We were just in the middle of (yet another) healthcare study internally when the news of AbbVie’s $10.2B offer for Stemcentrx came out. This post was already in the works and was going to talk about why we still put about 20% of our investment dollars into the healthcare space (the rest goes to technology investments). I wish I could say we were investors in Stemcentrx, but I cannot. However, we’ve had our fair share of solid healthcare exits over the years, and I’d like to summarize why we continue to like the sector.

In our analysis, we were reviewing the performance of a few healthcare-only VC firms currently in the market to determine where we wanted to place our bets. Of course we start by looking at performance…absolute, against various benchmarks and also against the performance of the healthcare-focused VC funds already in our portfolio. How do they stack up? Can we upgrade?

Performance is tricky, however, because you have to carefully focus on the prior strategy and team (more on this topic in an upcoming post) that delivered those returns. The past several years have been very good for healthcare VCs, actually record breaking, especially for biotech investors in large part due to a very attractive public market environment, as seen in the graph below comparing biotech indices to the S&P 500.

VCs saw a shortened time to exit and a large number of liquidity events. For example, while down from 83 in 2014, in 2015 there were 59 venture-backed healthcare IPOs, led by 43 biotech IPOs, and record worldwide M&A volume of $430B. Corporate partners are also very active investors, with 25% of all biopharma Series A deals having a corporate participant1. Areas of strong interest in biopharma include (1) oncology, especially immune-oncology, (2) Orphan/Rare diseases, (3) gene therapy/gene editing, and (4) anti-infectives. The regulatory environment is very favorable now as well, with the FDA approving 45 drugs in 2015, the highest number since 1996, and as many as 70% of the drugs in the biotech pipeline are “first-in-class” medicines2.

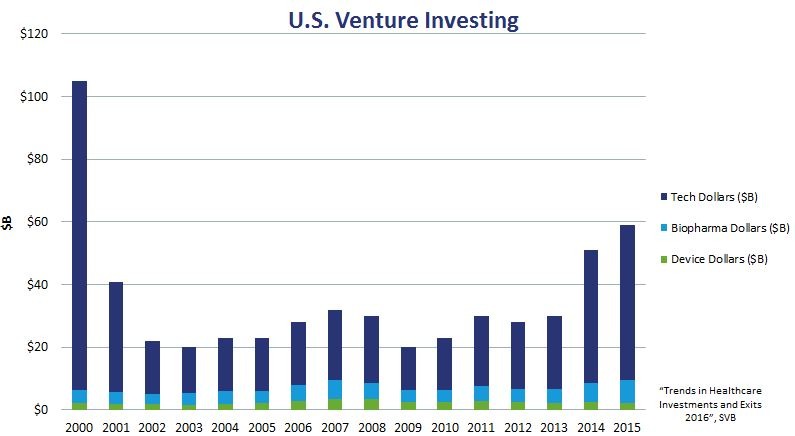

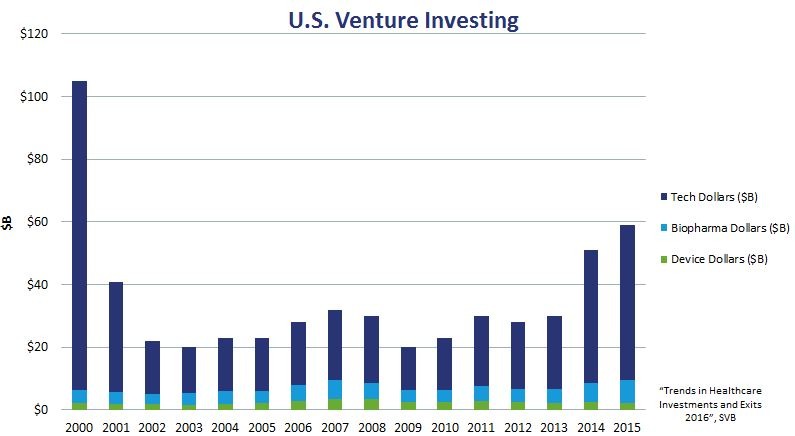

Still, only about 15% of total US venture investment goes into healthcare; in 2015 12% went into biopharma and 4% into devices – the remaining 84% went into technology investments3. Interest in medical devices has been decreasing from a high of 13% of total U.S. venture investment in 2009. This decline has been due to the meager returns recorded by investors active in the space as well as adverse legislation in the form of a medical device tax (which has since been suspended).

At Top Tier Capital Partners we describe ourselves as “investors in innovation,” and as such we will continue to be active in supporting healthcare-focused venture capital funds. Over the next several years we expect to continue to see a high level of innovative and breakthrough medical technologies which will be funded by venture capital.

1Source: “Trends in Healthcare Investments and Exits 2016”, Silicon Valley Bank.

2Source: “The Biopharmaceutical Pipeline”, PHRMA.org

3Source: “Trends in Healthcare Investments and Exits 2016”, Silicon Valley Bank.