When looking back at 2017 in venture capital, the year actually looked surprisingly like 2016. We were concerned even then about capital inflows, valuations, and the low number of IPOs. These issues continued throughout 2017. On the positive side, however, in 2017 we saw the stock market reach all-time highs, an increased number of buyers for venture-backed portfolio companies including new strategic and financial buyers, and the wave of innovative new companies and technological advances in both IT and Healthcare continue at a steady pace.

The major headlines revolved around advances and adoption of autonomous vehicles and efficiencies gained through machine learning that can make sense of and finally utilize all the data that has been collected over the years. 2017 will probably go down in history as the year that cryptocurrency, especially Bitcoin, became a household word. While not as widely discussed, new creative exit opportunities, such as the Social Capital SPAC, were created to potentially allow large, privately funded companies to provide liquidity for their investors. The company that garnered the most press by far was Softbank, more specifically the ~$100B Vision Fund, as pundits and investors mulled the impact of that late stage capital on valuations and the overall market. Snap was probably the most anticipated IPO of the year, but interest has since fizzled out, and Uber, which many expected to ready for an IPO, ran into significant headwinds – much of which was the result of internal issues of sexism and harassment brought to light by one of its engineers. The outing of this behavior sparked a number of others to come forward, and #MeToo has taken on a life of its own, not just within the tech world.

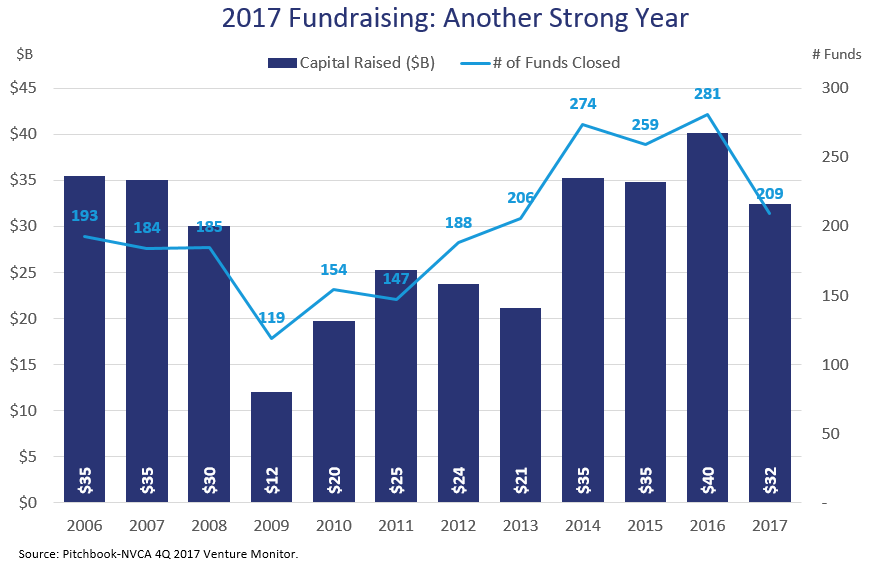

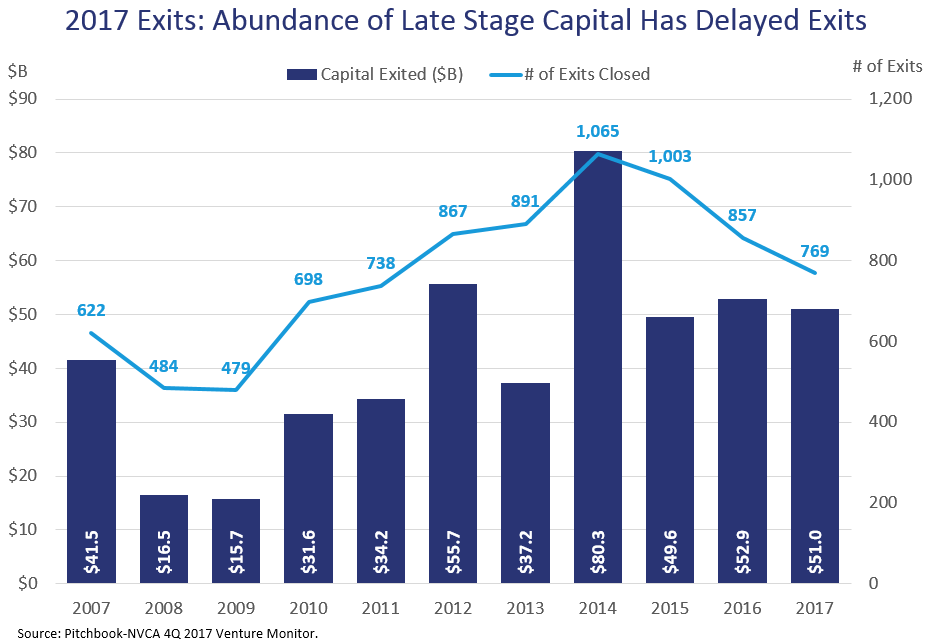

Coming off of a record-breaking 2016 in which $40B of total capital was raised for U.S. Venture Capital, 2017 saw $32B raised across 209 new funds according to Pitchbook. This is a sharp decline in the number of funds raised, which included some large growth funds. The increased amount of late-stage capital for venture-backed companies enabled a number of unicorns to raise additional growth rounds and delay exits.

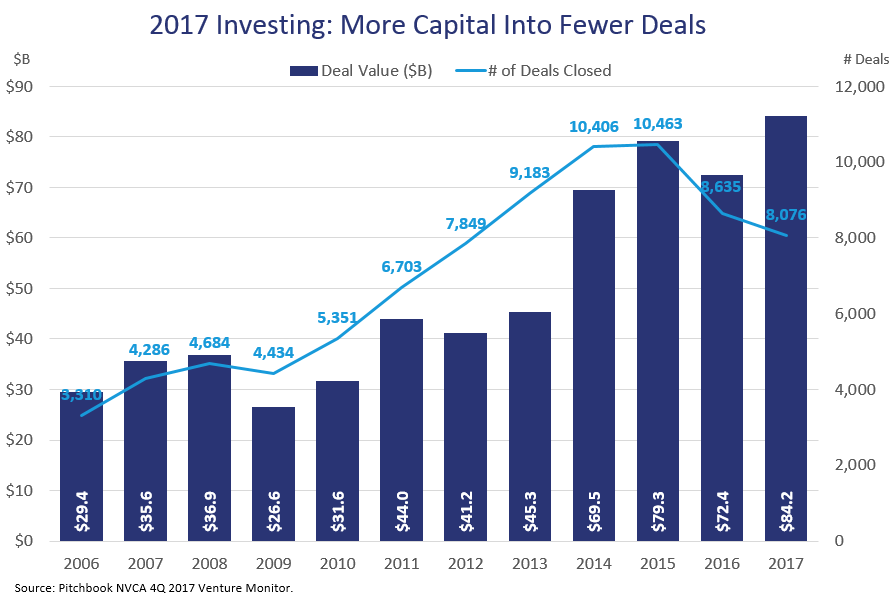

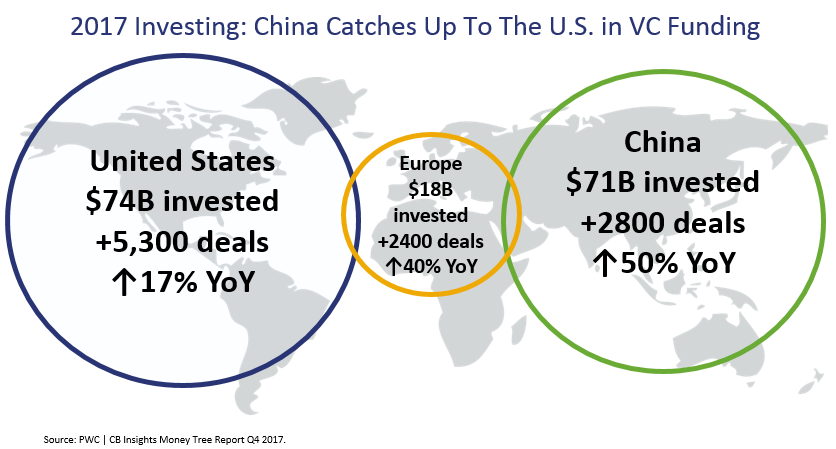

2017 saw the most capital invested into companies since the dot-com bubble, but the total number of companies funded is decreased for a second year in a row demonstrating that companies are raising larger rounds. Regardless of the data source (Pitchbook reported ~$84B of capital was invested while CBInsights reported $74B), what is clear is that China has now caught up with the U.S., and we expect that it will easily outpace the U.S. and become the largest venture capital market in the world in 2018.

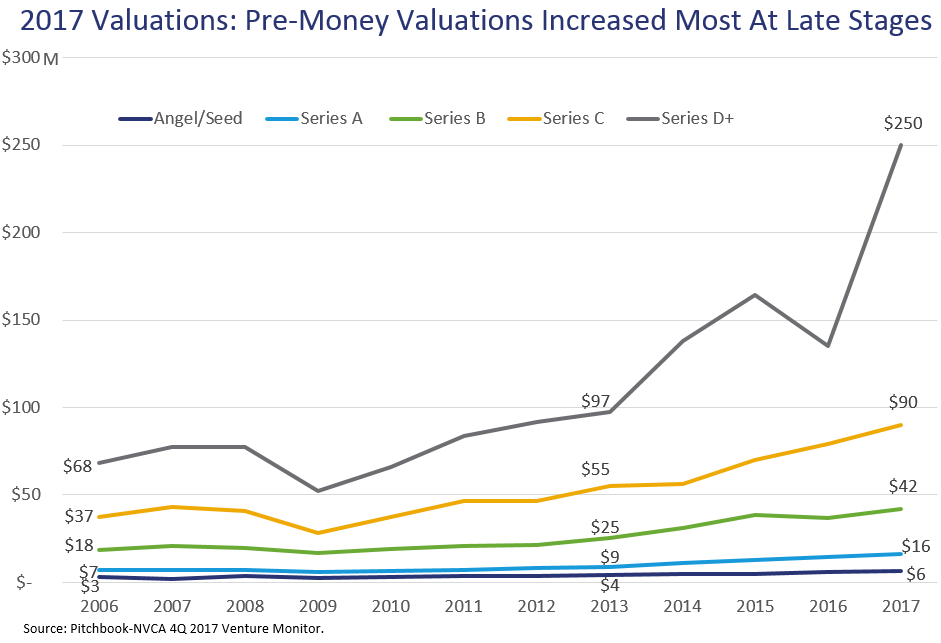

The full year valuation data shows that valuations continue to rise, although we would argue that comparisons over prior years don’t fully take into account that the companies are later-stage with more revenues. Moreover, the significant increases are at the latest stages, where large investors (like Softbank) are buying exposure to highly targeted leading companies rather than requiring these same companies to tap the public markets for financing.

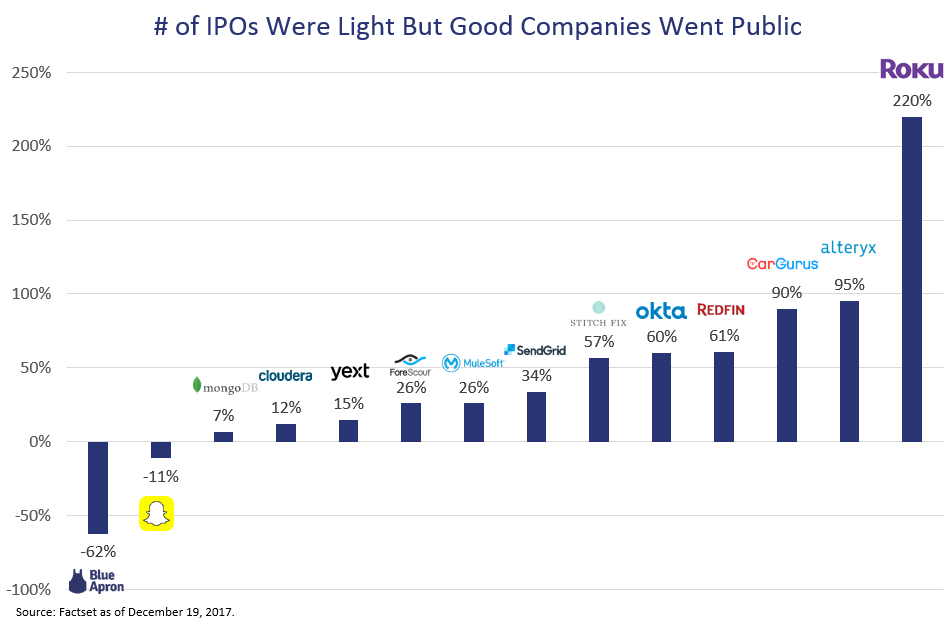

And despite increasing valuations, large corporates proved they were willing to pay up for high quality companies (according to BCG). In 2017, Pitchbook reported an aggregate $51 billion in exit value, but only from 769 exits, the lowest number since 2011. The number of venture-backed IPOs were also light in 2017, but we saw healthy companies go public and 12 of the 14 tech IPOs are trading above their offering price.

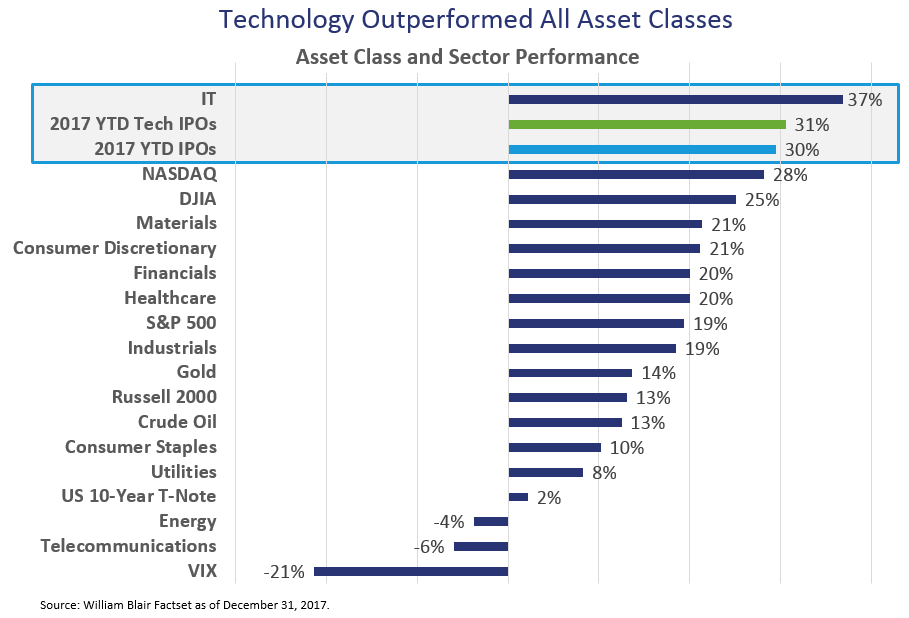

Technology is currently outperforming other sectors and asset classes as the level of innovation has accelerated and has created highly disruptive companies. These companies are selling their products and services to traditional industries to help them stay relevant and competitive. We don’t expect the level of innovation to slow, nor the level of interest for all companies to become tech-enabled businesses.

Our expectations for 2018 are that the venture capital industry will continue to be the funding source for innovative new products and services. We believe important areas to watch are machine learning/AI, blockchain/cryptocurrency, frontier technologies including robotics, autonomous vehicles and space, and healthcare advances in the areas of personalized medicine and gene therapy/editing. We’re encouraged that the list of buyers of venture-backed companies continues to expand and expect that a number of well-known technology “unicorns” may finally go public in 2018. We are optimistic that it will be another strong year of fundraising for VC firms, but we foresee access to the best managers continuing to be an issue – especially for those that don’t currently have a seat at the table. Lastly, we are encouraged by the open discussions within the venture community around the need to address workplace culture issues regarding sexual harassment and diversity. We hope the industry continues the discussion and works to put into action solutions that can resolve these important issues.

Please check back here in the coming weeks for a breakdown of 2017 trends within the TTCP portfolio.