The lack of regulation or even established best practices for ICOs means the logistics of switching funding types remain murky.

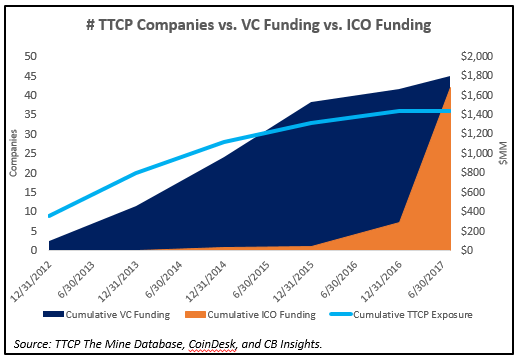

A handful of TTCP managers have had exposure in the blockchain space since 2013. Of our total exposure, 50% have had up-rounds in their last fundraising cycle, and only 5% have filed for bankruptcy or have gone out of business. The graph below plots TTCP’s cumulative exposure to the blockchain space by number of companies against the cumulative funding of blockchain through traditional VC and ICOs, respectively.

Our data indicates a strong correlation between TTCP’s cumulative exposure and cumulative VC funding in the blockchain space, with decreasing growth rates through 2016, while ICO funding follows an increasing growth rate within the same period.

The findings also demonstrate that general partners do not need to invest in ICOs in order to be invested in the blockchain space. To date, less than 10% of our blockchain related portfolio companies have issued an ICO, and even fewer of our indirect commitments are through ICOs. However, it is important to recall that even as a non-SAFT equity investor, this equity may be converted to tokens. As a result, managers with blockchain or cryptocurrency investments are beginning to acknowledge the high likelihood that they will eventually own tokens. We look forward to further dialogue with our managers on this ever-changing landscape and expect to see changes in investment strategies and Limited Partnership Agreements to cover ICO activity. We at TTCP are excited by the prospect of blockchain’s ability to spark innovation, but we encourage our underlying managers to consider the potential regulatory and pricing volatility risks.