In recent years the rise in prominence of smaller, typically seed stage focused venture funds has transformed the landscape of early stage investing. This rise is driven by many factors, most notably the dramatic decrease in the financial, human, and resource capital required to start and grow companies. At the same time, mobile innovation has spawned new business models that in a short period of time can achieve great scale and reach. Since capital is the engine for growth for fast-growing startups, VCs realize they have to either find these companies early or plow capital at a later stage into those that show signs of breaking out. Those VC firms that manage larger funds are finding it increasingly more difficult to justify the time required to develop dedicated seed-stage programs. This is the opportunity for seed and micro VC funds: find talented entrepreneurs with great ideas, be active and helpful during the formation stages of the company, and then position the startup to attract capital from credible follow-on investors.

To capitalize on the opportunity, Top Tier created the “Alpha Manager” program to discover compelling early stage managers with smaller funds that have differentiated strategies and the potential to generate superior returns—hence the word “alpha” in the name. We recognize that investors with an advantage in terms of access to deal flow and ability to leverage their networks are best positioned to succeed. We have also taken a deliberate and thoughtful approach to building a diversified portfolio across strategy, geography, and stage focus. In the last two years, we have committed to nine micro VCs and see our role as LPs very much the same way these firms view theirs: as value-add investors. We believe we have learned a tremendous amount about the qualities that make a good investor. One data point that continues to show up time and time again is the ability to attract other high-quality investors.

Recently, our friends at 645 Ventures—a seed-stage fund based in NYC—combed through data from 2014 and 2015 to analyze the quality of the investor syndicates of seed funds [645 Ventures “MicroVC Exposure to Top Series A VC Funds”]. Their analysis confirmed the trend of diminished involvement of top VCs in seed rounds. They noted “over 75% of startups studied had seed rounds with no participation from top VCs until Series A.” More troubling, there were only 160 micro VC-backed seed rounds that eventually raised a Series A round with a “Top VC”, which represented a very low hit rate of just 7%. However, they found a subset of micro VC managers, which they dubbed “sharpshooters,” that had an abnormally high hit rate in attracting a “Top VC” in the follow-on financing round. This group includes TTCP’s Alpha Managers Crosscut Ventures and Fuel Capital with a ~50% and ~35% hit rate respectively. We believe that the infrequent participation of “Top VC” firms in seed rounds combined with the ability of specific micro VCs to capture a significant percentage of seed deals that achieve Series A from such firms creates a distinct opportunity. Backed by this data, we postulate that the Alpha Manager program offers LPs the potential to gain substantial indirect exposure to otherwise inaccessible VC firms.

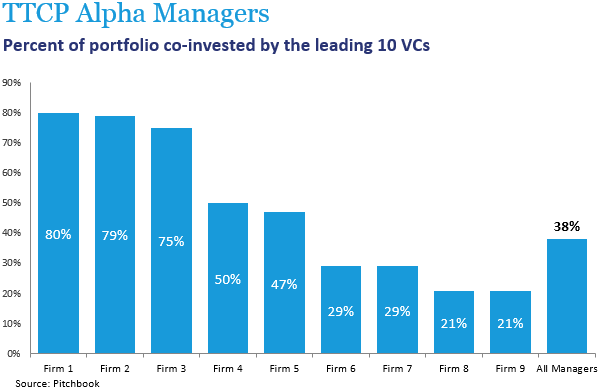

To drive the point home, Top Tier conducted a separate analysis on how one might get indirect access into a handful of leading VC platforms and franchises. We analyzed the underlying portfolios of our nine Alpha Managers to identify which of their companies had at least one of the leading VCs we defined above. We did not distinguish whether that investor came in before, during, or after the round where the Alpha Manager invested—we simply wanted a data set that allowed us to measure indirect exposure. What we found was remarkable: across all the portfolios, 38% of the companies had a leading VC as a co-investor. The analysis is broken down by manager in the chart below.

The key insight is that a portfolio of seed and micro VCs can provide an alternative way of gaining meaningful access to what many consider to be “hard-to-access” VCs. The hit rate of individual managers is also revealing: three Alpha Managers had hit rates over 70%, due largely to close working relationships with one of the leading VCs. In our view this reinforces the old adage that venture is all about the network, and those select individuals and firms with privileged access to those networks that have a high propensity to be investors in the best startups are more likely to generate good performance.

This analysis has been enlightening on several fronts. We now have early evidence that allows us to measure the quality of co-investors for a particular Alpha Manager. We feel this becomes a powerful tool during due diligence of prospective managers, as well as the monitoring of an existing investment. In addition, this places greater emphasis on understanding an Alpha Manager’s network and reputation within the broader VC community. After all, if that manager is regarded as a great filter for top early stage investors, then good performance may follow suit. The challenge however, is teasing out these qualities, which inevitably requires one to actively follow and participate in the early stage ecosystem—to see fund managers in action and assess how they engage with the portfolio companies and fellow venture investors.

Original research created by 645 Ventures (not the property or creation of Top Tier).