This is a follow-up on the post we made earlier this week that discusses the difficulty in analyzing past performance of VC funds because of team changes. In that post we said, “[Evaluating] Performance is tricky, however, because you have to carefully focus on the … team that delivered those returns.” As a Limited Partner, it is our job to determine whether the go-forward team and strategy has the ability to deliver a 3x (or better) return – after all, these are blind pools when we invest. In order to do that, the logical first step is to deconstruct the historical track record to determine the likelihood of producing similar strong returns in the future. (Of course with the prescient investment caveat, “past performance is no guarantee of future results.”)

Venture capital is a people business: LPs invest in VCs and VCs invest in entrepreneurs. There has been and will always be a qualitative part of the investment decision based on pattern recognition and the intuitive ability to assess talent. A lot has been written about judgement on the softer attributes, but we’ll only say that having that skill set is very, very important to the fund decision making process. Naturally, however, VC firms change as Partners retire and new Partners are brought into the firm. As a result, the expected future return also will change over time, sometimes for the better and sometimes not.

Let’s look (on a blinded basis) at two of the funds we evaluated over the past year to illustrate this issue. What we’re looking for is whether we can develop conviction that the go-forward team can deliver top quartile performance and has the bandwidth to invest the new fund.

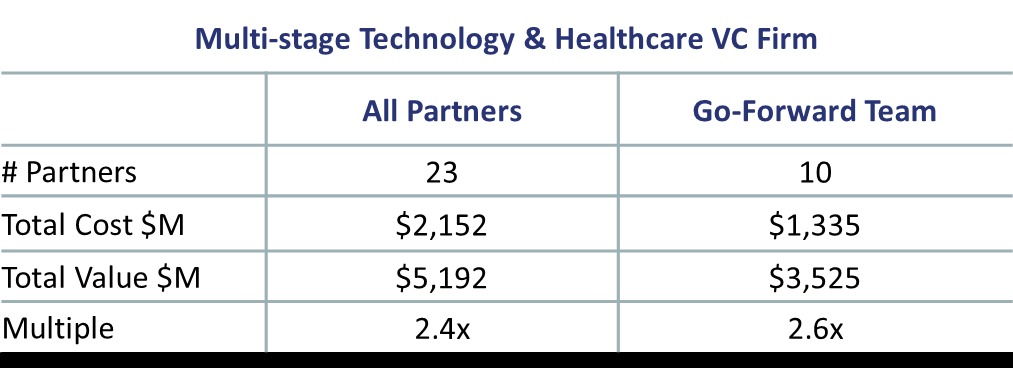

The first example is a multi-stage venture capital fund that invests in both Technology and Healthcare.

In this case, the go-forward team has a just as strong, and actually an even stronger, track record than the entire team that had been investing over the past three fund cycles. However, there was actually a mixture of departures of both good investors and bad investors. The good investors retired, went off and joined other VCs or started their own firms – truly a loss. On the other hand, the bad investors were weeded out over time – a very important and always difficult thing to do. Although 13 people left the firm over three fund cycles since 2007, given the solid track record of the 10 person go-forward team we would give this fund a “thumbs up.”

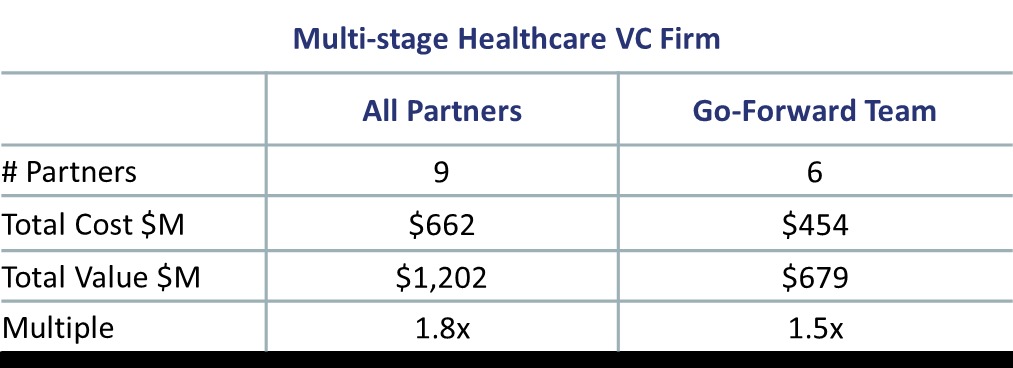

As you probably expect, we also offer an example of a firm where it really does look like the “assets walked out the door.” This example is a Healthcare-only firm.

In this case, two of the Partners that left the firm had mediocre track records, so their departure will be helpful to the firm’s ability to generate strong future returns. If that was all, the go-forward team would have a track record of 1.94x, close to the 2x threshold that most investors look for (especially if the data set includes recent funds where many of the investments are held at 1x). However, the Partner with the strongest track record also left, and so the go-forward team track record declines to 1.5x as shown in the table above.

We recognize that firms consistently add new Partners to replace those that leave, and the second analysis doesn’t include the historical track record of new Partners that were brought on to replace the old, but the purpose of this post is to emphasize the importance to LPs of spending enough time to fully understand the capabilities of the go-forward investment team.

Data: TTCP Investment Process