There have been some recent posts and tweets from Fred Wilson, Bill Gurley and others about the first, second and third tier cities for start-ups. While we agree that Silicon Valley is clearly the first tier market, over the past several years we have purposefully invested in what we believe are some of the best funds in other locations, especially Los Angeles, Seattle, Boston and New York.

You hear it often – “Be Local” – and Fred Wilson points out that to have a robust start-up ecosystem you need adequate local venture capital start-up funding. The venture capital industry has been built on relationships, and often VCs invest in entrepreneurs they believe can build great companies by developing new products, services and business models. Silicon Valley and the San Francisco Bay Area are clearly #1 on everyone’s list, and at TTCP we believe you must be local in order to both build relationships and to understand the trends that are happening in these start-up communities. While TTCP is a global investor, our offices are in San Francisco, the heart of venture capital. A few short years ago most start-ups were based in Silicon Valley. However, in part due to young entrepreneurs who would rather live in the city, the epicenter has shifted from the suburbs of Sand Hill Road to the city of San Francisco.

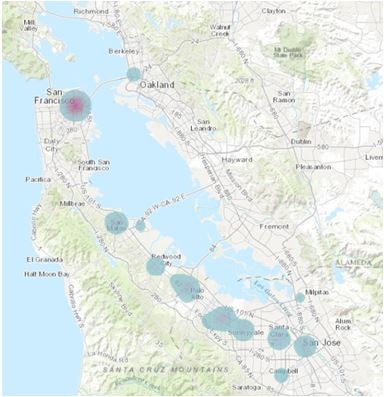

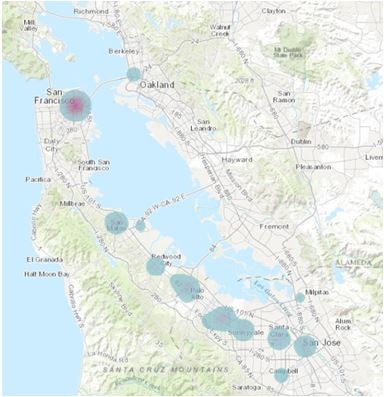

This trend became more evident as we looked at the location of the portfolio companies in our most recent fund of funds. This fund, started in 2014, invests in venture capital through funds, secondaries and co-investments. We have the same performance bar globally and will invest in what we believe to be the best opportunities – using risk-adjusted qualitative and quantitative metrics – regardless of location. Roughly 20% of our investments are located outside the United States and, of the remaining 80%, most activity is on the West or East coasts as shown below.

What we’ve seen recently is the clear shift from the suburbs to the city which brings more start-ups to San Francisco. With that comes more VC firms opening offices, or relocating offices, to San Francisco. This same phenomenon, by the way, happened in Boston with start-ups and VCs moving from Waltham to Cambridge/Boston.

56% of our companies are located in the first tier market of Silicon Valley/San Francisco as shown in the heat map. The map also shows the density of start-ups in San Francisco; 20% of the portfolio companies in our most recent fund have a primary mailing address within the city limits of San Francisco.

At TTCP we believe it would be very hard to do what we do if we were not living and working in this region. Our networks are broad and multi-generational, and we believe our proximity makes us well suited to assess changes at the venture firm, venture fund, individual partner or company level. Moreover, we use many of the products and services produced by our underlying portfolio companies so have firsthand knowledge of their benefits and viability.

In today’s world more than ever, venture capital appears to be a local game. Be local.